Housing has become more affordable for existing homeowners but the opposite for first-time buyers, according to the National Audit Offices’ report.

These are the report’s key findings and my thoughts:

For existing owners, housing has become more affordable but it’s the opposite for first-time buyers (FTBs)

Since 2008, the number of home owners who spend a minimum of 25% of their disposable income on housing has dropped by half to less than 20% of mortgage holders. This is no surprise – that’s because bank base rates were dropped and, as a result, mortgage rates are at a historic low.

When it comes to deposits, FTBs now pay 21% on average, and this number was only 13% in 1990. FTBs, by 2014, were borrowing 3.2 times the average income to buy a home, up from 2.3 times income at the turn of the millennium.

I don’t know if it is because I have an optimistic nature but there are two ways of looking at this. Surely it is good news? The reality is first-time buyers can put down an average of a 21% deposit, when in the 1990s it was just 13%.

The question and research that I believe is required is do first-time buyers actually need to put down a 21% deposit or is it just that they can because of the Bank of Mum and Dad, many of whom are now better off thanks to being third generation homeowners, or have made a lot of money out of their housing stock and are now trading down, fuelling a growth in higher deposit levels.

The reality is from a mortgage perspective, particularly with the likes of Help to Buy, FTBs only actually need 5%.

The other question to ask is whether this figure has gone up because of the government’s Help to Buy Scheme? How are deposits being recorded for first-time buyers when up to 20% of the money comes from the government itself?

Buying for the first time? Download our FREE first-time buyer eBook.

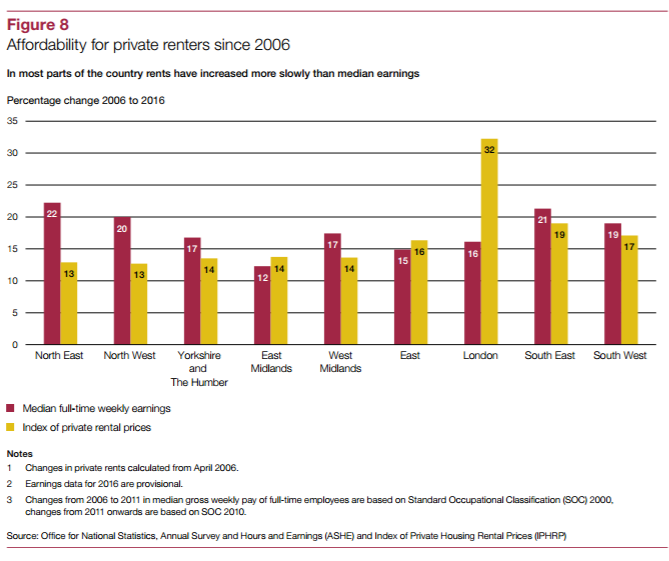

Private rents and earnings

Since 2006 private rental costs have, by and large, followed changes in earnings throughout England

Let me just repeat that. Private rents have ‘followed changes in earnings’. That is not what newspaper and media headlines say at all and it’s about time the reality of rental growth was reported properly and accurately; they are not ‘extortionate’ nor are they ‘sky high’.

However, this has not been the case in London; the report states that average earnings there have gone up by 16% and rents have risen by 32%.

Sadly this is the reality of supply and demand in a wealthy city. The solution needs to be delivered by the Mayor. Interestingly, although rents have risen by 32% since 2006, on average, according to the UKHPI index, property price – the cost of providing rental accommodation – has risen by 61%, which is almost double the cost.

So actually, although rents in London have risen faster than wages, they have risen at almost half the cost of buying a home, proving that renting versus buying affordability has changed dramatically. It is not always cheaper to buy than rent, especially if you only have a 5% deposit.

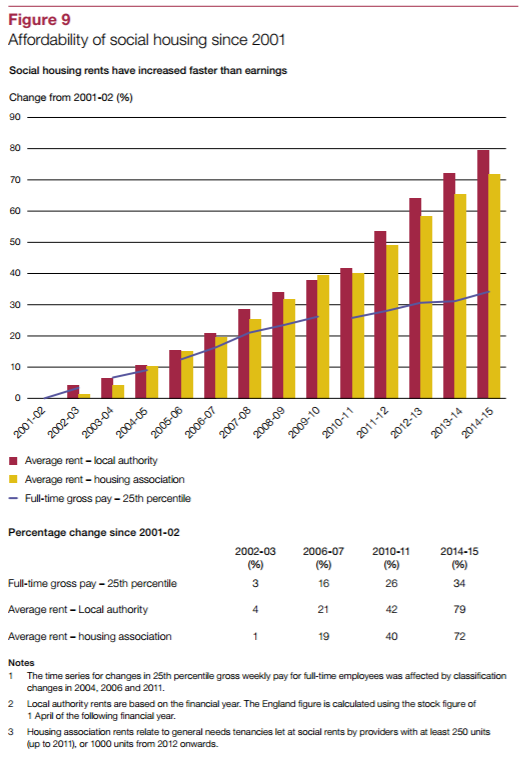

Social housing

Social housing rents have increased faster than earnings since 2001-02

Since 2011, local authority and housing association landlords have been allowed to set rents at affordable levels, defined by government as 80% of local market rates. By 2014-15, new tenants paying so-called ‘affordable’ rates in London often paid 60% more than new tenants on traditional social rents.

The fact that social housing rents have increased faster than earnings as well as private rents also suggests that this isn’t because landlords are greedy – because if private sector landlords are, then the data above clearly shows that social landlords are even more greedy.

Are you a private landlord? Here's how to choose a letting agent.

The reality is they aren’t. Social landlords (in the main) do an amazing job and have had a rough deal from successive governments who have not offered anywhere near the support that, in my view, they should have done.

The fact is the cost of renting has gone up because:

1. The cost of buying houses to rent has increased

2. The accommodation is better quality, which naturally costs more.

Now I am all for safely and legally let properties, but the more it costs to provide high quality rental accommodation, the more rents have to rise to compensate.

And when there is higher demand than supply in a market and a sector isn’t monitored and enforced anywhere near enough, then it shouldn’t be a surprise that vulnerable and low paid workers are being taken advantage of with poor quality accommodation by bad landlords and agents.

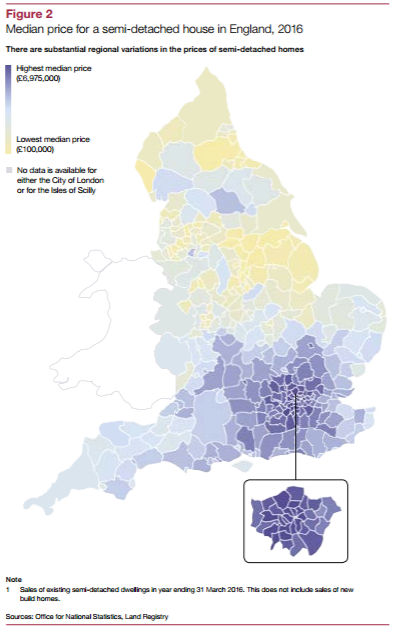

Regional variations

There is substantial, and growing, regional variation in the English housing market

As you can probably guess, the price of a semi in London and areas of the South East is usually a lot higher than in, for example, the North West or North East. The divide in prices between London and the rest of England has only grown wider in recent times.

What do the NAO conclude overall?