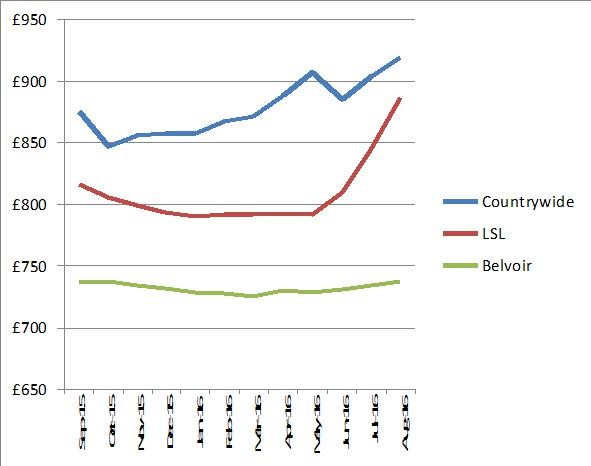

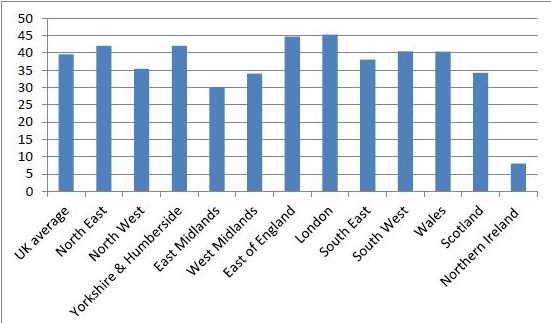

Irrespective of which index you look at, rents have had a reasonable rise this year, albeit slower than in 2015. They have, as usual, pretty much increased in line with wages. The Belvoir index measures rents on a ‘like for like’ basis, using offices that have been around since 2008 and have a consistent level of rental income, and their data clearly shows that rents are moving forward, albeit slowly. LSL’s index shows more robust growth due to student lets showing an increase of 5.2% vs 2.4% for Countrywide. The key takeaways from the rental data is that rents do not necessarily increase in line with property prices but with wages and, in the main, it is unfair to accuse landlords of charging ‘extortionate’ rents when, outside of the capital, rents are classed as ‘affordable’ as they take up a third or less of wages.

Download our comprehensive rental summary.

Average national rents - history

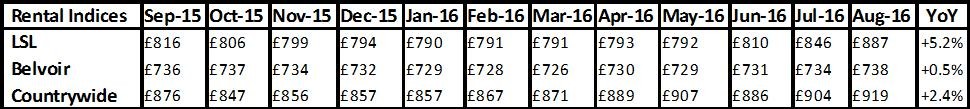

What’s happening to rents regionally?

As with property prices, we are seeing a slowdown in growth in the South, while the Midlands and the North are experiencing good growth currently. The ONS index is now produced monthly and provides a robust view of the changes in the rental market and confirms that rents are NOT rising ‘exponentially’ in any region. According to LSL, the main news is London rent rises have finally slowed, although the South and the rest of the UK is doing well. According to Countrywide, more properties coming onto the market following the large increase in purchases in March to beat the stamp duty is leading to better choice for tenants and as a result a slowing of rental growth. Their data shows that “The proportion of landlords cutting the asking rent has doubled over the last 12 months in cities in Southern England” naming the power houses of Cambridge and London with the largest proportion of homes with rental cuts. For them, Manchester was the big growth area. The ONS data suggests that Scotland, Wales and the North East are not seeing rental growth, while East Anglia and the South East seem to be the top performers.

Looking to rent? Read our expert checklist.

