Last year I predicted that the papers would start reporting pending property price crashes during April and May. Nothing clever about it, I just look at the figures for Q1 2016 which were skewed due to the 3% stamp duty and, if property prices/transactions then slowed as forecasted for Q1 2017, the papers would be able to populate headlines, whether a crash was coming or the market was just naturally slowing.

However, with an election to cover, the headlines took a little longer to come through than I thought.

But, there are now here and will probably run throughout the summer:

The Guardian report on this too, but suggest they won’t fall as fast as some would like.

So what are the chances of a house price crash?

There are several reasons a house price crash is predicted at some point in the future. The first is one that I no longer think is valid and hasn’t impacted now for 17 years. It relates to this chart from Nationwide:

Basically up until 2000, as soon as house prices rose beyond the long run average of 4-4.5 x incomes, property prices tended to fall back in line.

Three reasons I think this has changed for the long run:

However, as Paul Cheshire, Professor of Economic Geography at LSE, points out, the house price to earnings ratio may become more of an issue and affect demand if incomes and property prices stop rising. And if both go into reverse for any reason, this will also impact on the ability of the Bank of Mum and Dad to support their kids, which would mean the loss of the 9th biggest mortgage lender.

The ‘new average’ house price to earnings ratio is still rising

The second argument that may suggest a crash is around the corner is that the earnings ratio have risen back to the increased highs seen in the last crash, not the 3-4x income but to 6x. This is partly because house prices, in some areas have continued to increase while incomes are stalling, putting a strain on affordability. We are currently seeing this in London which this, together with the lower buy to let purchases caused by tax increases, means a reduction in demand is taking place.

So with incomes not increasing by that much and for some real incomes are actually falling, how have prices still risen to date? The main reason for this is due to the huge fall in the main cost of buying a property: the mortgage interest rates. In the 1980s they were often in double digits and in the 1990s reached 15% at one point. With many rates being below 3% today, people can afford a higher earnings ratio than in the past.

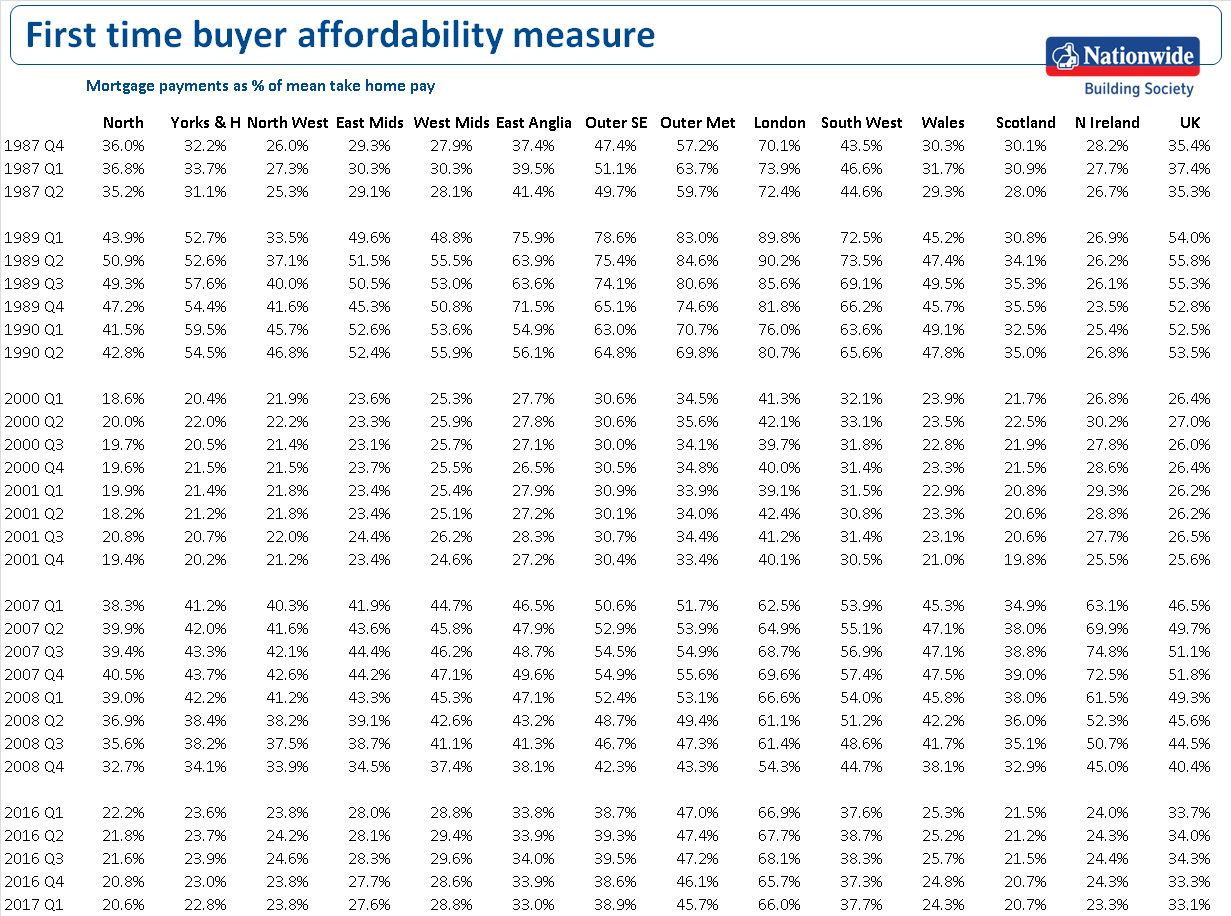

This second chart from Nationwide illustrates this as it looks at the amount spent on a mortgage today versus the past for first-time buyers as a percentage of mean take home pay – and does this by region.

