While housing standards have increased, not enough homes are being built to keep up with the nation’s needs, according to a new report by the National Audit Office.

Housing is always high on the agenda for any new government since the credit crunch. To me, having somewhere to live is as essential as getting looked after when you are ill, being protected by the police when in danger and having a good education and something to eat. It’s crucial to have a roof over your head and the idea or reality of homelessness is something no-one in this country at least should have to face.

And, ever since I’ve been in the property market (far too many years now!) affordability issues in the housing market are as rife now as when I started.

The National Audit Office (NAO) have recently released their fascinating report with the intention of providing “an overview of the housing market in England, the overall, cross-cutting public policy landscape, and the Department’s (for Communities and Local Government) housing strategy.”

They also have some great data:

The only issue I have with the data above is that the £1 trillion pound ‘estimated increase’ in the value of our housing stock is an overestimation of property price growth; 2009 was the lowest point in property prices following the recession when prices had dropped by 25% so a lot of this growth was actually property stock values recovering NOT increasing – there is a big difference between the two!

Below is our summary of the report plus some more of my thoughts:

Characteristics of the market

The first part of the NAO’s report looks at the most important trends in the housing market. Here’s what they discovered; the summary isn’t really a great surprise!

Housebuilding in England hasn’t kept up with our needs

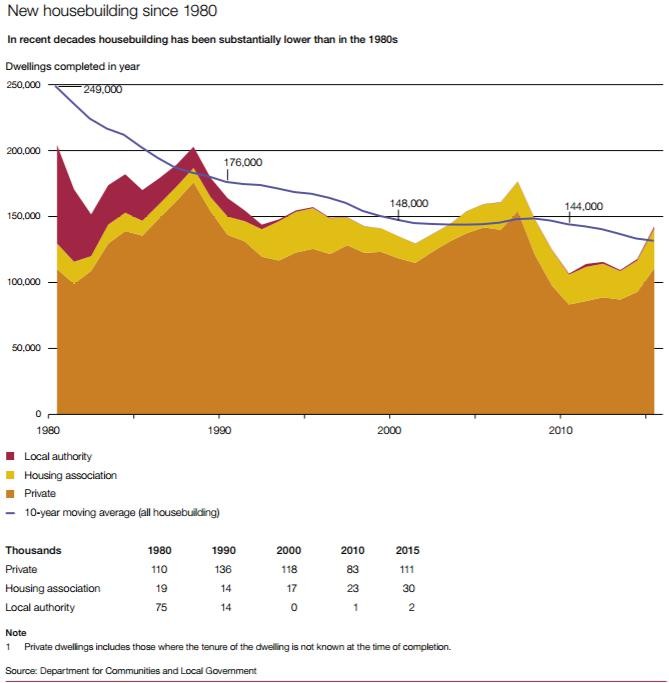

Demand for housing in England has risen from the 1980s onwards but housebuilding hasn’t matched this increase. Housebuilding in the public sector has dropped and private sector building is affected by economic factors, including recessions and the cost of finance to buyers.

From 2001-2010, 144,000 houses were built per year on average, 100,000 fewer per annum than the 1970s. This clearly shows that it’s the loss of building from local authorities that has helped to drive the stock issues in the market – particularly from an affordability perspective – not, as are often blamed, the private sector.

To match future demand, more houses need to be built in most areas of England, especially the capital. Forecasts project that around 230,000 new households will be formed every year from 2011-2021; this much higher than the annual average of 166,000 extra homes in England over the last decade.

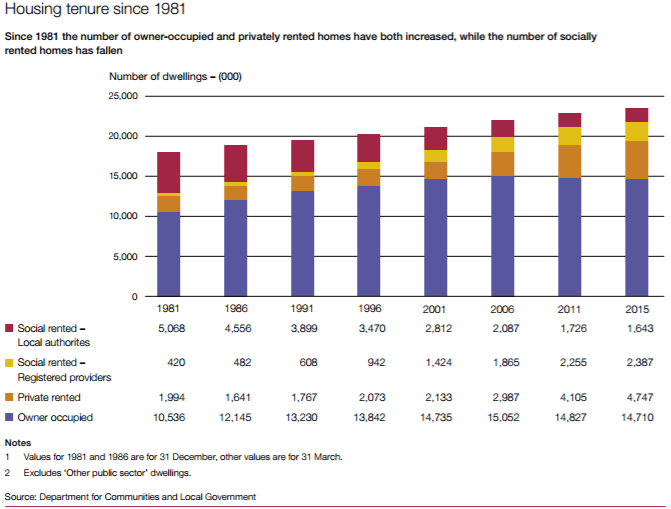

More private rented accommodation and home ownership but fewer social rented homes

Since the early 1980s the volume of homes owned in England has risen from just under 10.5 million to 14.7 million by 2015. In 1981 there were just 2 million private rented homes; by 2015 this had more than doubled to around 5 million. Conversely, the number of social rented homes fell from 5.5 million in 1981 to just 4 million in 2015.

Again this is interesting data. The problems in the rental market are often blamed on landlords and letting agents. I don’t believe that’s true. Successive governments have continued to allow an unregulated and poorly enforced private rented sector to grow at the expense of the social sector.

Effectively it has been successive governments’ policies to drive people out of social housing into the private rented sector. Landlords have then taken the rap for what is a natural growth in housing benefit payments.

Governments have a choice – they either use tax payers’ money to build affordable homes for vulnerable and low paid workers, or they pay the private sector to house them. Currently, rightly or wrongly, they have chosen the private sector to house them, but did so without regulating landlords and letting agents.

It’s about time MPs started to accept responsibility for a market they have controlled and influenced rather than scapegoat landlords and letting agents. All MPs have done is passed legislation to drive improvements in the market. Yes it’s worked. Good landlords and letting agents provide good quality rental accommodation at a fair price.

The problem is, MPs and most local authorities (the likes of Newham and West Midlands I would class as exceptions) have not done anything about enforcing legislation or getting rid of rogues – that’s meant the vulnerable tenants governments have driven into this sector to be taken advantage of.

Worried about renting? Read our how to rent quick guide.

The quality of housing has improved

In 2001 the Department for Communities and Local Government (DCLG) defined what constitutes a decent home. By spring 2013 there were around 1.1 million fewer social rented homes that didn’t meet the standard compared to when it was first introduced. The stats say that roughly one in three homes in the private rented sector are classed as ‘non-decent’ as opposed to just 14% in the social sector, but we know that this is due to huge amounts of money which successive governments have (to be fair!) done a good job of at improving what little social housing stock they have left.

Want to improve your home? Read our maintenance quick guide.

So, some useful data – but this information needs to be used wisely and fairly to reflect what’s really happening in the housing market as opposed to be misused to ‘beat up’ the private sector who are, in my view, not the problem.

I lay that firmly at governments, local authorities and MPs. They allowed the housing crisis to happen when they could have intervened far more. Instead they have done precious little but try to divert blame (or allow others to do so) onto the private sector.

That wouldn’t be so bad if it wasn’t for the fact that if governments don’t truly understand why a market is failing, they don’t create successful policies to fix it.

And that, in my view is the biggest housing crisis we have – not enough of the right solutions being pursued to fix the real problem: a lack of affordable homes provided by government/local authorities at rents/price the vulnerable and low paid can afford.

What do the NAO conclude?