Standing back from all the uncertainty in the news and looking at the property market indices this month, it’s a miracle the market is still performing so well. And despite some worries and wobbles from London and the South East, and of course Aberdeen’s continued decline in both prices and rents, it’s good to see that Hometrack is reporting “All cities recording positive house price growth” up by 2.8% year on year. And there seems to be more good news on the way with London prices turning positive (+0.4%) after a poor few years.

Read the full report for more details

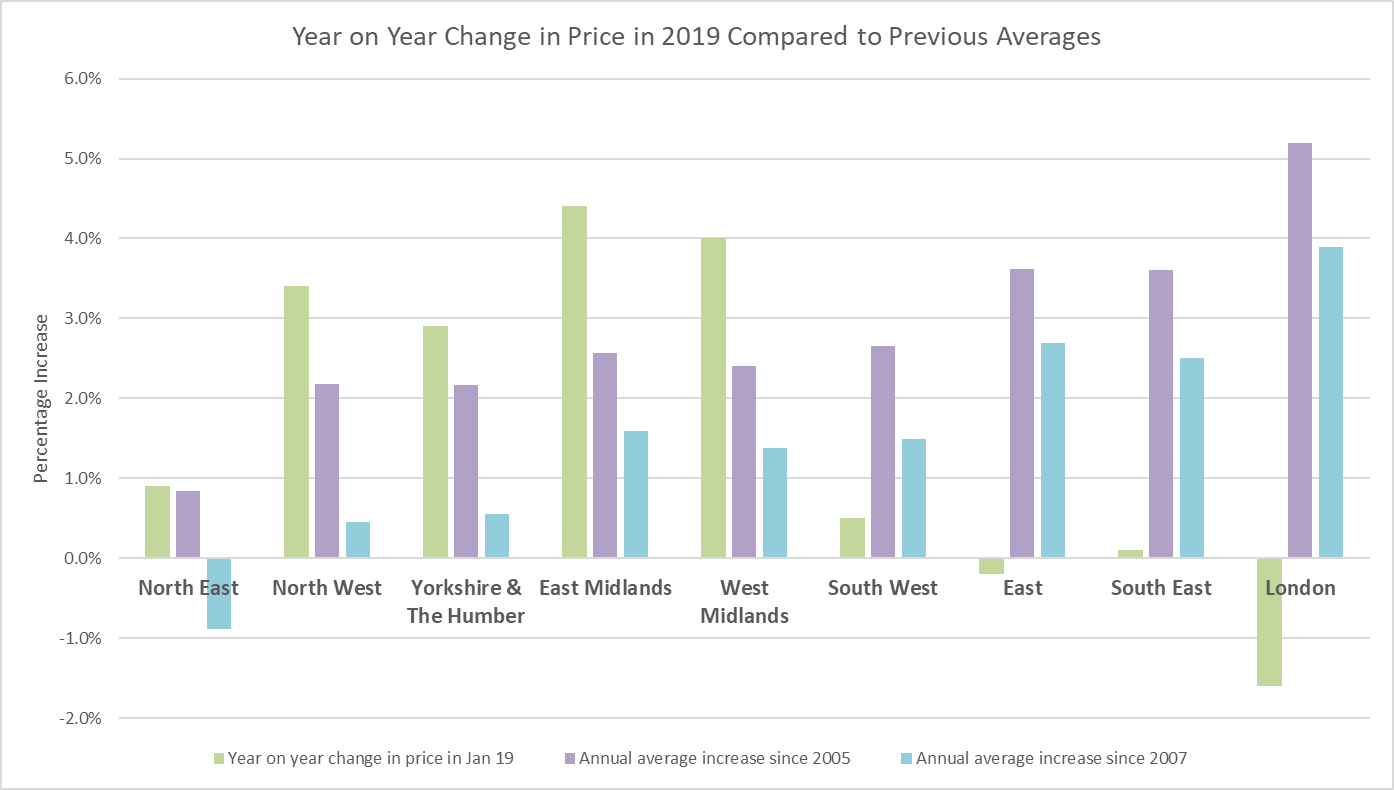

Country wise, England and Scotland are seeing the lowest growth year on year, while Wales and Northern Ireland are showing much stronger growth according to the Land Registry. Our own chart shows though that Wales hasn’t seen much annual growth since 2005, with prices increasing at less than 2% on average – lower than inflation. And although NI is doing well year on year, overall prices have still been showing an average fall of 4% each year since the crash. The good news is though that this low growth is helping to improve affordability, with the latest Halifax Affordability Index showing that the “cost of maintaining a mortgage in Northern Ireland now only takes up half of the average earnings (19% vs 39% in 2008) for the region than 10 years ago (51% of 2008 levels), with Scotland (18% vs 30% in 2008) not far behind. Typical mortgage payments accounted for over a quarter (28.8%) of homeowners’ disposable income in 2018. This means mortgage affordability levels for home movers have improved significantly by 39% since 2008 (35%).” Of course for Londoners, life is tougher, London with their “average mortgage payments, as a proportion of disposable earnings rising by 18% (from 40% in 2008 to 47% today), driven by house price increases”.

Source: UK HPI

Regionally, the North East property market is still way behind other regions, with price growth hardly registering and prices now 10% lower than they were in 2007, 12 years ago. In contrast, the Midlands and North appear to be doing well currently, but the reports are already suggesting this growth may be about to subside as they have picked up the “Largest supply increases observed in the West Midlands (+8%) and the East Midlands (+4%). However, stock levels in the South and East still appear to be high year on year, suggesting regional values will be suppressed for the near

Read the full country and regional summary here

With Belfast, Manchester, Sheffield, Edinburgh and Leicester showing the highest growth year on year, with the previous strong growth areas of London, Reading and Bristol falling into the lowest performers. And our charts below show how much variation there is in price growth over time with Nottingham showing price growth of less than 2% annually since 2005, even though they are growing at over 4.5% currently against Cambridge’s economic success driving prices at a pretty consistent 4% annual growth since 2005.

Read the full town and cities report here

This month Hometrack have produced a new chart showing average sales volumes and transactions and it shows a surprising resilience market wise since 2014, albeit on a local level, transactions are performing at completely different rates. Unusually, bad news spooks first time buyers, but with prices rising and falling quite regularly over the last 12 years, it’s clear this current generation of FTBs are more savvy than those before and see a depressed and dampened market as one which is good news for them, rather than one to stay away from. What’s helping with this is that although getting a deposit is tough for this generation, once you are on the ladder, the mortgage rates are so low, if you can get over the deposit hurdle – especially with the Help to Buy Scheme, this means living costs are pretty affordable compared to previous generations.

Read the complete demand, supply and transactions report here

PropCast - The house selling weather forecast

Source: The Advisory

| How to choose a leasehold legal expert - ALEP |

Passing on your property wealth - Chase de Vere |

Buy to let tax - Nicholsons |

|

|

|