It’s always a nerve-wracking time for the property market when it comes to the Budget.

However, this Budget was very different to others I’ve covered since the Conservatives got into power following the credit crunch. Overall, it actually wasn’t bad and I think there is more good news than not for the property market – including investors and buy to let landlords.

However, this ‘feelgood factor’ is all very dependent on what happens with Brexit, which hopefully we will know more about in November, unless a deal gets dragged out over Christmas.

Why was the Budget good news?

For many years now, I’ve presented on the link between ‘property, politics and economics’. For the property market to be successful we need:

Overall, as far as the first four key success factors, the Budget pretty much passes each of them.

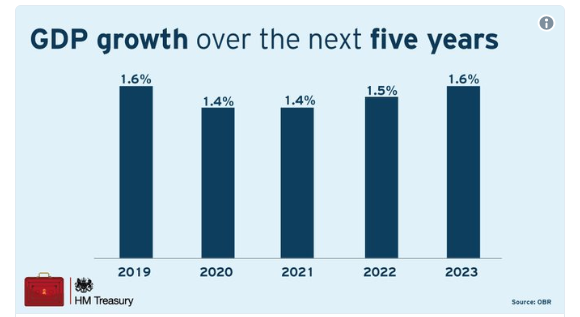

Growth forecasts are looking pretty good (Brexiting smoothly being assumed):

When an economy is growing year on year that typically means more jobs, more money to go around and that means affordability of homes is easier.

Real wage growth?

Up until now, the growth that we have had economically hasn’t always translated into better affordability due to the government’s cap on government wages at 1% – as Labour pointed out, this has meant nurses, fireman, police and teachers have seen a huge fall in their real wages.

According to academic analysis of public sector salaries over the past decade, commissioned by the Office of Manpower Economics and published in July 2017, “median hourly earnings of UK workers dropped in real terms by almost 6% between 2005 and 2015, with some sectors suffering worse drops than others.” Source: www.theguardian.com

The Guardian quoted these findings from the report:

However, the Budget suggests that ‘regular pay growth’ is 3.1% and is expected to grow at above inflation for the next five years. That is great news because we have seen that when wages beat inflation growth, landlords can typically put rents up – much needed with current tax rises – and it also means purchasing a home can get easier as house price growth is expected to be in line with inflation moving forward.

In addition, there was a good boost to everyone’s take-home pay through:

These kind of measures make a genuine difference to the money people have in their pocket.

Higher employment

All of this growth means the chance of job losses is lower and indeed unemployment is expected to hit one of its lowest rates of 3.7%. More people in jobs means more people can pay their rent, so fewer arrears, and it also means people are more confident to buy a home if they think their employment prospects are good, subject to Brexit, of course!

Universal Credit, easing the pressure?

We are all aware – particular landlords renting to those on benefits – of the huge problems the migration to Universal Credit is causing claimants and there was some good news with a boost to the benefit. I don’t think this is going to impact on landlords or tenants that much any time soon, but at least it is being recognised. One thing to watch out for is the government suggestion that they would support more benefit claimants with setting up their own business. That’s all well and good, but this can pose problems to those who let property as it may not be allowed in the tenancy agreement and you may not want people running businesses with your address on it!

First-time buyer and social/council housing boost

Good news was given to those who have shared ownership properties as the first-time buyer stamp duty relief will be applied to those buying up to £500,000. For some this will even be backdated.

And Help to Buy is expected to continue to 2023; not necessarily for all but certainly for first-time buyers who are the biggest beneficiaries, with around 80% of properties purchased through Help to Buy so far being to first-time buyers.

In addition, the previously announced removal of the cap on councils’ borrowing to build new homes comes into effect very soon and there was support for a further 13,000 social homes through Housing Associations. Having said that, there are more than 1million households on council waiting lists, so while the announcement of more social homes is good news, it is still a drop in the ocean when it comes to what is actually needed to relieve the housing crisis for the vulnerable.

Finally, for those in areas where prices are way above what they can afford (such as Cornwall), there was a boost in funding to help provide homes to local people at a discount which would apply in perpetuity.

Biggest boost to investors: infrastructure investment

For investors and buy-to-let landlords to make money, investment in infrastructure is key, along with increased demand in the local area. And the government has a lot going on to help boost potential returns for savvy investors, including:

Reduction in Private Residence Relief

This was the one downside for those who are typically referred to as ‘accidental landlords’ – ie those who let a home they once lived in. Basically the relief is going to be restricted to people who let to live-in tenants, such as those who rent a room or via the likes of Airbnb, although relief remains for those who are disabled.

This, together with previous tax changes, may well mean these accidental landlords choose to move back into their homes or sell up prior to its introduction in April 2020.

There is still time to secure the current relief and it’s worth visiting a specialist tax advisor to find out whether you should continue to hold, or if it’s time to sell up.

Overall though, this was a much more positive Budget for the property market than we’ve seen for a while.

Having said that, I’m saddened that the government still isn’t offering tax relief to individual investors who create new homes as opposed to buy existing ones, both for sale and for rent (private and social). In my view, the government is not going to achieve its 300,000-a-year new homes target without this and it would be so simple to introduce, not to mention good for local neighbourhoods to see small local developments being built, rather than just large ones.

| Passing on your wealth - Chase de Vere | Buy to let tax - Nicholsons |

|

|