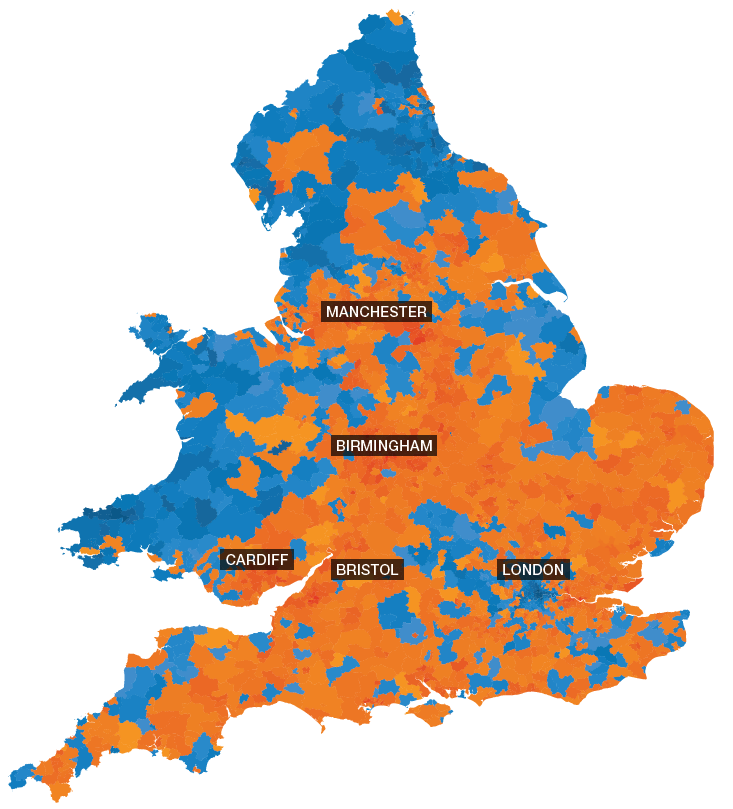

The consistent view running through this month’s indices is that there is little supply for buyers to choose from, but for those that are selling, there are deals to be done as the NAEA point out “the number of sales agreed per member branch remained at eight in October”. Rightmove report there are “14.9% fewer new sellers than in the same period a year ago… the largest year-on-year slump in any month since August 2009” while Home.co.uk claim “the supply of new sales instructions is down 10%”, and Hometrack suggest that “Zoopla listings’ data shows that the number of new homes listed for sale per agency branch this year is lower than over the last four years”. A tough market therefore for buyers looking to purchase (bar better value prices) and indeed for the industry - who will no doubt be hoping the election will allow some certainty on how the country will move forward, and this will result in an early uptick in activity in 2020, rather than uncertainty and a slow market.

For more in depth analysis, read Kate Faulkner's comprehensive report here

Wales has been the chart topper year on year but has now slipped back, so Northern Ireland is topping the year on year price growth charts – albeit at just 4% growth, still leaving many in negative equity. The contrast is with England prices growing just in line with inflation at 29% since the credit crunch, while Wales and Scotland struggle to see decent rises, with Wales up just 9% over 12 years and Scotland, just 6%.

