London is made up of 32 boroughs, some of which are host to some of the most expensive properties in the world, which reside next to social housing, owned by the state and rented at around a third of the cost on the open market.

London continues to see demand move onwards and upwards as the population is ever increasing from a mix of people who have lived there all their lives, through to those around the UK and abroad looking to find their own fortune!

Because of the huge area London covers and the vast differences within it, we don’t like reporting just on ‘London’, so instead have created our own monthly London property report.

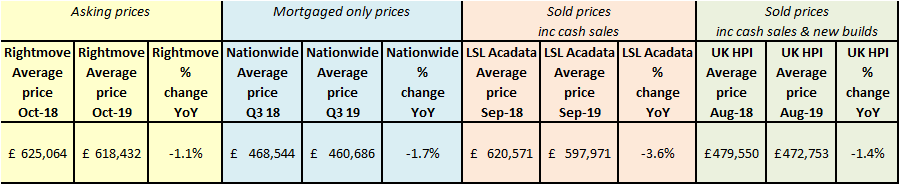

Currently the property price indices see average prices range from a ‘low’ of £460,686 from Nationwide for mortgage only properties while Rightmove’s asking price index (not necessarily the price paid) suggests an average price tag of £618,432.

However, if there is one thing they all agree on, it’s that London property prices are currently on a ‘downward trend’ and this is typically due to the market over reaching in a post credit crunch boom and now it’s hit ‘affordability buffers’ with a limit on mortgage lending.

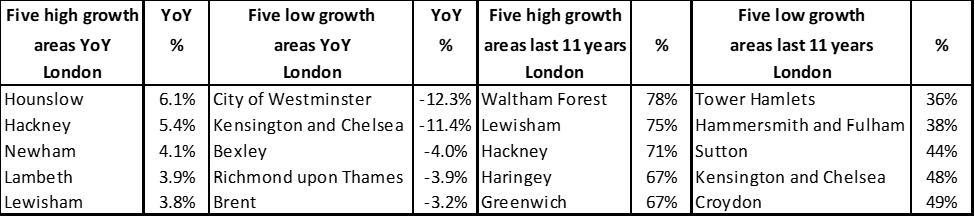

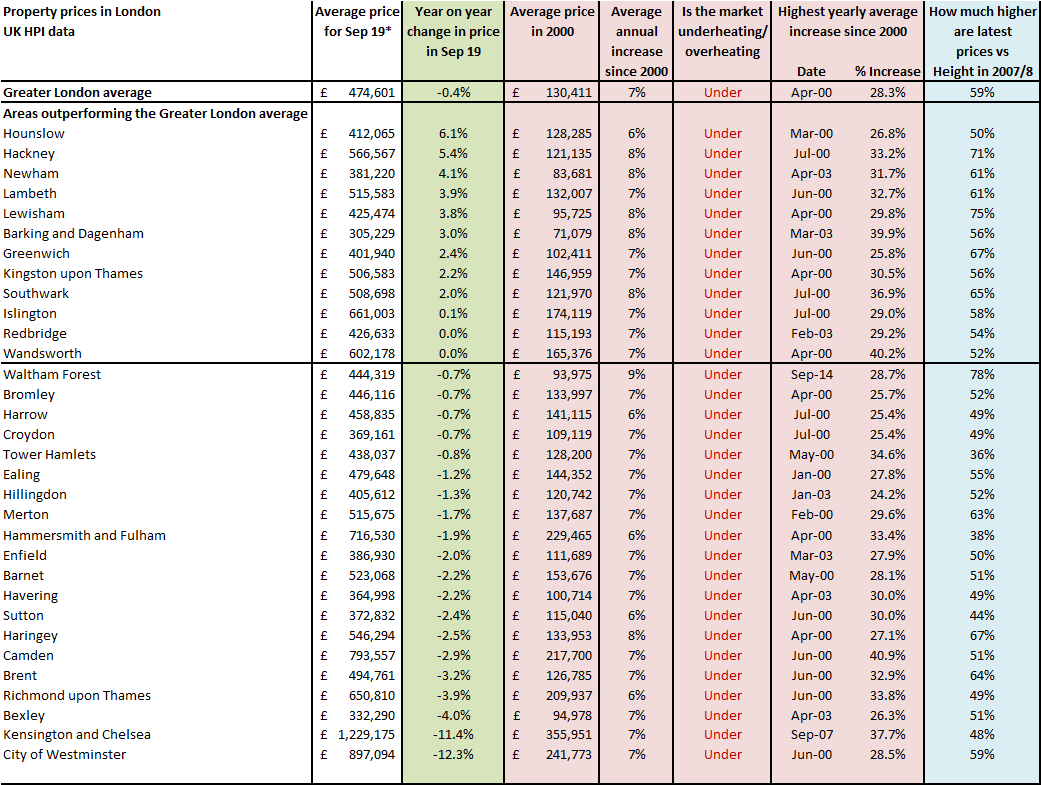

London boroughs are performing differently though, with Hounslow taking the top spot year on year – up 6.1% - while Waltham Forest prices are a staggering 78% higher over the last 11 years. Meanwhile, City of Westminster and Kensington and Chelsea properties are down from 11-12% year on year, while over the last 11 years, although still growing ahead of inflation, the likes of Tower Hamlets, Hammersmith and Fulham have only achieved growth at half the rate of Waltham Forest and Lewisham: 36% and 38% up respectively.

Source: UK HPI

This data alone shows how much a ‘London average’ is a pointless figure to anyone looking to buy and sell in the market and really it’s about understanding the local borough performance and then drilling down to an individual property on a street.

From an individual borough perspective, around half are in positive territory while the other half are seeing falls and every borough is currently under performing versus it’s long term annual average rises.

Source: UK HPI

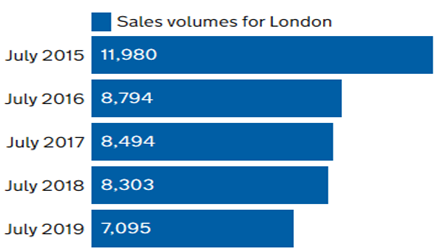

From a transaction basis, it’s not a surprise, but things are slowing substantially:-

Source: UK HPI

This is partly due to the recent falls in prices, but was inevitable as 50% of buyers and sellers dropped out of the market when the credit crunch hit and from 2012 to 2016, much of the volume increases was due to pent up demand – and sales.

The likelihood is, transactions in the capital will be similar ongoing to 2018 volumes as this was the first ‘normal year’ we have had for a while, and volumes since September 2018 have been subdued due to people waiting to see what happened when ‘Brexit was done’.

Over the summer of 2019 we did see some more activity due to people getting ‘fed up’ of waiting to see what happened next and although prices have fallen back, they hadn’t collapsed over Brexit talks despite the fears put out in the news.

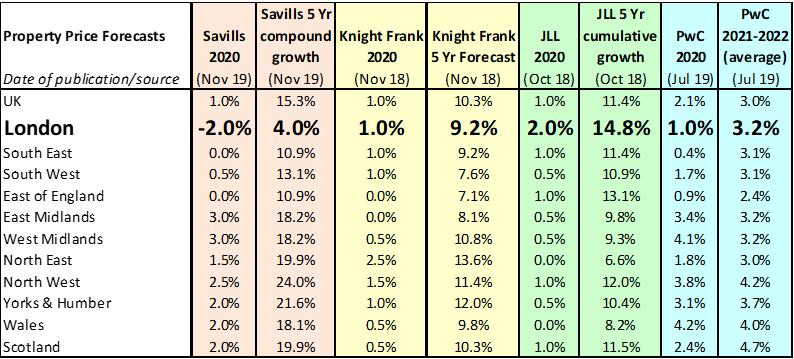

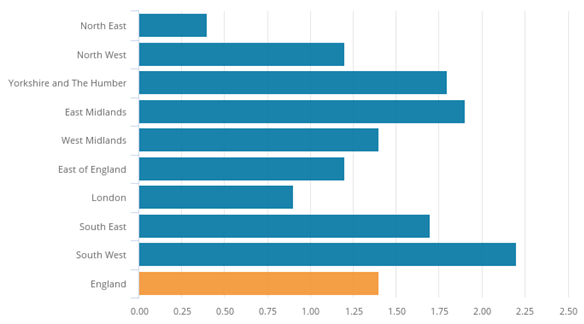

According to most of the forecasters, London may not top the charts when it comes to expected price growth, but it’s always been a relatively solid performer.

And for those thinking they can get better returns ‘up north’ this isn’t necessarily the case. You have to choose properties very carefully as some have hardly seen any growth for decades. Two key benefits of the London market are forecasted population growth in double figures – compared to little in the North East and only 5% over the next seven years in England, coupled with vast amounts of investment pouring into areas such as Newham and Tower Hamlets, both of which are positive drivers on demand that are difficult to replicate in other areas.

