I was on BBC Radio Wales last week discussing the Nationwide house price index and property market in Wales, I had a great time chatting with the excellent Peter Johnson and you can listen back below – (I’m on from about 52 minutes in)

To find out more about the Welsh market and whether it’s on the up or perhaps about to crash, read below!

Q - The Nationwide index suggests that house price growth slowed to around 0.5% in 2018, down from 2.6% in 2017 – what does this mean?

A – Not much for Wales, prices in the region have risen by about 4% in the last quarter according to the same data – much better than the national average. Similarly to other regions, Wales is now on the ‘up’ while the likes of London and the South East which have previously driven the national average price growth up are seeing some falls.

Q – There are many housing markets aren’t there? There is not just one house price.

A – Exactly right, I talk about this all the time and Wales is no exception! Cardiff prices are up about 5% year on year whereas Newport prices are up about 14%. This huge growth in Newport is thanks to the “Bristol effect”. As there is now no cost to crossing the Severn, it means more people from wealthy Bristol are buying and pushing up prices more than the average in Newport.

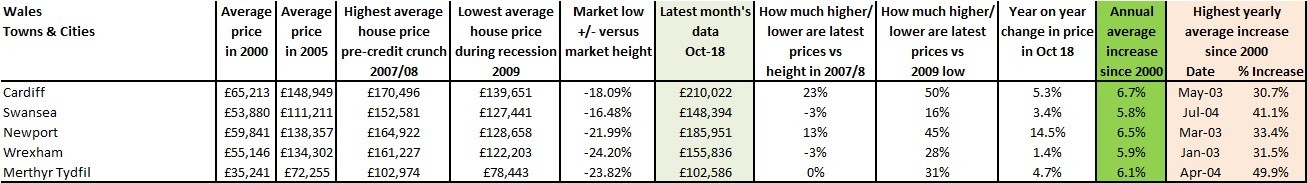

Here’s a breakdown of how prices have performed in individual towns and cities in Wales since 2000 and in particular since the credit crunch.

As you can see, although Cardiff and Newport prices have recovered well from the heights achieved in 2007, Swansea, Wrexham and Merthyr Tydfil are still struggling to see prices higher than over a decade ago – good news for buyers, tougher on those wanting to sell, unless you are trading up and benefit from a bargain.

Q – In Wales we don’t move as often as the rest of the UK, these figures don’t mean much unless you are actually moving…

A – Indeed, the latest data from Barclays/Hometrack shows that people move house about every 19 years across the country. However, in Scotland people move more often, every 15 years, but in Wales it is every only every 23 years on average, no surprise as having family who live there, it’s a fab place to live!

Q – It can be difficult to buy a house even in your mid 30s with tougher lending criteria, can’t it?

A – I think that affordability issues are slightly overplayed, especially bearing in mind prices in Wales are typically lower than most other areas across the UK. It’s true lending criteria is tougher, which is for good reason, but in Wales, the average first-time buyer pays around £140k and although that will scare many people, it’s the ‘average’, it doesn’t mean there aren’t properties being sold for less. For example, I looked at Cardiff and there are still properties available for under £100k and if that’s too expensive, you can look at shared ownership.

| Financing a shared ownership property |

|

Worry less about the ‘averages’ you hear about and more about working out what you can afford and then seeing what that can buy you and where.

Q – How much of the market is still being affected by the 2008 crash?

A – Since this time, certain areas and even individual property types have performed very differently price wise since the credit crunch. In Merthyr, for example, prices are similar now to what they were then, in Wrexham they are around 3% lower but in Newport and Cardiff prices are around 20% higher than in 2008.

This doesn’t mean though that every property has grown at this rate in these areas. Some will have done better, some worse.

What’s important is to look at local sold property price data to see what properties similar to yours are selling now and then talk to your local agent to work out what’s happening to prices for the property type you are buying and potentially selling.

For more information about the Welsh property market visit our regional property price map.