Your Move and Reeds Rains manage over 40,000 tenancies, so have a wealth of experience and knowledge about ‘what tenants really want’ and thanks to their new survey of over 3,000 tenants.

This research can help political parties, agents, landlords and other services to have a much better idea of what policies will work (and fail) in the Private Rented Sector (PRS) what needs to be done to make sure their time in the PRS is an enjoyable experience.

It’s a must read for anyone writing about or involved in the PRS and you can download the report here.

Key points from the research shows the PRS is inaccurately being portrayed in the media and by MPs and landlords and letting agents are being unfairly targeted, when stock shortages and poor enforcement of existing rules and regulations are the main problems.

The reason this is dangerous is that policies based on wrong information will (and is) leading to tenants being done more harm than good.

The research shows:

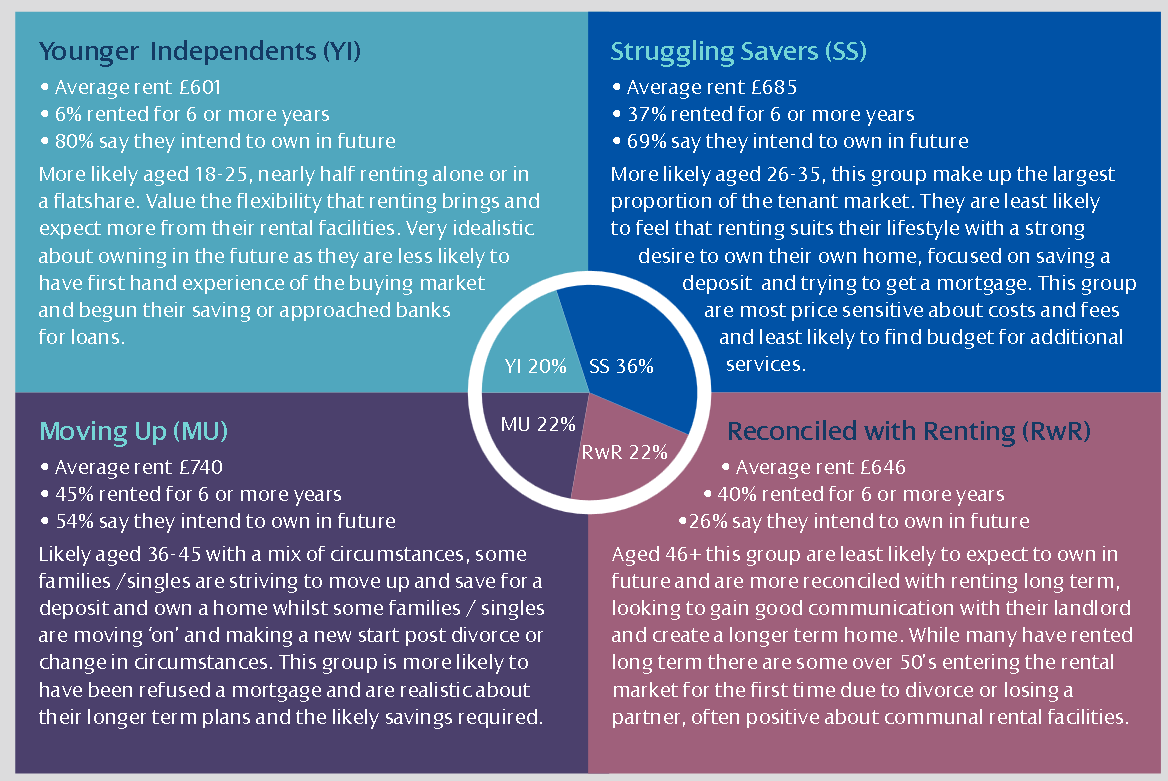

64% of tenants are Younger Independents, Moving up or Reconciled with Renting

And we also know from the English Housing Survey that 18% of tenants in the sector are on benefits, yet no policies have been set to protect them by successive governments, ensuring they can only rent properties which are legally and safely let.

There isn’t ‘one’ tenant! Lots of people rent for different reasons

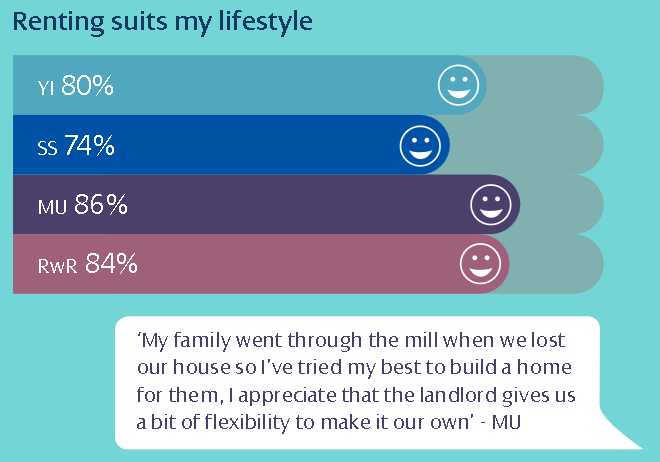

For most, renting works for their current circumstances

Research from the LSL report shows that the majority of people are renting because it is a tenure that works for them:

Costs of renting: salary required £24,516 or as a couple £12,258 each

People claim rents are ‘sky high’ and ‘rocketing and need to be controlled. Yet rental inflation according to the government’s own ONS data is just 2% a year ie. less than inflation.

And although people are quick to criticise the ‘cost of renting’ few do this following an analysis on the actual cost of delivering a legally and safely let property. This is now, in several areas, not possible to do without enormous deposits, especially with the new accounting rules on mortgage interest which will mean some landlords will pay more in tax than they earn in net income.

