Included in each rental summary is an overview of the demand and supply of rental property, together with capital growth and yields for buy to let investors. Here's the latest summary of what's happening and includes data from LSL, RICS and Paragon.

For the full report, read Kate's rental summary

Demand & Supply

RICS “Tenant demand continues to rise, but at a more moderate pace, with the headline demand net balance coming in at 28. New instructions to let remain broadly unchanged at -3. This marks the 18th consecutive month that demand has outpaced supply, pushing the three month rent expectations net balance to 38%. (May 15)”

Paragon Group “Paragon Mortgages highlight the continued growth in tenant demand in the second quarter, with 43% of landlords believing demand is either growing or booming. The level of growth is expected to continue over the next 12 months with more than half of landlords (51%) believing they will continue to see a rise in demand. The research also identified the tenant groups that landlords are most frequently letting to with almost half of landlords (47%) renting to young couples, young singles (43%)of which 42% were families with children. (Jun 15)”

For the full report, read Kate's rental summary

Capital Growth & Yields for Landlords

LSL “The gross rental yield on a typical rental property in England and Wales, before taking into account factors such as void periods, remains stable as of May 2015. Gross yields of 5.1% in May are unchanged from both April 2015 and May 2014. Total annual returns, on the other hand, have continued to cool. Across England and Wales, returns came to 9.5% in May 2015 – down from 9.8% in April and 11.8% in January. This means that the average landlord in England and Wales has seen a return of £16,727 in absolute terms, before deductions such as mortgage payments and maintenance. Of this, the average capital gain contributed £8,453 while rental income made up £8,274. (May 15)”

RICS “Respondents, on average, expect rental values to rise by 3% over the coming year and by an average of 4.8% per year over the next five years. (Jun 15)”

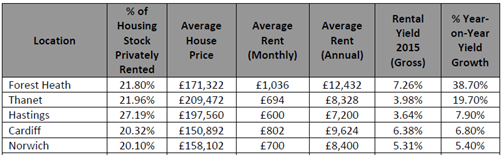

HSBC Latest top five yield changes by area:-

Kate Faulkner comments on Capital Growth & Yields:

“Most landlords appear to think that rents are likely to rise in line with the long term annual inflation rate of 3% each year. However, we should remember that this is after rents recovering in many areas to heights seen back in September 2008. What it does imply though is with LSL suggesting yields are not increasing, that despite the fact that rents may be rising for tenants, they are only increasing at the same rate that landlords are having to increase their investment (in some areas) of buying and investing in buy to let.”

For FREE, independent and up to date advice on Buying, Selling, Buy to Let or Renting a Property, sign up for FREE to Propertychecklists. Join now to access our FREE property checklists, including:-