Rightmove “Early Christmas gift for buyers as sellers lower their price expectations”

Home.co.uk “Rising supply pushes market to the brink”

NAEA Propertymark “Housing market slows amid uncertainty”

RICS “Prices now seen falling nationally although some parts of the UK are still recording solid growth”

Nationwide “Slight uptick in annual house price growth in November”

Halifax “Annual house price growth slows to 0.3%”

LCPAca Residential Index “Monthly price growth falls to just 0.1%”

Hometrack “UK city house price inflation ranges from +7.7% in Leicester to -2.8% in Aberdeen”

For more on property prices, download my comprehensive update.

So we’re in the final few months of data and analysis for 2018 and it’s fair to say that it’s pretty much performed ‘as expected’ with the market slowing, especially driven by the South and East. However, the market isn’t just slowing according to the latest data, and although you can’t rely too much on month on month data, most of the surveys are suggesting the market is going into reverse. Although Hometrack state that “Despite Brexit dominating the headlines, our lead housing indicators suggest no imminent deterioration in the outlook for prices or levels of market activity.

The slowdown in London since 2016 has been a result of weaker market fundamentals. Uncertainty around Brexit has been a compounding factor.” And in the main I agree, I do think from now, particularly with no indication before Xmas as to what is going to happen, that Brexit is going to hold the market back until a decision has been made. One way I notice this is by the number of queries I get as to whether now is a ‘good time to buy or not’ and they are definitely going up, be it first time buyers or investors asking the question!

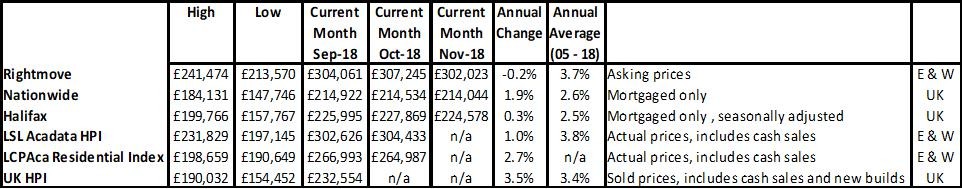

For more, see our data on the various national price reports.

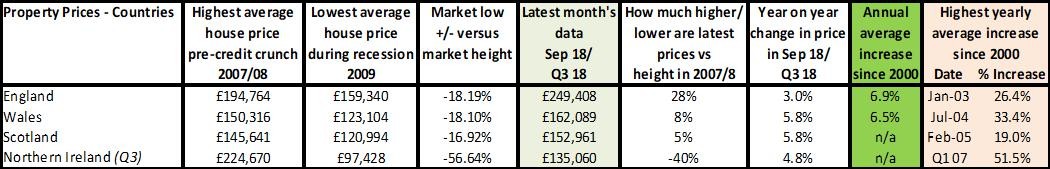

Source: UK HPI

Overall, as far as the Land Registry figures by country are concerned, performance is pretty good – even in England which has seen a drag on growth from the South and East of England. Even Northern Ireland which is still experiencing prices ‘on average’ 40% lower than 10 years ago, is seeing good growth year on year. Wales and Scotland are seeing a bit of a stronger recovery, with prices up (on average) by nearly 6% - double the England average - year on year.

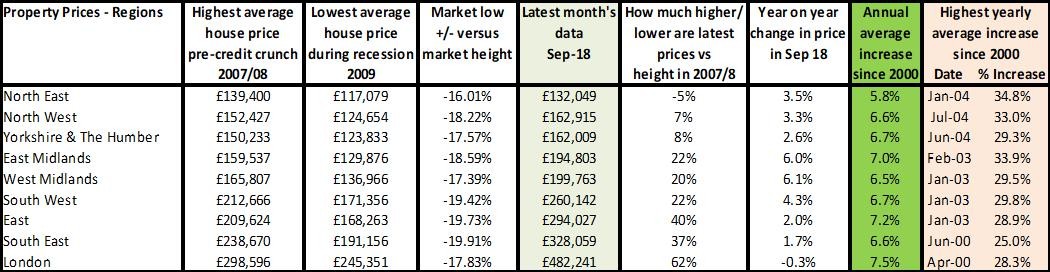

In England, regionally it’s mixed, with London going ‘backwards’ but after large growth, meanwhile the Midlands is topping the performance charts. Interestingly though, the ‘ripple effect’ isn’t working in the way it did prior to 2005, with the North East, still seeing property prices 5% lower than a decade ago, yet price growth year on year is just 3.5%, half that of the Midlands. The property market is definitely changing from a capital growth perspective, and it is essential agents and others service providers really understand the implications of lower capital growth.