As you can see, affordability today isn’t that different to what is was back in 1987 and is actually lower than at the start of the crashes in 1989 and also in 2007. Bear in mind, too, that FTBs are on average putting down deposits of 15-25% as opposed to the 5-10% they paid in the early 1990s and they are already paying down their mortgage via repayment, so have a better equity cushion than in previous recessions.

To download this in its entirety, click here.

In the Daily Mail article, what Paul Cheshire, Professor of Economic Geography at LSE, points out is that this squeeze on affordability, especially with real wages (ie income net of inflation) falling since 2010, this could slow demand and therefore slow prices. Basically, although affordability isn’t currently any worse than it has been in the past, if incomes continue to fall in real terms, the benefits of lower mortgage rates could be eroded, thus potentially reducing demand.

But haven’t we a shortage of properties versus population?

And, for those that think a rise in population means guaranteed increase in demand versus supply, that may well not be the case. According to the Professor, “rising demand is far more the result of rising incomes than increasing population”. For example, is research* in the Greater London Area shows that the overall population only increased by 0.1 percent from 1951 to 2011 but real house prices increased nearly fivefold with real incomes increasing threefold as the table below shows:-

Greater London Area

Period % Change Pop %Change Real House Prices

1981-2011 +20.5 +227.6

1951-1981 -16.9 +71.9

1951-2011 +0.1 +463.2

*for more research, read The Economics of Land Markets and their Regulation, Edward Elgar. http://www.e-elgar.com/shop/the-economics-of-land-markets-and-their-regulation and Urban Economics and Urban Policy: Challenging Conventional Policy Wisdom, Edward Elgar.

Prices have hardly risen in some areas – what will happen there?

The reality is though that there have never been such huge divisions – not just a north/south divide but a wealth divide – in the UK and I don’t think that any property market falls will be uniform as they have perhaps been in the past.

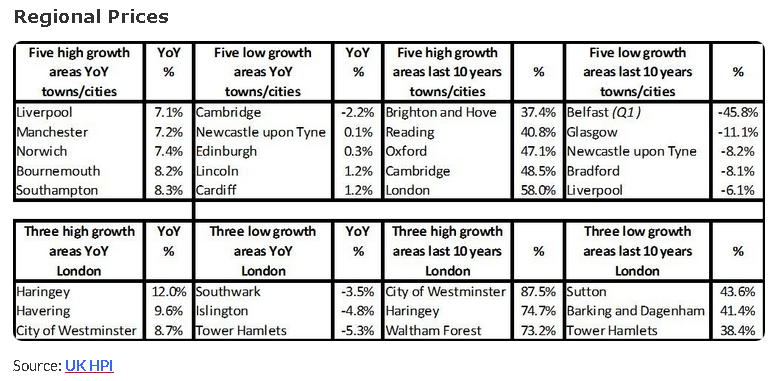

As the chart below shows, in the last 10 years, areas like Cambridge and London have increased by 50% while, in contrast, areas such as Belfast are still down substantially, so it would be difficult to see if these areas would be hit again before they had had a chance to recover from the last crash.

And even locally, taking a look at London boroughs, some have risen by 70-80% while others have risen at half that level.

For more, read our latest property price report.

So currently, we are experiencing some signs of things which might cause a crash, but the evidence currently points towards a market stalling, particularly in the South and London where prices have risen so much.

For the rest of the UK, many property prices haven’t seen a strong recovery since the credit crunch and, as a result, haven’t fuelled enough growth for another crash.

However, we are all in uncertain times, so all we can do is watch the economy, see what happens next politically and then interpret the property data as best we can to help you understand what the future holds for the property market.

For those not sure whether to buy or sell now, here’s a little help to how I have approached these uncertainties in the past.

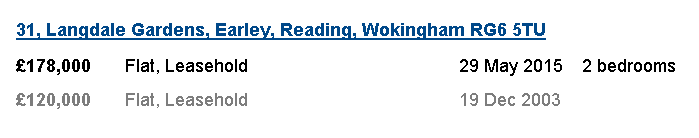

This is a flat I bought back in 2003, when people were predicting there would be another crash (four years too early!)

During this time, other people were paying over £130,000 for similar flats, so to help cushion myself from a possible fall, I made sure I bought at a price that meant I could still retain a decent equity level if this did happen.

During this time, other people were paying over £130,000 for similar flats, so to help cushion myself from a possible fall, I made sure I bought at a price that meant I could still retain a decent equity level if this did happen.

During the crash, similar properties were still selling out at £130,000-£135,000 so even if forced to sell during that time, I could have done so at a profit, or at least broken even and not slipped into negative equity.

Fortunately I managed to hang on and when the market moved upwards, was able to sell at a decent profit.

The trick is to remember that when you buy a property, you are likely to be on the ladder now for 50+ years. This means you are bound to experience market highs and lows. Sometimes you’ll make money, sometimes you won’t, but hopefully it will balance out.

As long as you don’t over gear, protect yourself from life getting in the way (sickness, loss of job, etc) and are never forced to sell when prices are at their lowest, you should always be able to retain a roof over your head.

Key checklist: Analysing your property market

Read next: Kate's latest property price update

Time to watch: