Your Move and Reeds Rains manage more than 55,000 tenancies a year, meaning they have access to a wealth of experience and knowledge about what tenants really want, and their latest survey from 3,500+ tenants has produced some fascinating research.

The research is useful for political parties, agents, landlords and other service providers to have a clearer idea of which policies and initiatives will work and which won’t in the Private Rented Sector (PRS).

It also combats some of the myths constantly perpetuated in this market that tenants are ‘miserable’, pay ‘extortionate’ rents and are ‘second class citizens’ to home owners – only renting because they can’t afford to buy.

This research clearly shows that many of these statements don’t apply to much of the PRS.

Below we’ve summarised the key elements of the research, which will help landlords work out a strategy to let now and in the future and help policy makers consider whether planned changes are going to succeed or fail.

Below is a summary of the report and some of my own conclusions. You can access the full report here.

The idea that all tenants rent because they can’t afford to buy is clearly inaccurate, as is the belief that people rent because they ‘have no choice’. The reality is many are renting through choice, because it suits their current needs.

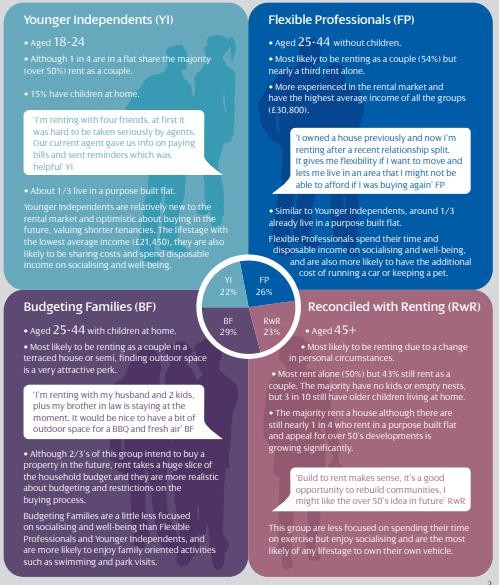

It’s clear from this definition of different renters that many rent because it works for their current life circumstances. Looking at the data, those who would perhaps prefer to buy are in the Budgeting Families (BF) and Reconciled with Renting (RwR) groups, but most are still happy with the properties they rent.

Key figures from the research show that renters are more optimistic about the option to buy in the future and that in the main, renting is affordable, costing around 30% of their income:-

RwR tenants intend to rent for the longest period, 5.8 years average versus just 2.6 for YI (although not necessarily in the same property)

81% of renters in the Younger Independents (YI) group intend to buy in the future; this drops to 74% for Flexible Professionals (FP), 67% for BF and just 34% for RwR

Overall, 63% of tenants intend to buy in the future; up from 57% in 2017

Average rent as a proportion of income stands at 31%, up to 33% for YI and BF – Halifax figures show that mortgage payments account for 29% of household income, but bear in mind renters don’t have to fund maintenance or buildings insurance

RwR tenants are the most content with their situation, 72% are happy renting compared to 66% of renters overall, again providing evidence that the PRS is providing a quality product to tenants and there is no need for them to feel like ‘second class citizens’.

Of course, renting is different to owning a home, and with housing being a large part of anyone’s expenditure, it’s no surprise that the cost is a top concern. In addition, the discussion on tenant fees has clearly raised this as a worry.

Again, in the main this is an unnecessary fear. Research from self-regulated agents showed average fees were £200 outside of London, £300 within London.

The key for tenants is to make sure that they checkout the agent and landlord BEFORE falling in love with a property and paying ‘whatever is required’ to secure it.

Top 5 tenant concerns in 2018:

Rent cost (43%)

Fees (34%)

DIY restrictions (33%)

Restriction of keeping pets (22%)

Maintenance (22%)

The reporting on the rental market is often out of date with the reality or because agendas are involved, the report states:

“This research advocates challenging age old perceptions of the rental landscape and what tenants can expect to include or budget for. Giving tenants greater choice in how they budget and plan for their own future can forge great trust between tenant and landlord.”

With regards to planned changes happening in the market, 70% of all renters say that not having to have a security deposit through new ‘zero deposit’ services would be influential in their decision to rent a specific property. The problem renters find is paying a deposit, one month’s rent upfront and fees. This can be a lot to ask out of their income and the creation of the tenancy deposit schemes has meant renters can’t get their previous deposit money back before putting their next one down:

The average rental deposit in England and Wales is £1,041 according to TDS

Raising a deposit before for new place before getting previous deposit back is stressful due to cash-flow issues

More than 50% of tenants are interested in a different type of deposit scheme, including an insurance-backed scheme.

A surprise idea which was welcomed was including contents insurance within rent, particularly for younger life stages and, considering the low take-up of insurance, this is potentially a good idea – as long as the insurance genuinely offers a good deal for tenants:

Only 56% of tenants take out contents insurances

YI tenants are least likely to take it out

More than 50% of FP and YI tenants are interested in having contents insurance covered within rent

Price (86%) is the biggest consideration when choosing insurance but YI are more influenced by expert advice and RwR think more about level of cover and ease of purchase.

What tenants want from a property – essential information for landlords

Although there are some poor, often criminal landlords and agents that are exploiting tenants, it’s clear that many, rightly so, have high expectations when it comes to the kind of facilities provided by the landlord.