Average rental costs from the survey respondents show the average rent is £681 per month nationally, varying from £500 to over £1,000 on a regional basis. That’s £8,172 per year, which with affordability classed as 3x income requires a salary of £24,516, or as a couple £12,258 a year.

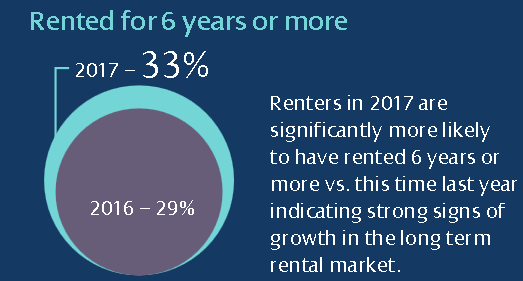

How long are people renting for in total and what is the average tenancy length?

The ‘horror’ stories of tenants being ‘kicked out’ of properties is not the norm, it’s the exception:

This is also backed up by the English Housing Survey which shows the average tenancy is 4 years. The Assured Shorthold tenancy agreement is working and most landlords (and agents) take good care of long term tenants. The idea they are ‘kicking them out’ at every opportunity is wrong.

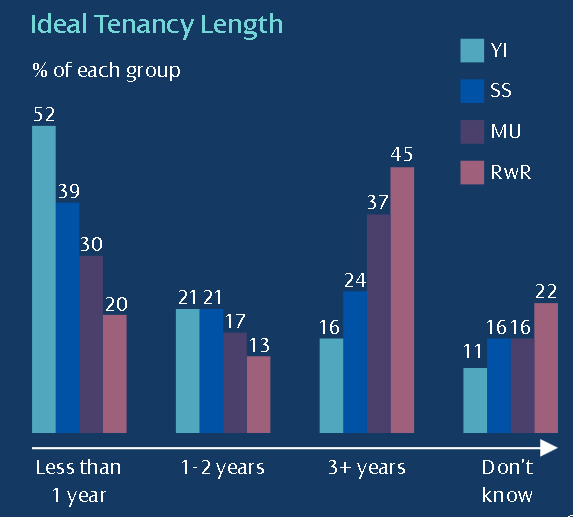

From a tenant’s perspective, this is the tenancy length they would like and it shows flexibility is key. Up to 30% of tenants rent from ‘accidental landlords’ that could not rent if 5 year tenancy agreements were introduced.

Where would these tenants live if we lost accidental landlord stock?

What help do renters who want to buy need?

To set policies based on an ‘assumption’ that anyone renting wants (and could) buy is wrong.

Looking to let? Watch our new BTL tv programme.

Firstly, the main problem for renters wanting to buy are:

This is not the fault of landlords, or letting agents. It’s purely a problem with a lack of stock due to successive governments and local authorities failing to build enough homes and, this, together with the disparities in people’s earnings, has meant property prices have moved, in some areas, beyond people’s ability to purchase.

Better communication of ‘help to buy’ and more accurate information about deposit levels actually required as opposed to what buyers are being able to find and schemes like shared ownership would help to move more people out of renting.

In my experience people are renting who could buy, they just aren’t aware it’s possible.

Looking to let? Watch our new BTL tv programme.

For those who ‘choose’ the rental sector, how can we make renting better for them?

This is probably the most helpful research from the report is what landlords – and letting agents – can do to help them.

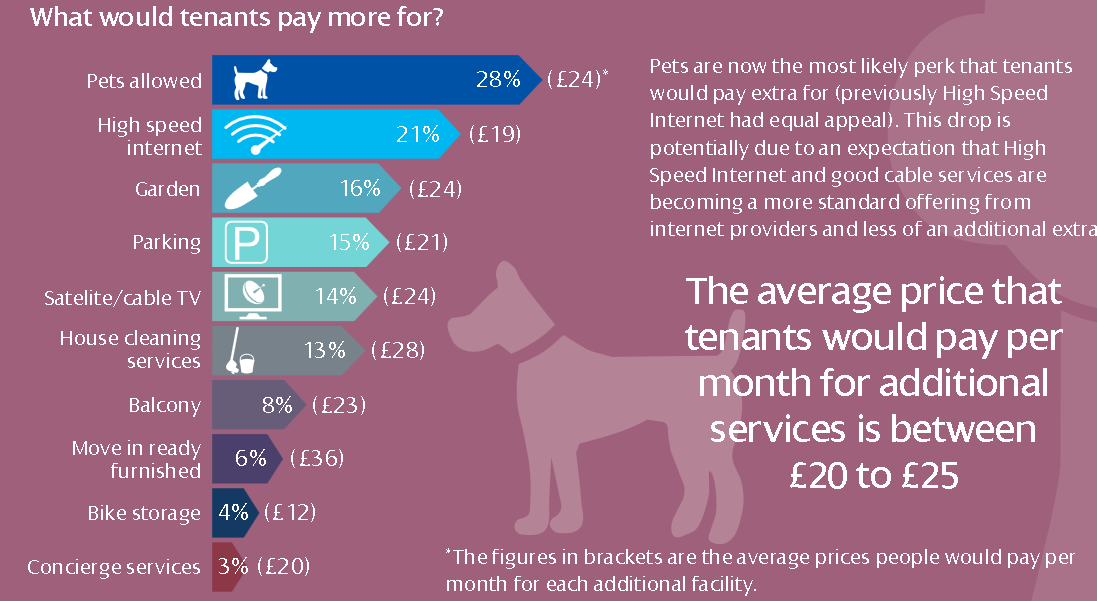

The biggest thing is PETS! So go and visit the Lets with Pets campaign TODAY and if you are an agent, make sure your landlord appreciates the value of offering tenants the opportunity to have pets while protecting yourself to make sure the pet is a plus and doesn’t cause a problem in your property