Every month we do a summary of the various rental indices to help you understand what’s really happening to rents both across the nation, this can provide important information for both tenants and landlords.

Download my full summary for September 2014.

Report Headlines:-

Belvoir Lettings ”The average rent for offices across England which have traded consistently over the last five years is £693 per month - a slight year on year increase. (Aug – England, Wales & Scotland)”

Acadata/LSL “Rents ease slowly up to reach all time record high as peak lettings season approaches. (Aug 14 – England & Wales)”

Homelet “In the three months to August, average rental values for new tenancies in the UK were 7.8% higher than the same period last year. (Aug 14 – England, Wales & Scotland)”

SpareRoom “In August the average UK rent was £563, up from £546 last month. (Aug 14 – England, Wales & Scotland)”

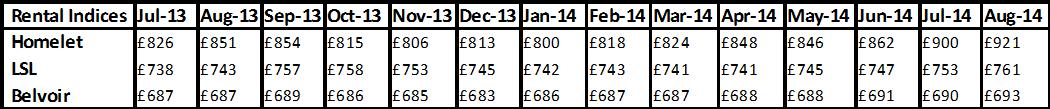

Average National Rents

Kate Faulkner comments on Rental Report Headlines:

“Currently rents are moving upwards, but in the main it’s only in line with inflation. So from a Landlord’s perspective, in real terms, they are no better off. Ideally if wages were rising, as they should be, with inflation, neither would tenants be either. However, for many tenants who have been in a property long term, their rents aren’t increasing at all. The danger is with Labour’s talks of introducing ‘rent caps’, rather than helping tenants, they could be enhancing the income of individual landlords at the expense of tenants and be scaring off good quality, long time institutional investors who can provide quality long term rents! ”

Download my full rental summary for September 2014.

Capital Growth & Yields for Landlords

Acadata/LSL “Gross yields on the typical rental property in England and Wales stand at 5.1%, representing a fall of 0.2 percentage points from one year ago, down from 5.3% in August 13. However, compared to the previous month gross yields are up slightly from the 5.0% seen in July 2014.

“Taking into account price growth and void periods between tenants (but before costs such as mortgage repayments or maintenance), total annual returns on an average rental property stand at 12.7% over the twelve months to August. This is up from 6.4% in the year to August 2013, and an increase of 0.6 percentage points since July, when returns were 12.1%.

“In absolute terms this means the average landlord in England and Wales has seen a return, before deductions such as mortgage payments and maintenance, of £21,239 in the last twelve months. This is made up of rental income of £8,233 and an average capital gain of £13,006.

“Looking ahead, if rental property prices continue to rise at the same pace as over the last three months, the average buy-to-let investor in England and Wales could expect to make a total annual return of 17.2% over the next year, equivalent to £30,997 per property. (Aug 14)”

Kate Faulkner comments on Capital Growth & Yields:

“Yields for new investors are going to be tough to make ends meet when interest rates rise, so it’s essential BTL investors seek expert mortgage advice and factor in mortgage rates of 5-7% seen before the crash. For long term BTL investors, property price rises are good news as this is the main way to earn money from BTL versus other investments and as they bought some time ago at lower prices, their yield will be unaffected.”

Download my full rental summary for September 2014.

For FREE, independent and up to date advice on Buying, Selling or Renting a Property, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-