The hot topic in housing is the struggle facing young people as they try to get on the property ladder. But what about their grandparents? They face what is, in my view, an equally difficult issue: whether to move from their home to somewhere more suitable for independent living in their later years.

These may feel like entirely separate issues but the latter can have a considerable effect on the former: if an older person downsizes, it can free up capital which they may decide to use to help family members onto the housing ladder.

According to Knight Frank, downsizing to a home with one fewer bedroom will release around £52,000 in equity on average across England and Wales, with large regional variations, much of which could be passed onto children to help them get on the ladder.

In terms of stock, a large property vacated by an older person could then become a home for a family, who leave behind a smaller property, which may be ideal for a first-time buyer. This, in turn, is good news for the housing market as one person’s decision to move could ultimately result in a whole chain of transactions.

Looking to trade down? Read our expert checklist.

Why are older people reluctant to move house?

Leaving behind the family home is a major decision that many older people are reluctant to take, for various reasons. These include:

Emotional connections: It’s a huge upheaval to leave behind the family home and all its memories to move to somewhere new. And, if there are no suitable properties in the area, or the move is to be closer to family, valued friends and neighbours may be left behind, too.

Hassle: The thought of moving all their belongings, of broken chains and sales falling through may also put people off. Finding a sympathetic and knowledgeable estate agent they trust may help to alleviate these fears, as will leaving the packing (and unpacking) to a removal company which offers a complete service.

Wanting space for the family to stay: This is something I can never understand, even though my own mum did exactly this. But why spend tens or even hundreds of thousands of pounds on bedrooms you rarely use? It would cost a fraction of that to put them up in a nearby hotel a few times a year… which would be a lot less stressful than trying to live under one roof, too.

Cost: While there are, of course, costs involved in any move, they may not be as high as people perceive, particularly now that stamp duty is, in the main, now relatively low. It’s also important to weigh up these costs against the daily struggles faced by an older person living in an unsuitable home.

Why downsize?

These reservations should be balanced carefully against the benefits, of which there are many:

Financial benefits: Downsizing to a smaller, cheaper property, can free up capital which could be used to boost a pension or help out family members with university fees or onto the housing ladder. However, it’s vital to seek independent financial advice to ensure any lump sums are given legally and in the most tax-efficient way.

Home is easier to manage: A smaller home should require less maintenance and, if the move is to a new build or dedicated retirement property, maintenance issues will be non-existent. This is a big issue for older people, being cited as the main reason for downsizing or considering a move by 56% of respondents in the McCarthy & Stone ‘Understanding perspectives on downsizing in later life’ survey.

Health benefits: Better health and well-being was reported by 64% of people who had downsized, according to the McCarthy & Stone survey.

Better social life: While moving away from friends and neighbours can be stressful, moving to a retirement development could be the answer as research shows that residents are less lonely than those in general housing.

Looking to trade down? Read our expert checklist.

Source: McCarthy & Stone

Where to go

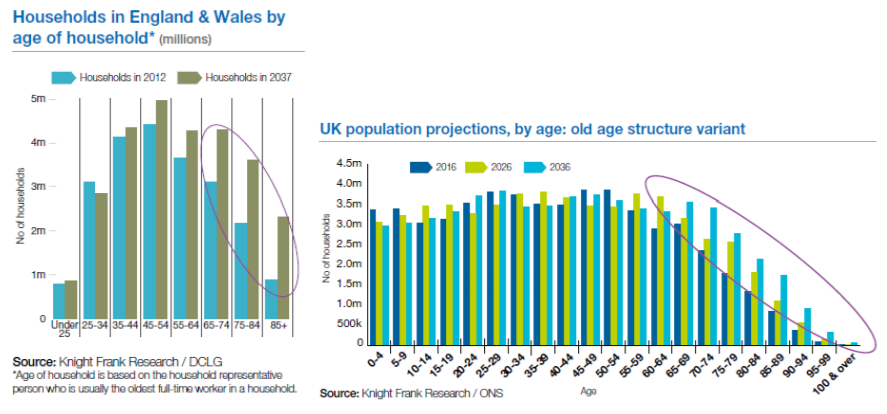

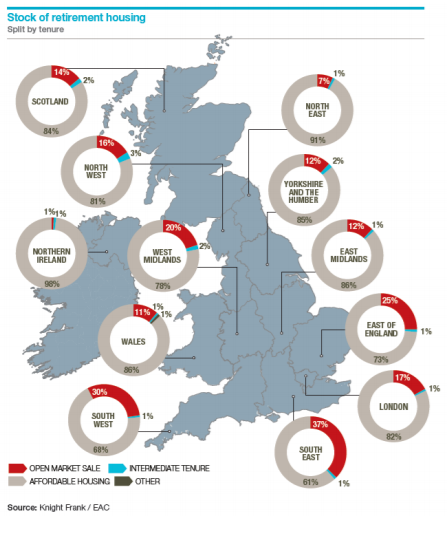

Unfortunately, stock is just as big an issue for older people as it is for other househunters. To meet the nation’s growing needs, the supply of retirement housing needs to increase five-fold, according to Knight Frank.

By 2039, one in 12 people will be aged 80 or over, likely to require some support at home or elderly care

Just 3% of new-build units currently in the pipeline or under construction are designated ‘elderly’ or ‘sheltered’ housing.

This needs to change, as it inhibits movement up and down the housing ladder and, with our ageing population, the problem is only likely to get worse.