publication date: Nov 23, 2017

|

author/source: Kate Faulkner, Property Expert and Author of Which? Property Books

Budget 2017 - what do you need to know?

I’m actually wondering if I missed something. I am fairly sure that quite a few of the announcements made were already in the public domain and the news on stamp duty for first time buyers was hardly a well-guarded secret, so I’m left a little deflated to be honest!

However, there were changes other than property which will, as always, impact on the market.

The good news…

For those of us who like a tipple, there was no increase in duty on alcohol. But there were some changes which will help all those in the property market:

1 - National Living Wage to rise for over 25s From £7.50 to £7.83 from April 18

2 - The National Minimum Wage will also increase in April 2018 for:

- 21-24 year olds to £7.38 per hour

- 18-20 year olds to £5.90 per hour

- 16-17 year olds to £4.20 per hour

- Apprentices to £3.70 per hour

3 - Increase in personal allowance:

- This is probably one of my favourite policies and it’s great that this will increase £11,500 to £11,850 from April 2018

4 - Increase in higher rate tax threshold:

- Good news for landlords, but beware any additional income over £50,000 can still result in the loss of child benefit payments

5 - Help for those being switched to Universal Credit from Jan 2018:

- Quicker help with access to a month’s worth of support within five days via an interest-free advance, This can be repaid over 12 months.

- Housing Benefit will continue to be paid for two weeks after a Universal Credit claim.

6 - Extra help for benefit tenants renting privately from 2018:

- Low-income households in areas where private rents have been rising fastest will receive an extra £280 on average in Housing Benefit or Universal Credit. However, this is an odd phrase as it’s not necessarily a rise that is causing the problem just the general cost of renting a home.

