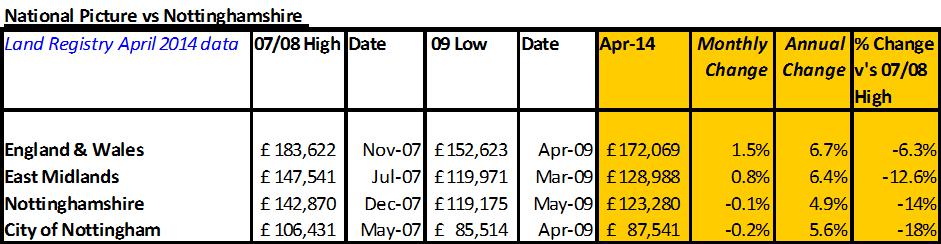

Prices in England and Wales are still down around 6% since the credit crunch, although are up over 6.5% year on year, suggesting by the end of the next year or two, property prices could be back to their 2007/8 heights.

Regionally, it’s going to take some time for the East Midlands and Nottingham prices to recover to previous heights and could be a few years before everyone is out of negative equity.

| East Midlands | Nottinghamshire | City of Nottingham | |

| Since Credit Crunch | -12.6% | -14% | -18% |

| Year on Year | 6.4% | 4.9% | 5.6% |

Positive house price growth year on year in each region continues, which is good news – and we haven’t seen this level of growth for a number of years. But as prices are still less than they were during the height, there are still some good buys to be had. For example, you can buy a property in the City of Nottingham, on average, for £87,000 which would have cost around £106,500 at the height of the market.

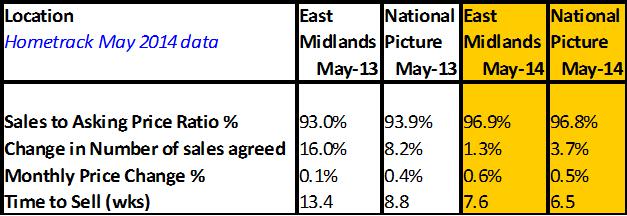

Activity in the housing market continues and if you are selling, the great news is, according to Hometrack, it’s now taking around half the time to sell your home than a year ago at just over 7½ weeks. The ‘offer to asking price’ ratio has also improved since this time last year, increasing by 4%, and now stands at just under 97%. The number of sales agreed during May stands at only 1.3%, compared to 16% a year ago, which would indicate that sales volumes remain low compared to the market high.

What’s happening to rents?

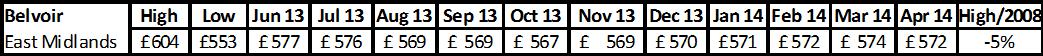

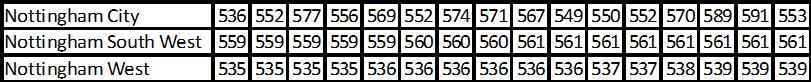

Data from Belvoir Lettings shows that rents continue to be fairly stable on a national basis, with very little month on month change, and across the East Midlands, rents continue to be great value compared to the rental highs of 2008 as you’ll pay around £572 per month instead of just over £600.

Local property price analysis for Newark and Beeston Property Markets

How is the Beeston area of Nottingham performing?

Paul Sweeney of Robert Ellis in Beeston says the housing market is certainly in a better place than a year ago. Confidence is returning to the market with first time buyers coming back, which is having a knock on effect for those wishing to trade up. First time buyers and professional couples are snapping up the typical terraced and 1930's style houses, which is driving prices upwards as generally they are willing to pay more than property investors, who in the last few years have mainly purchased these types of property. Currently, when these types of property are placed on the market, a number of viewings are taking place within a few days, quickly followed by offers. The market is very active up to around the £250,000 mark, and active for properties priced around and above £750,000. There are more properties coming to the market, but with a much higher percentage of stock sold subject to contract.

As far as work on the new tram line is concerned, most locals are looking forward to having the tram and associated regeneration work to the area, even though the ongoing work can be disruptive at times and commuting can take longer.

How is the Newark area of Nottinghamshire performing?

Local agents say that the market has definitely improved since last year, with both buyers and sellers returning. There are a good number of first time buyers looking to purchase, who are keeping the lower end of the market buoyant, with prices increasing by around 5-10%, particularly on your typical terraced properties, however, at the higher end of the market, £500,000 upwards, this has not seen such price movements. Buy to let investors are still looking to purchase, however there are a number of 'accidental' landlords who are now looking to sell their properties rather than let them out as the sales market is improving. There is more stock coming up for sale, but as properties are selling a bit faster, the stock includes a higher number of sold subject to contract properties.

For FREE, independent and up to date advice on buying, selling and renting a home, sign up for FREE to

Property Checklists. Join now to access our FREE property checklists, including:-