Source: UK HPI

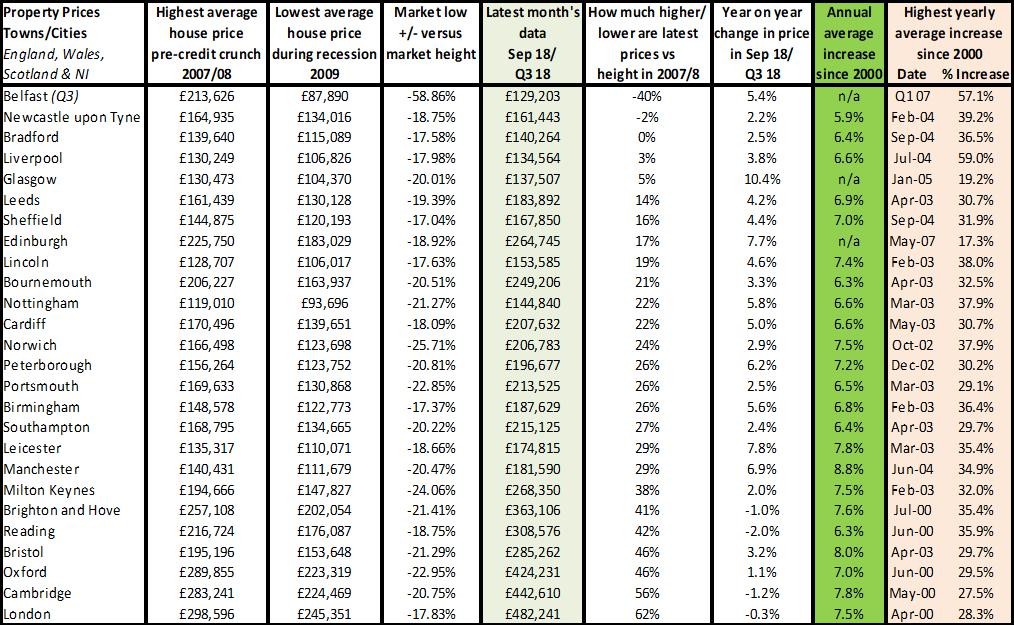

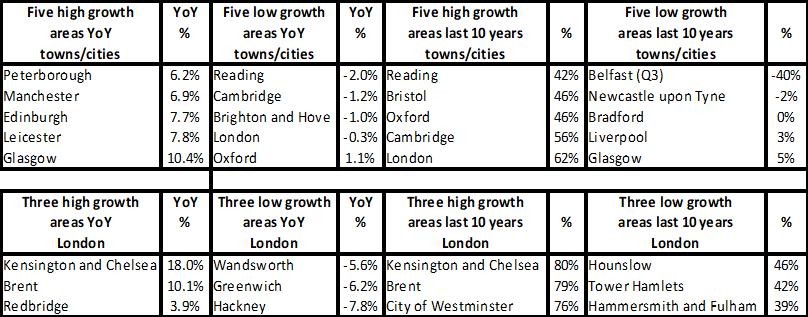

Of all the towns/cities that top the charts this month it’s Glasgow that leads the way with the ONLY double digit growth of all of the 26 places we track. Other good performers include Leicester at +7.8% with Edinburgh just behind, closely followed by Manchester and Peterborough. In contrast, areas ‘down south’ and in London are seeing falls, but it’s also quite scary for the market that in areas such as Newcastle, Bradford and Liverpool, prices are hardly rising at all year on year – and have not really risen at all over the last 10 years. Much of people’s ability to be able to move since homeownership overtook renting in 1975 is the growth in equity which allows people to move ‘up the ladder’. The question is what happens when this equity growth doesn’t materialise? Do people just ‘stay put’ or are they able to save to continue to find the additional funds to move upwards? These are essential questions for the industry to be able to answer – sooner rather than later – and indeed work out how to motivate sellers in this ‘new property price era’.

Source: UK HPI

For more, see our comprehensive regional and city data.

Transactions, supply and demand

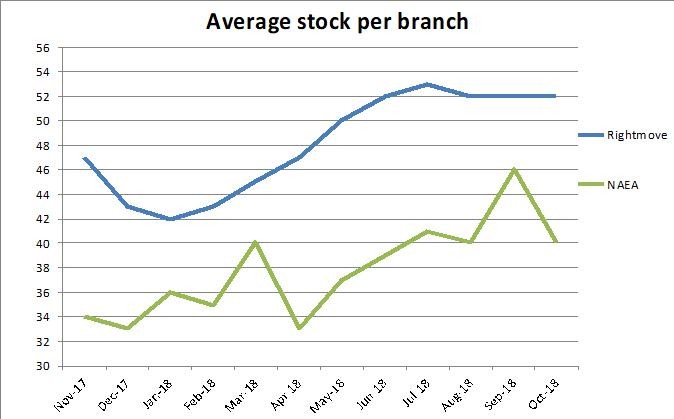

It’s actually quite astonishing how well property market volumes have performed this year, bearing in mind all the doom and gloom we have had about the economy, the uncertainty driven by Brexit and especially in light of headlines threatening ‘30%’ or ‘35%’ property market falls – from no other than the Bank of England Governor. In the past, any one of these headlines would have stopped the market in its tracks – but to date it just hasn’t. Talking to consumers, I think the last two recessions and better property market data, coupled with less sensational media headlines, has changed people’s views and they are not so worried about buying in a ‘hot’ or ‘cold market. With such low stock levels available, they appear more concerned about getting ‘the right deal’ if they are an investor or getting the ‘home of their dreams’ if a buyer, accepting that the market may rise and fall during ownership. This is good news if it’s really happening and we’ll know better next year depending on how the market reacts in the first three months of the year. What we are likely to see now is Brexit uncertainty starting to impact with bad economic news (eg the pound falling) and likely to be (in my view) stock market falls looming too, possibly for the UK and for Europe too. If this happens, it’s likely to help drive a deal sooner rather than later and as soon we have, the property market has a chance of performing as well in 2019 as it did in 2018 in most places.

| Buy to let tax - Nicholsons Chartered Accountants | Storing your belongings - Big Yellow | Quick guide to buying and selling - SLC |

|

|

|