With the latest data from the Nationwide index out on Wednesday, it appears that the ‘fears’ of a fall in confidence in the economy and property market are abating.

According to the Nationwide, average annual house price growth for the UK rose to 5.6% from 5.2% in July. This suggests that fears of the impact of Brexit are unfounded (so far!), mostly due to the fact that we are yet to see any economic consequences of the vote and also because falls in demand are being matched by falls in supply – the latter of which are at a 30 year low, according to RICS.

However, what this BBC piece shows is that whatever is happening ‘nationally’ or even at a local level, it doesn’t necessarily mean this ‘average trend’ applies to your individual property price.

Peterborough is featured in the film and it’s an incredible place to study – especially for a property statistics geek like me!

The filming looked at two places, all along the same road in Peterborough: Lincoln Road.

Property prices are rising, falling and some are staying the same

The first film involves Terry Lucking from Belvoir! Peterborough looking at properties which, despite the fact that the government’s UK HPI index says prices are going up ‘on average’ by 8.5% per year (similar to England increase) within a mile of each other.

The film shows that based on local supply and demand factors, some properties are going up in price, some down in value, while others have stayed the same price for over 10 years!

And, despite the fact that Peterborough is just 45 minutes from Kings Cross (and only 37 minutes from 2018), the average property price in this area is still 26% lower than the England average at £165,000.

Local factors affect individual property prices

Along the five mile stretch of the Lincoln road, there are 49 properties for sale. The most expensive is being marketed at £850,000, but you can still pick up a two bed flat for £90,000 or a two bed terrace (albeit on a main road) for just £105,000.

Prices on this road, as they are in many other places across the UK are rising, falling and staying the same and it’s these price changes that make up the ‘average’ that’s often reported.

However, individual property prices are affected by:-

Primarily it’s all about supply and demand

So if two buyers are chasing one property one month, prices typically go up, while if in the next month two sellers are competing to secure offers from only one buyer, they will fall – whatever is happening to the ‘average’ figures.

We know that supply is typically restricted at the moment, so anything that affects demand, such as wage changes and access and the cost of financing, will affect prices.

Looking to buy for the first time? Here's our first time buyer quick guide

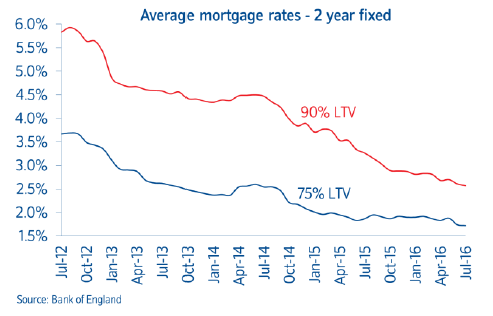

Currently demand remains buoyant as confidence is returning after a ‘knock’ from the uncertainty surrounding the Brexit vote, but while wages are still rising ahead of the cost of living, access to finance is increasing and the cost of financing a mortgage has fallen dramatically since 2012, in many cases halving!

Anything that reduces these drivers of property prices, will affect how much they rise or fall by.

In addition, there is individual supply and demand for:

Different property types: bungalow, semi, detached, flat

The number of beds – studio to five bed or more

Then it’s about location

As we saw in the VT, prices vary overtime depending on whether they are on:-

Next, when they were last sold

If a property was sold at the height of the market when developers were ‘riding the property price rush’ and prices were at their highest, with the credit crunch hitting, a desperate seller of these properties may now be willing to accept an offer for less than they bought it for.

Looking to sell sharpish? Read our selling a home quickly checklist

Then: specific property type with a limited market

For example, on Lincoln Road, they have sheltered housing accomodation which is currently worth around £50k when it’s previously sold for £85k

And last, but not least: property condition

If a property is in great condition, it goes without saying that it’ll attract a higher price than one which needs huge amounts of work. In theory anyway! However, what I find is that a property which needs mostly cosmetic changes such as a makeover and bathroom and kitchen can go for more than they would be worth in mint condition. All because of programmes like Property Ladder driving up demand for property ‘wrecks’ that are short in supply!

And the best value properties are those that can’t be bought with a mortgage as this reduces demand substantially. So properties with subsidence, ones with flooding issues, anything that means they can only buy with cash, reduces its value versus another property which hasn’t got these issues.

Search for sold property price data through the likes of www.nethouseprices.com and sign up to get regular emails to allow you to keep up to date with whats actually happening to properties in your area.

And…if you want to get an accurate valuation and view of your ‘personal property market’ to buy, sell or invest in, then talk to local experts, like Terry, so you know what’s really happening to prices.