We are all very aware of the constant message to twenty somethings ‘you have no chance of affording a home’ and the mantra is really ‘so don’t even bother trying’.

This is one of the main reason why I feel there is a rise in those renting versus buying. If you constantly tell people that they ‘can’t’ do something, then won’t bother to even try or investigate.

A good example is where I am from in Nottingham. People in the area think that prices have gone up dramatically. And they are right in some areas such as where I grew up in West Bridgford, a nice leafy suburb. But just over a mile away in Nottingham, two bed terraces can be bought for a around £70-80k and for investors that piled into often over priced city centre flats, they paid around £115k for them and they are now selling out for just £80k.

It’s true in London and economic power houses such as Cambridge and Oxford that due to intense stock shortages and huge amounts of money paid to people to work there, prices are high and it is very difficult to get on the ladder.

However, just because most of the media live in the South, it shouldn’t mean they take their situation and then impose it on the rest of the country.

Unfortunately we just don’t have a balanced and sensible discussion about property and particular there is little help on “how to put a roof” over people’s heads. The editors, bar specific experts, are much more keen to publish scare and horror stories rather than helpful ones. Imagaine if that was constantly done about cars, health, beauty and food? We can all easily find bargains in these industries and we never talk about the ‘average’ price of an egg by adding up all the egg prices in a retailer and then comparing this to local salaries!

What’s the reality when it comes to FTBs in England?

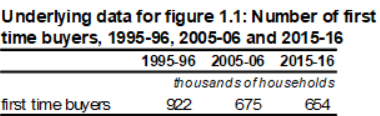

The numbers are interesting. The first table below shows that back in the last recession in the 1990s, there were nearly a million FTBs, but prior to the credit crunch this had fallen by a third to just over 675,000.

What’s interesting though is that during 2015-16, despite the news telling first time buyers property is ‘unaffordable’ and they can never secure the deposit or afford a mortgage, pretty much as many people bought their first home last year as they did prior to the credit crunch.

Source: English Housing Survey

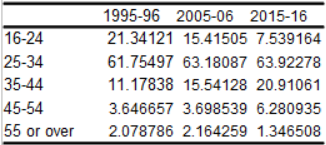

And, when you listen to the headlines, they tell you that the age of young people who buy is rising dramatically.

The chart below from the English Housing Survey shows the reality though.

Yes a lower percentage of 16-24s buy their first home. But aren’t a substantially higher number going to university/college now? Aren’t they all starting life out with a huge debt from taking this higher education?

And lets think about it. You’re in your teens and suddenly the world economy collapses. Maybe you are 15 years old. It’s likely your parents could have fallen into negative equity or even had their home repossessed. They may have got divorced, but couldn’t sell, so you were all forced to live together.

Then 5 years later, you're 20 years old. Jobs aren’t easy to come by and the ones that are aren’t always that secure.

The news tells you you will never be able to save for a deposit and can’t afford a mortgage.

Why on earth would you even contemplate buying?

But when you get to your mid 20s you have been renting a while, maybe find someone to be with and then in your 30s you settle down and have kids and want them to be in the best school for the area you can afford.

No wonder fewer 16-24 year olds are buying, no wonder the percentage who are 25-34 are buying and after 10 years of a severe recession where in the likes of the North East property prices are still 9% lower, on average, than they were 10 years ago, the age of a first time buyer has increased.

Age of first-time buyers

Source: English Housing Survey

It really is about time we stopped jumping to conclusions about property statistics and started to better understand what is actually happening on the ground.

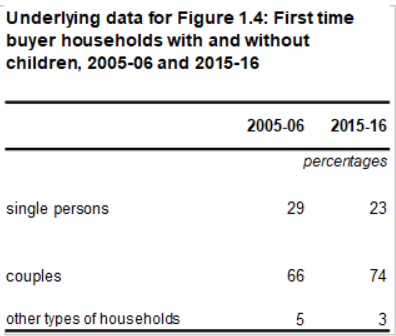

And one more thing. More people are living on their own, this makes affordability twice as hard, so it’s also no surprise that the number buying without a partner has fallen. If less people cohabit, then fewer people will be able to afford to buy, that goes without saying, but funnily enough it’s never been said or, in my view, properly researched.

Source: English Housing Survey

The reality is that in some areas being a first time buyer is rubbish and hard work. However, these are typically wealthy areas which have had severe planning failings.

Rather than blame developers as seems to be Shelter’s new campaign, it’s about time we looked to the Local Authorities and asked them what they are doing to solve the problem – especially as they are the ones how really decide what and where developers build.

For those who want to buy elsewhere in the UK, stop believing what you are being told and look to see what’s really happening in your area.

To help, do download our FREE First time buyer eBook or if you are in the area head to the First Time Buyer shows in London 30th September or Manchester 7th October.

| First-time buyer legals - Beaumont Legal | First-time buyer quick guide - Anthony Pepe | Quick guide to buying and selling - SLC |

|

|

|