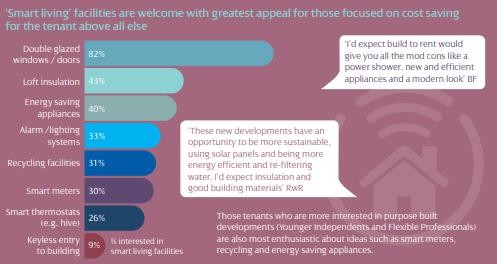

The chart below shows the key features which tenants are looking for when renting and, bearing in mind that brand new ‘Build to Rent’ institutional landlords are coming, this provides existing landlords with a useful ‘tick list’ of things they should be providing to their tenant to ensure they stay or to attract tenants into the future.

Build to Rent is a good initiative which has been financially backed by the government (as opposed to individual landlords who have been penalised). This is a concept which dominates in Europe – hence it being a very different market for tenants.

It basically consists of large projects to build 100+ units from scratch – typically flats which are then rented out for as long as the tenant wants. The flats are either rented by the company that built them, or sold onto large pension groups who want to secure a long-term income and see renting as giving good returns.

According to the research, the “appeal of new ‘living concepts’ is growing significantly year on year. Involving tenants more heavily in the shape of things to come will help ensure that new ideas resonate with the different lifestyle of tenants”.

Feedback from the research on Build to Rent:

More than a third of tenants are aware of Build to Rent initiatives, especially older tenants

53% of all tenants would consider Build to Rent, with YI particularly interested

43% of over 45s are willing to consider over 50s developments.

Will Build to Rent impact individual landlords?

The answer to this is ‘absolutely’, but only in areas where Build to Rent is coming to the market. So if it’s not coming to your town or city, it’s not something worry about so much, but if one is being built within a mile or two of property you let, then it definitely will.

As a result you need to know when it’s coming to market and ideally ensure your property is rented beforehand and make sure you are offering a comparable, or even better, property to let so that you can compete.

Overall, Build to Rent will also impact on the whole market as it’s likely to raise the overall standards that tenants expect, helping them understand that renting a property which is damp, mouldy and let illegally, isn’t something they have to expect or tolerate.

As such, all landlords should see Build to Rent as a boost to the PRS and hopefully help ensure tenants look for professionally let property rather than ones which give the market a bad name.

What can Build to Rent offer to tenants? How does this help individual landlords?

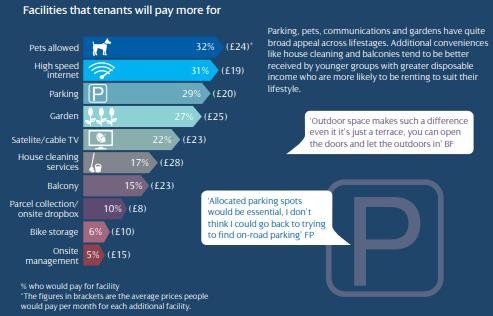

As far as what Build to Rent or large landlords can offer, as can individual landlords, allowing pets is one of the key things that tenants want and all landlords – including social landlords and freeholders of leasehold flats – need to reconsider their policy of not allowing pets.

We have been covering this recently, especially the horrendous situation where John Chadwick committed suicide because he wasn’t allowed to take his pets.

Pets are incredibly good for people’s mental health and help ensure they remain social – I should know, my pup has been incredibly helpful to me following recent difficult times and dogs have always been a major part of my life. I can’t imagine having to give up my pet due to a split and especially because of some ridiculous rule of ‘no pets’ that is now completely out of date and unnecessary when renting or leasing property.

In addition to pets, tenants would like developers to create:

57% of FP tenants would pay more for an onsite gym, 69% for YI with an existing fitness commitment

Older tenants would enjoy a private outdoor space

51% of BF tenants would pay more for a childcare club.

Tenants of all ages are interested in communal activities, with the most popular being barbecues (38%), followed by fitness classes (37%) and social evenings (30%).

However, all of these things can also be provided by individual landlords, even if it is not on-site, for example, making sure they are within easy reach of a local fitness company and even going to the effort of doing a deal if possible with them to pass on to tenants.

Communicating well with tenants is important for all types of landlord and letting agent otherwise a lack of trust can develop which only causes further problems down the line. Having a strong landlord/tenant relationship can make dealing with any issues that arise that bit easier.

The research shows that “Excellent communication is essential, with tenants claiming communication being equally as important as having a quality landlord and value for money. These factors are second only to the condition of the property itself and higher than security and parking”.

What would tenants like to see on a resident portal or mobile app?

Build to Rent landlords need to know that communication still plays a vital role in securing tenants and that mod cons are not the be all and end all. In fact, the research shows that the top three areas of importance for tenants considering a new build are:

Most of these things are relevant to any landlord and shows just how vital effective communication is.

As part of the survey, tenants from each of the different life stages offered their opinion on what is important to them when renting.

Younger Independents – Jacob, 20, is a student living in a converted house with three others:

Budgeting Families – Mark, 45, and Alice, 42, have two children and rent a semi-detached house:

Flexible Professional – Lisa, 31, lives in a terrace with partner:

Reconciled with renting – Jane, 59, is single and living in a purpose built flat:

This kind of research is essential for all landlords and indeed for policy makers to see that there is more to the PRS than just letting property. A lot of good work is and has been done to make sure renters don’t just have an ‘okay’ service, but get a great service and can live somewhere that suits their circumstances when they need to rent, not just because they ‘have to rent’.

For more on how to rent well, download the essential guide.

| Buy to let tax - Nicholsons Chartered Accountants | Choosing a letting agent - Belvoir | Renting a property - Property Checklists |

|

|

|