Demand & Supply

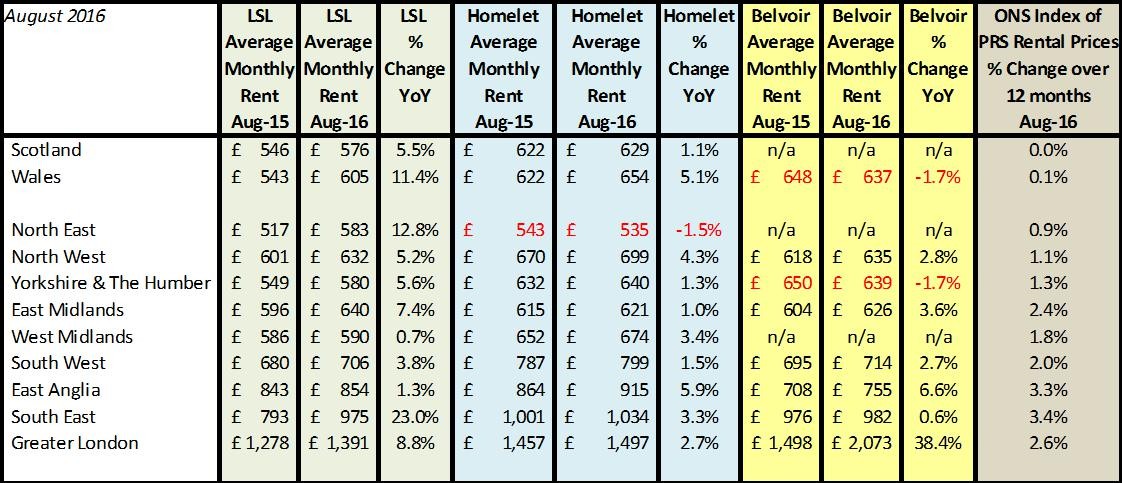

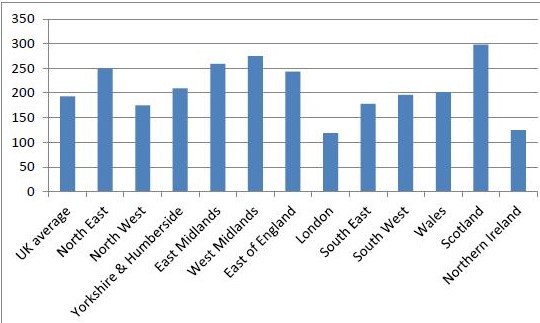

ARLA “In September, letting agents had 40 prospective tenants registered on average per branch, the highest number since February last year. Demand in the East of England and London sat much higher than the national average, with 45 prospective tenants registered per branch. Compared to the rest of the UK, demand remained the lowest in Northern Ireland.”

ARLA: Average number of prospective tenants per branch (Sep 16)

“In September, the number of properties managed per branch was 193. This was the highest level seen since April 2015, when there were also 193 properties managed per branch. The number of properties registered per branch was lowest in London where agents managed an average of 119 properties per branch. However, this is significantly higher than the 97 reported in London in August. Supply was highest in Scotland, where there were 298 rental properties managed per branch on average, considerably higher than the national average."

According to ARLA and backed by RICS, both demand and supply have increased. RICS believe they have seen the strongest growth in tenant demand in the last 12 months while, from a landlord instruction perspective, interestingly, despite the increase in taxes and the huge ‘buying forward’ in March, “Landlord instructions were more or less unchanged at the headline level, but did increase notably in London and Wales.”

Countrywide’s statement that we are on track (based on current trends) to let as many properties in 2017 as we sell, hit the headlines and shows the current robust nature of the private rented sector – despite George Osborne’s efforts to slow the market in favour of home ownership. At some point MPs need to accept that people who are renting are not just doing so because they can’t buy; for many it is sensible and cost-effective way of putting a roof over their heads. If it wasn’t, there wouldn’t be so many wealthy people choosing to rent.

Download our comprehensive rental summary.

Yields are becoming redundant as a measure for landlord success, we need measures that help to explain the ‘real’ profitability – or loss!

With price growth slowing and rents rising, we have seen, in the main, a rise in yields for the PRS. However, this measure just looks at landlord ‘turnover’ and ignores the fact that landlords are facing one of the toughest few years from a profitability perspective. They are having to take on board increased costs to improve health and safety, while also facing increased taxation so, although yields are a useful measure when buying, they won’t help landlords to understand the impact of lower profitability levels moving forward.

It is essential that landlords who have posted their tax returns now need to take these to a property tax expert to understand the future viability of their investment and know if they are likely to have to put money in. And landlords face further dilemmas moving forward. Although better yields can be secured by buying up north, data shows that since 2004, capital growth returns – crucial to property investment success – have not been forthcoming, meaning landlords who want to succeed need to ensure capital growth is built in when they buy, rather than relying on natural price growth to deliver their returns.

Thinking about letting? Read our expert quick guide.

Room Rents

SpareRoom

Matt Hutchinson, director of SpareRoom.co.uk says: “We’ve been talking about London rents seemingly forever, but now it’s the rest of UK seeing rents rise, while London renters are getting a reprieve, of sorts.

“Renters in Swansea will be feeling the pain, with rents up £40 per month year on year - adding just under £500 a year to their rent bill.

“Demand for rooms in commuter towns like Basingstoke, Harlow and Milton Keynes means rents in these areas are up considerably – 6%, 8% and 5% year on year respectively.”

Want to rent a room out? Read our expert checklist.