.png)

Rightmove “Another price record is set as the under-elevens keep the market moving”

NAEA Propertymark “Demand for housing drops as general election uncertainty starts to kick in”

RICS “Key indicators show little near term impetus”

Nationwide “Further slowing in annual house price growth in May”

Halifax “Annual house price growth eases again to 3.3%”

LSL Acadata HPI “Affordability struggles continue as election looms”

Hometrack “City house price growth is running at 5.3%, down from 8.7% in April 2016”

National Prices

The reports are currently giving mixed reviews. Some claim that the market is slowing due to the election, some suggest that property prices continue to move forward. However, I think that up until now the market has moved as expected. It has seen a recovery since the credit crunch, albeit a very mixed performance on a regional and even postcode basis with a ‘recovery’ defined as +60% since the falls through to only just recovering to prices seen 10 years ago, although not for every property on each street.

For more on property prices, download my comprehensive update.

However, the election result is probably a bit of a disaster for the housing market in the short term. We’ve lost yet another housing minister, Gavin Barwell (although he is now an adviser to Theresa May) so he will need replacing. Worse still, it’s going to be so hard for the current government to get anything passed, housing is in danger of falling off the policy agenda in favour of the likes of Brexit and public policy for education and social care/NHS. This would be such a shame as we have got so close to getting housing as a key focus for political parties. But as we know, politics is a very fickle sector.

On the other hand, for those who like a bargain or two, the continued uncertainty is likely to help drive some good deals which have been tough to find while markets were recovering so fast.

For more, see our data on the various national price reports.

Source: UK HPI

With three out of our four countries still not recovering their average prices from a decade ago and average house price growth being lower than the long-term average in six out of the nine English regions, it’s clear the market is slowing. This is an enormous departure from property price performance in the past. This is the first time I can see from the data where some areas haven’t recovered their prices to pre-recession levels and then have seen further falls. In the North East, for example, according to the Land Registry, prices on average are still 12% lower than they were a decade ago and now the latest data shows prices have fallen year on year. The media often talk about ‘bursting bubbles’ and it’s quite incredible that they have still not mentioned the fact that we have probably now seen the UK’s first true property price bubble for some properties/areas across the country. It’s likely over the coming years that people are going to start to realise property isn’t the money-making ATM it has been in the past and this, thank goodness, is likely to slow down market growth further. If wages can push through, this – together with government Help to Buy and shared ownership schemes – will help affordability tremendously over the coming years, hopefully helping to reinvigorate what is currently a low transaction market.

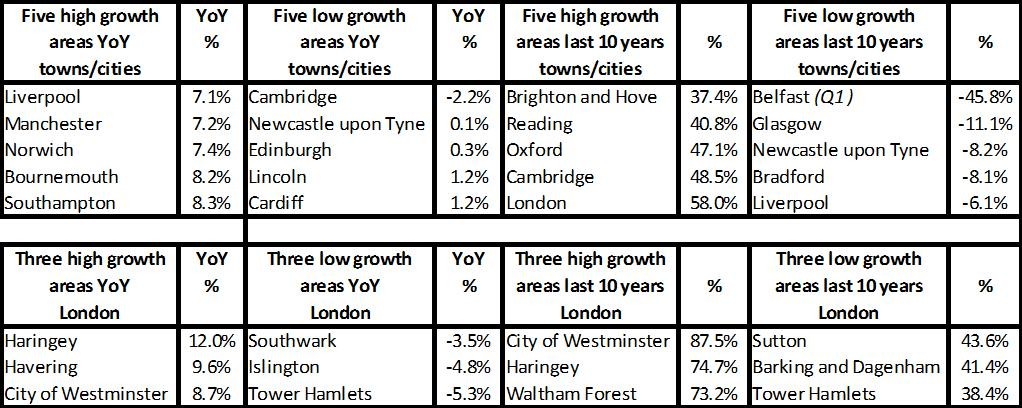

From a towns and cities perspective, outside the South and London, for now Hometrack are showing a definite revival in many key cities, such as Birmingham, Liverpool and Manchester.

For more, see our comprehensive regional and city data.

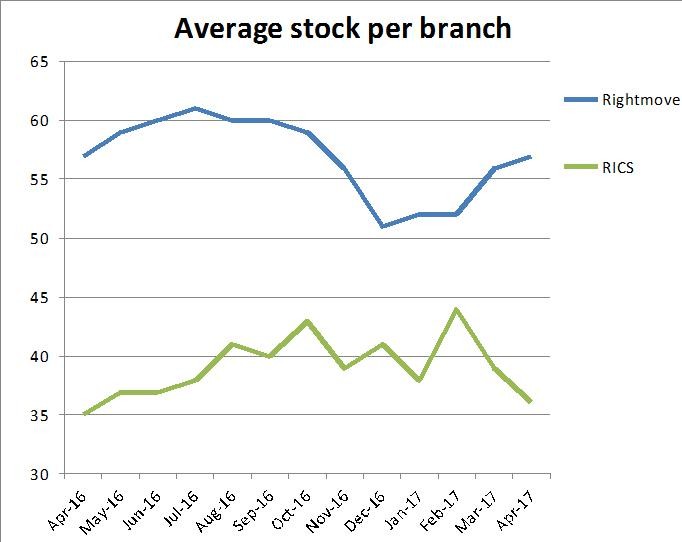

I am getting an increasing number of questions now as to whether the market is going to crash and if now is a good time to buy. However, as the RICS point out, a crash is unlikely while demand remains high and supply still low in many areas. Unless, of course, the election nightmare and the high level of uncertainty in the economy results in people turning away from the property market. The next few months through to September will be critical to securing an idea of how the housing market will react in light of such seismic economic changes to how our country is run.

For more on property prices, download my comprehensive update.