If you are buying, selling or investing you need to first understand what’s happened, what’s happening now and what will happen to prices in the future.

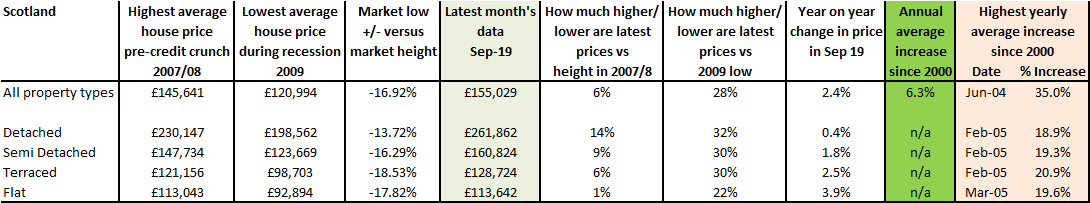

The data below shows that house prices in Scotland are up year on year, by only by 2.4% versus a long term average of 6.3%. The data also shows house price growth has slowed significantly since the credit crunch, with only 6% growth over 12 years. However, those lucky enough to have bought at the market low in 2009 would have seen, on average, 28% growth. So part of understanding what your property is worth when selling is to work out what’s happened to house prices since you bought the property.

UK HPI “Scotland house prices increased by 2.4% in the year to September 2019”

RICS “Respondents in Northern Ireland, Scotland and Wales noted a rise in house price during October.”

We know that different property types grow at different rates, so you can see below that if you are buying or selling a detached property, on average it will have seen a higher price growth than if you owned a flat, although currently you’ll see that flat prices, year on year, have performed better than other property types. Overall, terraced and semis may well offer better value for money than a detached home.

NOTE: Different house types only recorded from Jan 05 onwards

Source: UK HPI

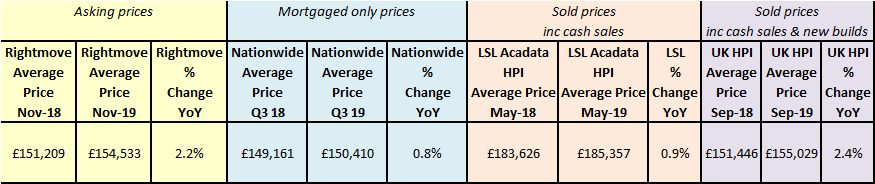

Below we’ve highlighted the different ‘average prices’ reported for Scotland. They vary from £150,000 up to £185,000, which is a big difference.

If you are buying, selling or investing, then don’t worry about these prices, check out what an actual property you’d like to buy or sell might be worth. You can see from the Land Registry data above, average prices for flats vary from £113,000 to £261,000 for a detached home.

We found properties available in Scotland for under £70,000 and if this is too much, you can look out for shared ownership property which you can purchase for a lot less. Basically if you aren’t on the ladder yet, talk to an expert to find out what your options are and don’t assume you can’t afford a property based on the ‘average prices’ you have heard and seen in the press.

It’s likely that city prices will appear more expensive than prices in more rural areas, so again, don’t worry too much about the ‘averages’ as these are made up of properties that are of all different shapes and sizes, some in millionaires’ row and others in areas where properties cost less than £75,000.

If you can choose where you live in Scotland you can see below areas which are a bit cheaper than others and also understand what’s happening in the local market. Aberdeen for example, is suffering price wise due to the oil crisis, so property prices there are LOWER than they were in 2007/8 – 12 years ago – and now might be a good time to ‘bag a bargain’.

Meanwhile, Falkirk, traditionally a good value place to live, property prices are up 7.5% each year so that’s likely to be a busier market and you might have to compete with others to purchase a property. Having said that, Falkirk averages are a lot lower than the bargain prices seen in Aberdeen at the moment!

When looking at property price averages, just use them as a ‘guide’ as there are plenty of properties available for a lot less and a lot more.

What is worth knowing, is if you are worried about buying a property now and prices fall, the ‘market low versus height’ column shows you how much property prices fell by during the recession – and it ranges from around -14% (Dundee) to -20% (Glasgow). The trick is if you do buy now and can have a deposit that’s around 30-40% you should always be able to re-mortgage if, as before, your bank ‘goes bust’, however, what you really need to do is make sure you are never forced to sell.

Find out how to make sure this doesn’t happen to you - read my article 'how to avoid and deal with repossession'.

NOTE: Different house types only recorded from Jan 05 onwards

Source: UK HPI

UK HPI “House prices increased over the last year in 25 out of 32 local authority areas. The biggest average price increase was Falkirk, where prices increased by 7.5% in the year to September 2019 to £130,000. The biggest fall was recorded in City of Aberdeen, where average prices fell over the year by 7.6% to £148,000.” (Sep 19)

Hometrack “The headline rate of UK city house price growth has increased to +2.9% - ranging from +4.7% in Leicester to -5.5% in Aberdeen. Large regional cities continue to post above average price growth on the back of rising demand and attractive affordability, supported by low mortgage rates. The pace of annual price growth across regional cities is slowing compared to recent years. That said, cumulative house price growth since the start of 2017 has been greater than 15% in Edinburgh, Leicester, Manchester and Birmingham.” (Oct 19)

For more information, download the full report here

You are often told you can’t afford to buy a property and if, like the Halifax Index shows, you are told you need to pay £147,000 for your first home and have a deposit of £27,700, it will probably frighten you out of your wits!

Source: Halifax/CML

Fortunately this is the ‘average’ that a first time buyer pays and the deposit they have, it’s not what a property would cost you and it’s not the level of deposit you actually need.

Mostly you need a 5-10% deposit, so if you can buy a property for £100,000, which is perfectly possible in Scotland, you would need £5,000 deposit and the government will actually gift you 25% of this £5,000. If a mortgage of £95,000 feels ‘too much’ then can you buy with a partner or friend – it’s how I got on the ladder back in the 1990s!

Here's more information about saving for a deposit and deposit schemes:

As you can see from the table below, people pay vastly different prices for properties in Scotland depending on their circumstances and if the property is a new build or someone is buying with cash:-

Source: UK HPI

Now you have got your head around what’s happening to prices currently, it’s worth knowing what’s expected to happen to prices into the future.

The latest forecast suggests that Scottish house prices will grow by between 0.5% (Knight Frank) and 2.4% in 2020 according to PwC. But over the next five years, price growth could be anything from 10% to 20%, giving you more equity in your home to trade up to the next one in the next five years.

Of course, prices may not rise, but it gives you an idea of what your home might be worth into the future.

We often spend too much time looking at property prices when what’s really important from an economic, industry and indeed consumer perspective is looking at how many properties are actually selling and knowing if the trend is up or down.

Historically we saw more sales in 2015 and 2016 because of pent up demand following the credit crunch. Over 50% of buyers and sellers dropped out of the market from around 2008 to 2013, so the sales volumes during these years were ‘artificially high’.

Overall, there tends to be around 100,000 homes sold each year in Scotland.

For more in depth information on Scottish property volumes, download the full report here

Currently most towns have a fairly buoyant market (bar Aberdeen) and Falkirk year on year, although property prices are going up, is seeing less properties being sold, but this may be because there isn’t enough stock on the market for buyers to choose from. Dundee and Edinburgh on the other hand are doing well – especially as much of the rest of England is suffering due to the lack of activity because of people hesitating to move due to Brexit.

Sales volumes by local authority/county

The rental market in Scotland is pretty affordable in most places, with the average amount spent on rent being either on or just below 30% of people’s salaries.

Whether you are a landlord or a tenant, the data below shows you whether rents are rising or falling, so you know if you can offer a ‘cheeky deal’ as a tenant or as a landlord if you are charging a fair price for your rent. Unlike property prices, it’s better to ask for the rent you want, rather than pitch the rent ‘higher’ and hope a tenant will ‘make you an offer’ as it rarely works this way and your property can lay empty for months, costing you far more money.

The chart below shows how average rents vary quite dramatically with Edinburgh – no surprises – being by far the highest and Dundee offering great value for money at almost half the rent.

It’s worth checking commute costs and times to the likes of Edinburgh from other areas which may be easier to find properties to rent and secure at a lower price, even if you have to drive or head to work by train. If this does work out better financially, it may help you save money towards a deposit to buy a home of your own.

We have highlighted below the different rental averages from each of the companies/organisations which track and comment on rents in Scotland:-

Source: Citylets

For a summary on average private rents for different property types, download the full report here

Citylets provide one of the best data sources by area in Scotland for local rental prices, so check if they cover the area you are looking to rent in and you will get a good idea of what rent you are likely to pay if they are going up or down.

The agent Belvoir also provide individual rental information and commentary on different areas within Scotland and we have summarised their feedback below.

Citylets information on Scotland:

“Rents rose 4.1% Year on Year (YOY) overall to stand at £821 per month on average. Larger 3 & 4 bed properties posted the strongest annual gains at 6.2% and 8.3% respectively driven in part by strong student demand throughout summer 2019 and reflecting new market dynamics introduced by the new PRT.”

Citylets information on Aberdeen:

“The data from Q2 2019 pointed towards a final leveling off in the Aberdeen rental market with annual growth at just minus 0.8% YOY. However, Q3 2019 surprises with annual rents down minus 3.9% at £716 per month and average TTL up 3 at 48 days. TTL had reduced 4 days YOY in the previous quarter. However good properties in good locations continue to perform well and landlords remain strongly incentivised to improve the condition of their properties. All property types (1-4 bed) saw negative annual growth in Q3 2019 and lengthening TTLs. A third of Aberdeen properties are let within a month.”

Belvoir rental information on Aberdeen

“For Q3 2019, rents decreased along with tenant demand for flats/HMOs but increased for houses. Both rents and demand are likely to remain static over the coming quarter.”

Citylets information on Dundee:

“With rents in Aberdeen falling further, Dundee posted strong annual growth at 4.8% and for the first time the gap

between the two cities is beginning to suggest possible convergence. The average property to rent in Dundee now

stands at £633 per month and rents in 45 days. The rental data for the city is consistent with the resurgence of

Scotland’s 4th largest city and its considerable positive economic and redevelopment. Elsewhere South Lanarkshire

was the stand out area posting growth of 4.5% YOY to stand at a record high of £610 per month taking 1 month to

rent on average (31 days).”

Belvoir rental information on Dundee

“There has been a moderate increase in flat rents, with house rents increasing at a faster rate, particularly on smaller family starter homes which are very much in demand. Tenant demand increased during Q3 2019 and due to the tax and regulation changes over recent years, resulting in landlords pulling out of the market, this has left a significant shortage of rental properties. Over the next quarter, rents are however likely to decrease slightly due to the time of year, but demand is increasing across the board. With the exception of room rents, Dundee has a shortage of all types of property.”

Belvoir rental information on Paisley

“Increased rents and tenant demand across the board were reported during Q3 2019, with flat rents likely to remain stable, but increase for houses. Demand is expected to stay the same for all properties over the next quarter. The Paisley office is short of most property stock.”

Belvoir rental information on Falkirk

“For Q3 2019, there were increased rents for both flats and houses: about +2%, with tenant demand remaining static. Rental levels and demand are expected to stay the same over the next quarter. Falkirk has a stock shortage of two to four bed properties.”

Citylets information on Edinburgh:

“Rents in Edinburgh continue to rise for all property types (1-4 bed) but the trend of reduced annual growth also persists. Property to rent in Edinburgh now costs £1148 per month on average - a record high - and takes 27 days to let. TTL lengthened a full 6 days on the previous year, however 1 bed properties in particular continue to rent quickly at 20 days on average. With noteworthy change in TTL for the capital it will be interesting to see if annual growth in rental values will continue to decline”

Citylets information on Glasgow:

“The Glasgow rental market continues to operate at a sustained and fast pace with the average property to rent now above £800 for the first time at £803 per month and taking 27 days to let. Whilst this was 3 days slower than Q3 2018, it is less of a reduction compared to the capital and anecdotal feedback from agents has surfaced little systemic concern. As per Edinburgh, 1 bed properties rented fastest at 22 days, unchanged on last year. Overall 67% of properties are let within a month, identical to Edinburgh.”

Below are the forecasts for rent rises. As a landlord, with Scotland having the ability to introduce rent controls, it’s important to make sure you are charging a market/fair rent to your tenants. If you are under charging, you may not be able to increase rents to market rents in the future if you are restricted on what you can increase them by annually.

Having said that, the rent control system is based on inflation, meaning that based on rents in 2007 versus now, if rent controls had been introduced, rents today would be 30% higher than they are currently. This is because typically, rents move in line with wages which have risen at a lower level than inflation.

Source: Savills

If you are landlord or considering investing in areas with Scotland, yield information gives you an idea of comparing one area to another. You have to balance rental yield with capital growth as buy to let really delivers best on capital growth overtime, so although yields in Edinburgh are low, you need to take into account the returns from capital growth too, then work out which property, in which area is delivering the best overall return versus your objectives.

More information:

|

Advantages of a new build property - Barratt |

Open Property Group |

Coreco |

|

|

|