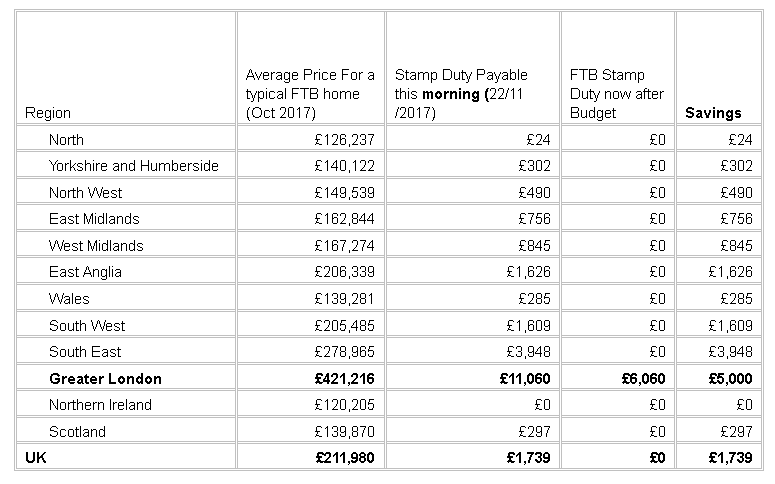

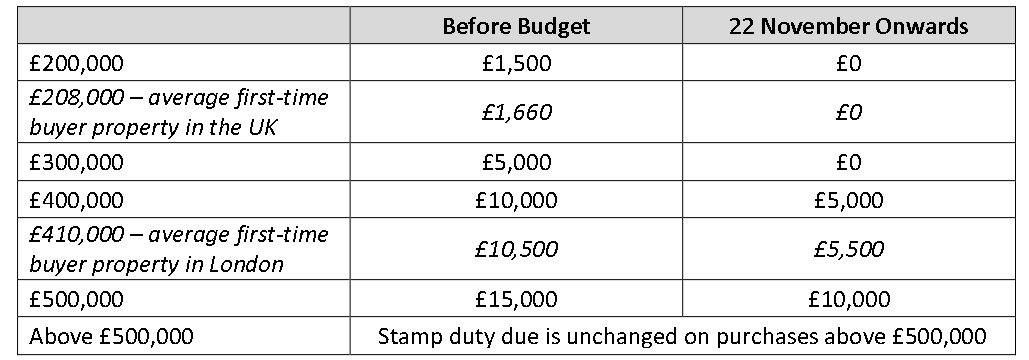

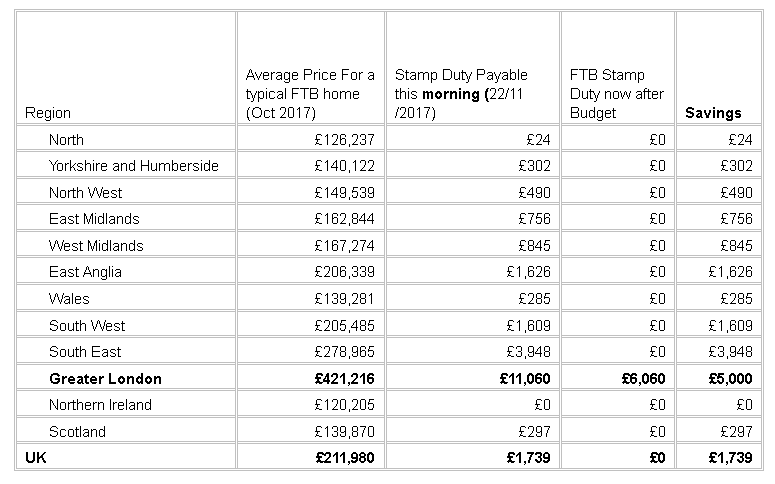

7 - First time buyers don’t have to pay stamp duty straight away:

- This will help from a perception more than a ‘pocket’ perspective. Many FTBs don’t pay any at all already. However, in areas such as London it’s around £5,000 (Halifax, see below). This is complex! See below for more details, for example if one of you buying is an FTB or if you have just exchanged.

8 - Cambridge-Oxford-Milton Keynes corridor continuing to fund up to 75,000 new homes (on-going):

- Completing the rail link between Oxford and Bedford, and Aylesbury and Milton Keynes

- Setting up a new East West Rail Company to speed up work on Bedford and Cambridge link

- £5 million to help develop plans for Cambridge South Station

- Building the Expressway road between Oxford and Cambridge

9 - 300,000 new additional homes a year, but not until mid 2020s!

- Planning reforms to ensure more land is available for housing, and that better use is made of underused land in our cities and towns

- £15.3 billion new financial support for house building over the next five years. This includes £1.2 billion for the government to buy land to build more homes

- £2.7 billion for infrastructure that will support housing.

- £34 million will go towards teaching construction skills like bricklaying and plastering.

- Local authorities can bid to increase their caps from 2019-20, up to a total of £1 billion by the end of 2021-22 if in areas of high affordability pressure to build more council homes.

- £400 million of loan funding for estate regeneration to transform run-down neighbourhoods and provide new homes in high demand areas.

10 - Help to Buy £10bn boost which helps an additional 135,000 people to buy a new home.

11 - The government will also create five new ‘garden’ towns - the chancellor has not confirmed where they will be.

12 - Changes to the planning system will encourage better use of land in cities and towns. This means more homes can be built while protecting the green belt.

13 - Additional monies for SME builders and small sites:

- The government will provide a further £630 million through the NPIF to accelerate the building of homes on small, stalled sites, by funding on-site infrastructure and land remediation.

-

A further £1.5 billion for the Home Building Fund, providing loans specifically targeted at supporting SMEs who cannot access the finance they need to build and possibly £8 billion worth of new guarantees to support housebuilding, including SMEs and purpose built rented housing.

14 - Empty homes premium:

15 - Creditworthiness and rental payment data:

- Launch of a £2 million competition to support FinTech to develop solutions that help first-time buyers ensure their history of meeting rental payments on time is recognised in their credit scores and mortgage applications.

16 - Right to Buy pilot in Midlands to continue for housing association tenants (£200m)

17 - One you might not think could help but - a new railcard for those aged 26 to 30:

- The government will work with the rail industry on a new railcard for Spring 2018.

- This could help 20 somethings look at homes further afield if it’s cheaper to travel

The bad news…

Well basically hardly anything new announced!

1 - Stamp duty for first time buyers:

- Only if both of you are FTBs, so if one of you have owned before or own now, you aren’t exempt.

- Applies on and after completions from 00:01 22nd November

First time buyers' legal companies (mostly) enter a code on the stamp duty return:

- Wales – applies until April 2018 when the Welsh Government’s new Land Transaction Tax is introduced

- Northern Ireland - applies

- Scotland – devolved so doesn’t apply

Most first time buyers don’t actually pay that much stamp duty, unless down South but every bit helps.

2 - Nothing for individual property investors to incentivise them to build:

- Certainly for those investors still hoping for a reversal of Section 24, it hasn’t happened and is unlikely to do so in this parliament I think. Nor will the additional 3% stamp duty be scrapped, partly as it’s making far too much money for the government!

- In addition there appears to be a higher capital gains tax implications for investors who have set up companies

This relates to the change in "indexation" which allows tax relief to be reduced based on the length of ownership and this will be frozen from January 2018. For more click here.

3 - Nothing for tenants:

- Bar their rental data being taken into account for FTB affordability and if someone is on benefits

- Right to Buy for housing association tenants

- Pilot only in Midlands

- Nothing on planning permission to relax rules to expand properties upwards

- Nothing to incentivise older people to trade down