According to a recent report from Savills, “Manchester needs at least a further three million square feet of office space and almost 100,000 new homes over the next decade to meet rising demand”.

So if Manchester is a potential hot spot for property, is it just a matter of buying any property you can and keeping your fingers crossed that it will deliver a great return?

No, not at all. If you want to make money out of property, you have to make sure you:

The key is buying the right property on the right street – and that’s not as difficult as it might seem.

When I ask people whether they want capital growth or income, they usually say both. That’s lovely in a real world, but, typically, data has shown that since the credit crunch properties tend to deliver one or the other. If you want both, you have to build the capital growth in when you buy; not, as many do, keep your fingers crossed that natural property price growth will take care of your investment returns for you.

Download and fill in our FREE property investment brief and make sure you visit a regulated, independent financial advisor so your property investments are protected and your (and any kids’) tax bills are minimised.

Carry out your own research

The biggest lesson to learn from the credit crunch is not to believe data from companies that are trying to sell you property as an investment – even big builders.

Their job is to sell you a property; that’s when they earn their money. If the property fails to deliver that’s your problem not theirs and you are the one who ends up losing out.

Here are some examples of properties which have been sold at a loss to people to date:

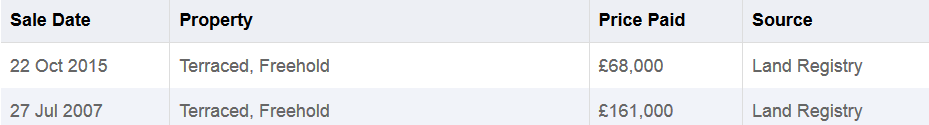

This property lost a fortune, even after being owned for eight years!

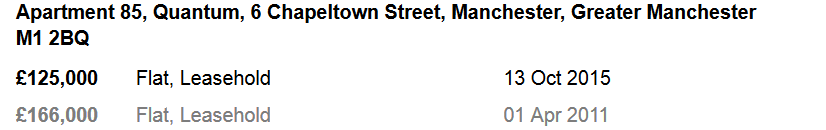

Even though this property was bought after the main credit crunch falls in 2009, it still ended up losing its owner £40,000 in just four years:

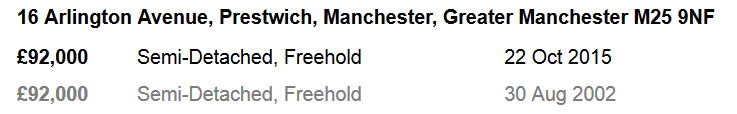

This property made no money at all in 13 years:

Where should you turn for research for property investment?

Talk to us!

I carry out huge amounts of individual property investment analysis throughout the year and know what to look for. I also present across the country, so here’s my last presentation on Manchester investment which is free to download, but you do need to sign in to access this essential resource:

Buy to let economics: What does the future hold in Manchester?

If you have a query, you can then email or call us

Read property, independent research from known experts

Companies such as Savills have fantastic people who work hard to produce some excellent research and have just produced a thorough analysis of Manchester which you can download for free.

Other reports that are worth reading for latest data and trends include:-

Sold property price data

You can work out what has actually happened to property prices on the actual road you are thinking of buying on by researching sold property price data going back as far as 2000. All you need is to find a property for sale, find its postcode and then input this at one of the many sold property price portals.

We use sold property price data from Nethouseprices and Rightmove.

DO NOT RELY ON ZOOPLA ‘ESTIMATES’ as unfortunately they tend to only be as good as the number of sales they can use to produce the data. In an area where there are lots of properties being sold, their estimates can be OK, but currently we are selling 21% fewer properties that we did pre-credit crunch, which reduces accuracy.

Always talk to your local agent

It is vital though to talk to local agents about current property prices as sold property prices tend to be three months out of date and the property market can turn from being vibrant and rising to falling quickly in this short space of time.

Our recommended agents with whom we work in Manchester include:-

AVOID PROPERTY INVESTMENT CLUBS!

I have been on the ‘property investment circuit’ since 2000 and throughout that time I have dealt with and heard of hundreds of people who have been sold absolute property pups or, worse, fleeced blind by property investment clubs.

The biggest problem with these clubs is they make money when you buy, not in the long term, whereas companies such as Belvoir, Your Move and Reeds Rains want you to achieve ongoing success so they can continue to work with you.

Another problem with property investment clubs is that they may start with good intentions but then the market moves against them unexpectedly. As they don’t typically put any of your money into ‘client money protection’ schemes, this mean they have often ended up using your deposit cash to help fund their business and lifestyle.

You are much better off taking some time off work and working with decent, long term organisations to find the right investment than paying money for ‘education’ or ‘mentoring’ or, worse still, to find you a property.

Here is a list of all the companies which have received bad press, some of which have resulted in them ending up in court:

Simon Morris: Fell from grace from the Sunday Times Rich List

A former Leeds United director, once having tens of millions of property, he ended up bankrupt and receiving a suspended sentence for trying to hide £1.5m of cash and gold bullion in Swiss bank accounts from creditors.

Ex-Leeds director Simon Morris sentenced over Swiss bank swindle

Simon Morris: From Rich List and Elland Road to fraud probe and bankruptcy

Ajay Ahuja: Taken to court due to so-called ‘below market value’ deals

There are numerous stories, many of which came to me directly, of money being taken for so-called ‘below market value deals’ then no property every materialising or not being BMV and deposits not being returned.

It’s much documented:-

Rogue Property Sourcing - Ahuja Group programme

Property 'Scam' Cost Buyers Thousands

Landlord Action exposes rogue property investment sourcing company

Simon Zutshi: One of his mentors took money from his paying clients

To be fair, Simon is a decent chap, but his book ‘Property Magic’ repeats that property prices double every 10 years – which they don’t – and unfortunately one of his mentors took those on one of his courses to the cleaners financially. Here’s the story.

Glenn Armstrong

This property developer, mentor and speaker has been on the circuit (and telly) for a long time, but is reported to have had issues, see Glenn Armstrong and his (investors) millions.

Inside Track

One of the companies that sold many a new-build flat in city centres, some within hours of putting them onto the market and have since been reported to have lost around 1,000 investors millions: Buy-to-let victims of Inside Track plan joint legal challenge for mis-sold homes.

I could go on… but hopefully now you get the picture! Unlike independent financial advisors, they are not normally regulated and rarely (if ever) hold your money in a separate account and insure it should it disappear. So instead, make sure you use a regulated financial advisor to understand what financial investment can deliver and work with mortgage brokers who understand property investment such as: Mortgage Advice Bureau, Coreco and the Buy to Let Business can all help you – and much of their work is done upfront free of charge.

For FREE, independent and up-to-date advice on buy to let, buying or selling a home, sign up for FREE at Property Checklists. Join now to access our FREE checklists, including:-