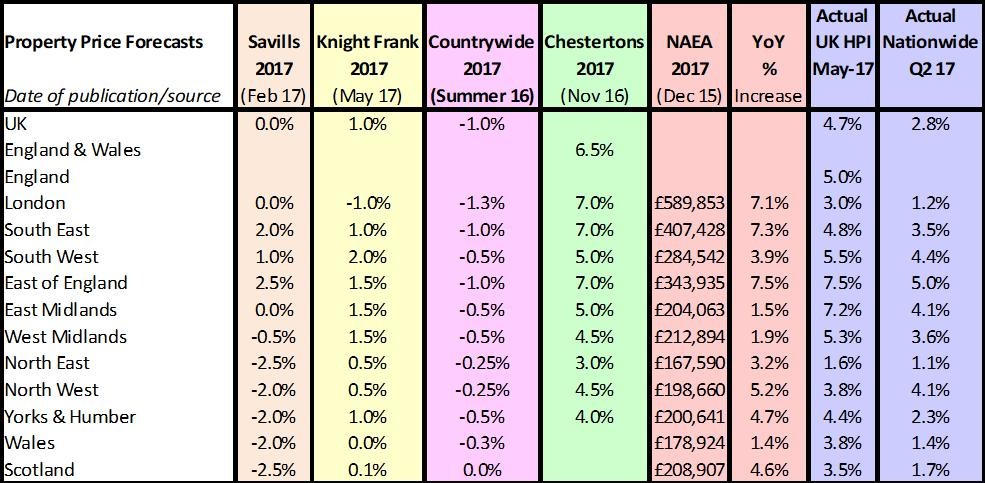

The chart below compares the different property expert forecasts for 2017 versus actual price growth recorded by UK HPI and Nationwide. The chart below compares the different property expert forecasts for 2017 versus actual price growth recorded by UK HPI and Nationwide.

The forecasters so far have either predicted a worse market than we are actually experiencing so far or a far more buoyant one. In reality, performance to the half year is pretty much somewhere in the middle.

Download my comprehensive property price summary.

Some parts of London, particularly at the top end, have seen property prices go into reverse – albeit after seeing prices almost double since the recession. While other areas expected to see a fall – such as the North, Wales and Scotland according to Savills – have actually seen growth rates of a few to 4.4%.

The South West and East Midlands through to the East of the country have perhaps performed much better than the forecasters suggested, with expected growth being minimal by most forecasters, whereas rates of 4% to over 7% have been achieved.

Where the forecasters have been most accurate appears to be for the North East, where minimum growth of just over 1% has been achieved versus forecasts of a -2.5% to 3% were predicted. Wales and Scotland forecasts have seen similar success.

Bearing in mind the enormously complex property market picture and the speed which property prices can turn up and down, it’s impressive that the forecasters get anywhere near close to the actual results and of course, we are still only half way through the year.

So far, despite the slowdown, the market is actually performing at a rate better than forecasters predicted in recent times, although slightly behind some of the older forecasts from Chestertons and the NAEA.

In my view, although the likes of Brexit, affordability and increased taxation are all being blamed for the slowdown, I think the key reasons for the easing in the market, where that is happening, is due to normal market activity over time. We saw huge falls during the credit crunch, followed by huge rises as the market recovered, followed by a more stable market as demand and supply starts to match over time. However, I do accept that government intervention in the market is making things worse (rightly or wrongly) in that the prime market is suffering due to higher stamp duty levels and that in areas such as London, the South East and East we are seeing more than expected slowdowns due to a loss of landlord purchases and in some cases, affordability issues due to restrictions on 4.5x income spending.

Download my comprehensive property price summary.

Forecast commentary from the experts

Savills - “Brexit has forced the market to change gear and created uncertainty. Against this new backdrop, our forecasts are for slower growth. Although we are expecting economic growth to remain positive, households will face weaker income growth and there may be some job losses over the next two years. The period of negotiation with the EU is likely to be a rollercoaster of confidence, with volatile sentiment indicators and lower levels of business investment.

“As importantly, the amount buyers are borrowing relative to their incomes is already stretched in some parts of the market. In particular, it is bumping up against the limits of mortgage regulation in London. While falling mortgage interest rates will create some capacity for house price growth over the next two years, buyers are unlikely to want to stretch their finances much further in uncertain times. So it is difficult to see any significant potential for house price growth until the terms of the withdrawal from the EU are agreed and economic growth picks up.

Knight Frank - “The headline rate of house price growth across the country has been slowing since summer last year, transactions have also fallen from recent peaks. There are several factors at play behind the recent slowdown in market activity – not least a lack of available homes to purchase. This has increased focus on the delivery of new-build homes across the country. Data from DCLG shows that the number of new homes being built in recent years has risen, but it still remains some way below the number needed to meet current demand – not to mention the large historical shortfall.

“The shortage of housing stock available to buy coupled with ultra-low mortgage rates have put a floor under pricing across the UK, but the question of affordability is becoming more pressing in some areas, especially as lenders still expect sizeable deposits from buyers. As the UK moves closer to Brexit, any economic uncertainty could have a knock-on impact on the housing market, especially if wage growth and employment levels across the country are affected.”

RICS - “The five year expectation series show some moderation in perceptions as to where prices and rents are likely to go over the medium term. For prices, the latest reading (using a three month moving average) points to an average annual increase of 3.2% in each of the next five years while for rents the comparative figure is 3.6%. Although these projections remain above the likely increase in average earnings over the period, they are lower than recent readings suggesting that affordability issues may be impacting on expectations.”

| Buy to let tax - Nicholsons Chartered Accountants | First-time buyer quick guide - Anthony Pepe | How to Rent - SafeAgent |

|

|

|