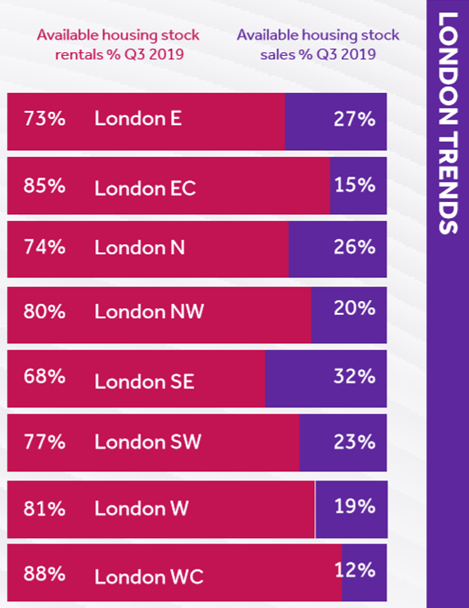

There is some interesting analysis from TwentyCi this month which shows how much of the actual transactions have shifted towards the rental market from sales:-

Source: TwentyCi

It’s clear that the major movers in the capital are renting. This isn’t just because of affordability. Many people living in a capital city are there temporarily working abroad for a period of time, or indeed they may rent in London for part of the year and rent or live in other parts of the world, if they are wealthy enough to afford two homes.

For those that are renting, even if they would struggle to afford to buy, renting gives them the option of flexibility at an age in life when things are not ‘assured’ as friends and relationships can come and go and, of course, in this day and age so can jobs and careers, particularly with the rise of the ‘gig economy’.

Rightmove asking rents show a positive trend year on year with average rents hovering around the £2,000 mark:-

Source: Rightmove

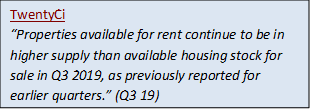

The best index, albeit only at a Greater London level is from the ONS which shows London year on year rent rises are not as high as other places across the UK, but over the long term, they have the strongest rise in rents:-

ONS Index of Private Housing Rental Prices percentage change over 12 months in Oct 19 by English region

Source: ONS

Over time, London rents tend to rise slightly ahead of the annual average inflation of 3%, but still not the ‘extortionate’ and ‘sky rocketing’ rents or rises that London landlords and letting agents are accused of:-

Source: ONS

Knight Frank reports that as a result of an imbalance in supply vs demand “rental values are being driven higher in lower price brackets. Average rental values increased 2% in PCL between £500 and £750 per week in the year to October. In POL over the same period, there was a 1.5% rise between £250 and £500 per week.” (Oct 19)

Although there is little reporting by borough on what’s happening rent wise, Belvoir’s Rental Index gives invaluable feedback from their individual offices:-

Sutton - rents for one bed flats had increased during Q3 2019, but two bed flats had slightly decreased. House rents remained static over the quarter. Tenant demand for flats remained static but increased for houses. Both rents and demand are expected to increase during Q4 2019. Sutton currently has a stock shortage of studio flats through to three bed houses.

Enfield - rents have been fairly consistent for 2019 with an average so far this year of £1,261 per month, rents reached their highest in April at £1,342 and their lowest in January at £1,148. This compares to last year’s average of £1,138 with a high of £1,446 in January with a low of £1,138 in December, suggesting rents have been fairly static in the area over the last twelve months when different property types are taken into consideration.

Kingston upon Thames - the current 2019 average is £2,117, rental averages hit a high in July of £2,600 when in January the average rent for the month based on Belvoir’s stock was just £1,600. Last year, the average was £1,700 per month so it’s likely that more expensive rentals this year have pushed up the average.

Stratford - the average so far this year is £1,430 with average rents over the last four months ranging from £1,200 to £1,540 reflecting different stock levels.

Uxbridge - the stock levels in this market are quite low so far this year and as a result, we are seeing the average rent so far being £1,500 per month versus just under £1,250 in 2018. (Q3 19)

Source: Belvoir

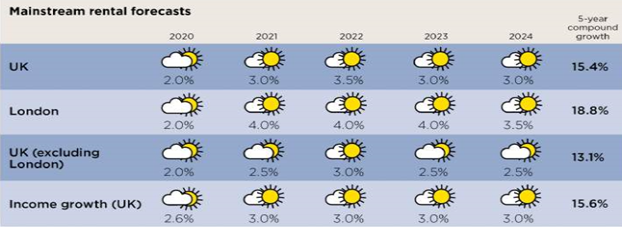

Forecast wise, Savills suggest rents will continue to rise at similar levels as they have in the past, with London growth only just outstripping that of the rest of the UK.

Source: Savills

| Advantages of a new build property - Barratt London |

How to run in your new property - LABC |

The legals of buying & selling a home - The Society of Licensed Conveyancers |

|

|

|