Download Kate Faulkner's full market report here

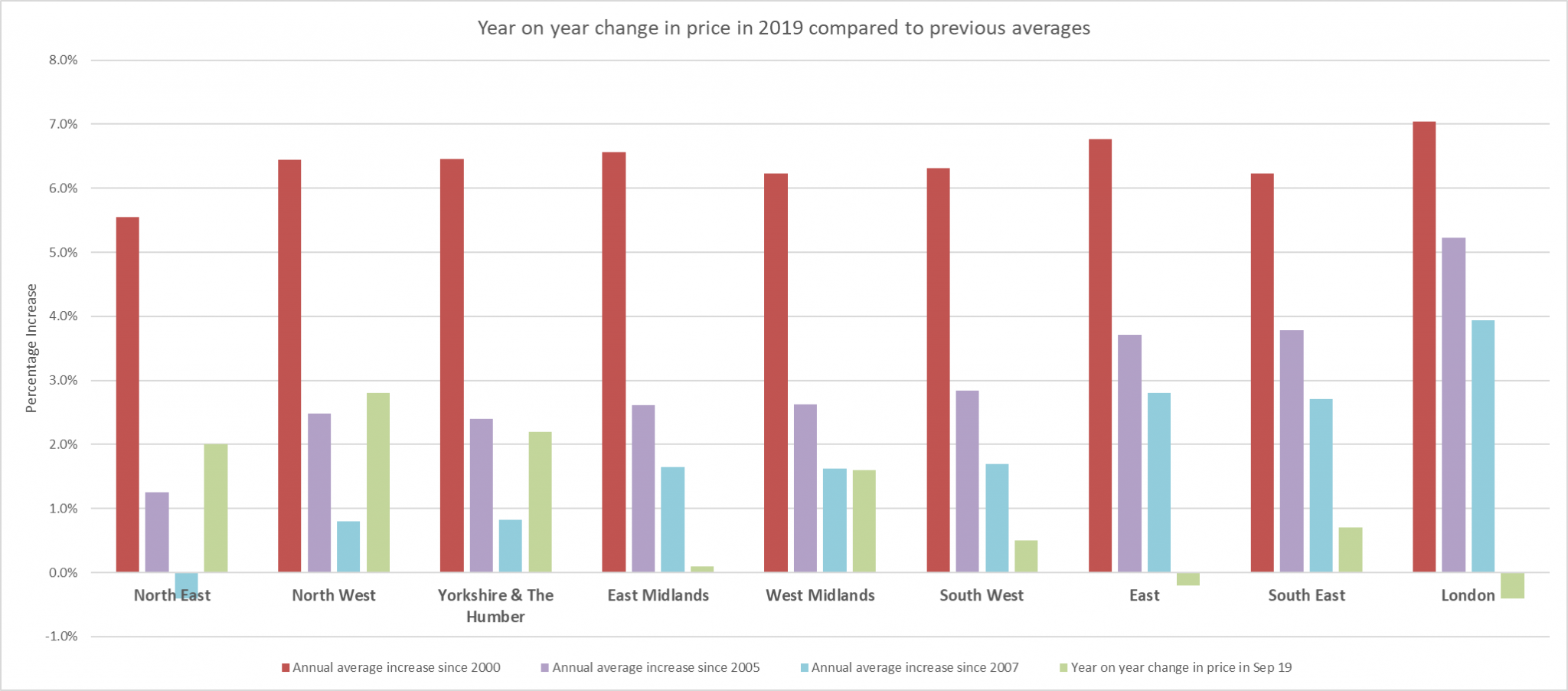

This time last year, many of the regions were performing well in the Midlands and North, but since the uncertainty of Brexit has come to the surface, many buyers and sellers have held off this year, depressing most markets to inflation or below rises. Meanwhile, although London had gone into decline, according to Hometrack “London has been through a 3-year repricing process accompanied by modest price falls – in contrast, average values have increased by up to 15% in large regional cities since the start of 2017.” However, over time London is still blasting house price growth versus the rest of the regions, even though recent price changes anywhere aren’t much to shout about.

Source: UK HPI

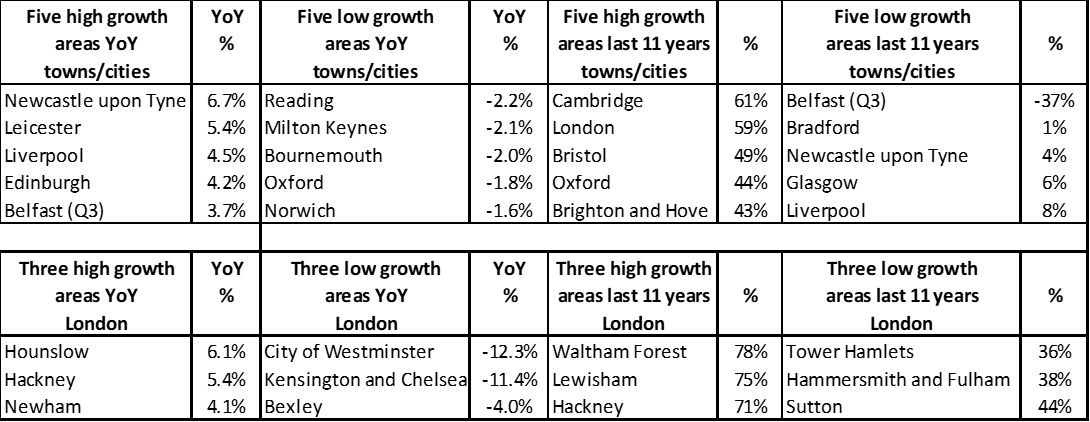

Although country and regional price growth looks pretty surprised, it doesn’t mean there isn’t still some good growth to be found. Newcastle upon Tyne topped the Land Registry growth in prices at 6.7% which even beats its long term annual average growth of 5.9% since 2000. Leicester isn’t far behind with prices rising year on year by 5.4%. However, year on year price rises hide poor performance over time with Newcastle rising by just 4% over 12 years while Leicester growth is more in line with inflation at 33%. Areas like Bradford and Liverpool continue to suffer pretty poor growth over time, suggesting that those investors who have moved out of London for so called ‘buy to let’ bargains may get good yields but are compromising on capital growth. And with all manifestos suggesting a continued ‘landlord lashing’, more may look to sell in the future as returns struggle to deliver based on past performance.

To find out more, download Kate Faulkner's comprehensive report here

Source: UK HPI

Strangely, the number of sales agreed seems to be holding up – with the NAEA saying they are the same as last month, while Rightmove suggest sales agreed fell by nearly 3% year on year (although larger properties are seeing even lower falls). It’s likely the lower prices and less competition for properties is helping to keep transactions moving, even if there are less properties on the market. To really know what will happen to transactions in 2020, we need to find out what happens election wise and then we can work out whether there will be a ‘mass sell-off’ if Labour get in or ‘a flurry of activity’ if the Conservatives managed to secure a majority parliament.

Source: The Advisory

| Guide to buying at auction - Auction Trade |

Passing on your property wealth - Chase de Vere |

Help to Buy a new build - Barratt London |

|

|

|