I’ve taken a look at the latest property price reports to help everyone understand the reality of what’s happening - without any spin and with a thought of what these stats mean for buyers, sellers, investors and builders.

Regional Averages – Scotland, Northern Ireland, England and Wales

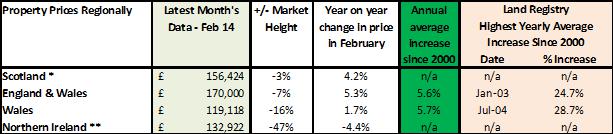

We look at different data for Scotland versus Northern Ireland and the Land Registry data for England and Wales, so they aren’t comparable, but do give a good indication of where each of the regions are at.

Overall Scotland, England and Wales are recovering well towards previous heights. England and Wales property price averages together show although prices are still good value, they are up near to their ‘annual average’ through the boom and bust we have experienced since 2000 of just over 5% growth.

Wales however was the last region into the recession, so as London has led us out, it will take a while for property prices in Wales to recover and as pointed out later, wages aren’t growing at all, which will continue to hold property prices back.

*Ros.gov Data (Feb 14) **Bank of Ireland Data (Q4 13) Please note ‘country’ figures cannot be compared

What’s happening to prices in Scotland?

Acadata’s Scottish index suggests average house prices are rising and house sales levels are increasing. Richard Sexton, Director of e.surv, part of LSL, comments: “Help to Buy has been the spark driving the engine of recovery for the Scottish housing market. Since launching at the tail end of 2013, the scheme has helped thousands get a foot on the ladder.

“Over the past year we’ve witnessed average prices climb by over £5,500, with Inverclyde seeing the greatest annual growth of all, at 16%. The region is clearly benefitting from its close proximity to Glasgow. In a sign of the widespread revival, all seven Scottish cities have also seen price rises from last year. This urban renaissance is being driven by first-time buyers benefitting from Help to Buy, typically taking the plunge in vibrant cities. Aberdeen in particular has seen the average house price climb by 12% over the past twelve months – still operating its own micro-economy.”

What’s happening to prices in Wales?

Oliver Blake, Managing Director of Reeds Rains estate agents, who has branches in Wales comments: “The housing market in Wales has turned over a new leaf and is clearly entering a new phase, with pent up demand and strong competition driving house price growth and rising sales.”

First time buyers are coming back into the market, especially in Cardiff where the LSL index suggests prices are up not just a few percent, but by over 7%. Oliver concludes that “wage growth is still slow, and across Wales this will prevent prices from rising too quickly.”

What’s happening to property prices in Northern Ireland

In Northern Ireland, property prices continue to struggle remaining -47% down versus the height of 2007/08. Whilst this continues to be tough for sellers who purchased their properties around five to six years ago, this could be the time for potential purchasers to look at getting on the property ladder, particularly first time buyers.

And reports from local agents are that investors are certainly taking advantage of the fact that prices are still low while rents haven’t fallen as much, so double digit yields are still possible.

FOR MORE DETAIL READ MY FULL PROPERTY PRICE REPORT

What’s happening to regions in England?

London is still the only region to have recovered to the high of 2007/8, although the

South East is now just 2% short of reaching its previous high.

The East and West Midlands, South West and the East are still down against the 2007/8 high

by between 6% and 14%

North East, North West and Yorkshire and Humber property prices remain

between 19% and 25% below 2007/8 heights

FOR MORE DETAIL AND A CHART WHICH TRACKS WHAT’S HAPPENING IN EACH REGION ACROSS ENGLAND

READ MY FULL PROPERTY PRICE REPORT

For FREE, independent and up-to-date advice on buying, selling and renting a home, sign up for FREE at Property Checklists. Join now to access our FREE checklists, including:-