Report Headlines

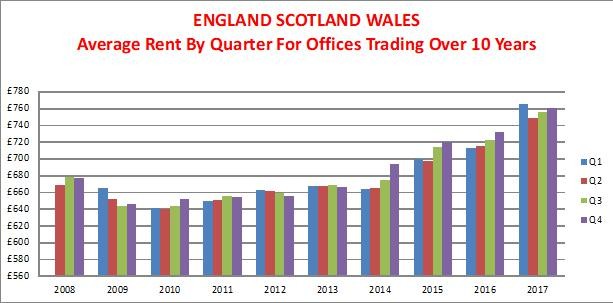

Belvoir Lettings “For England, Scotland and Wales where offices have been trading consistently over the last ten years, the average monthly rent is £744, a year on year increase of 1.75%.” (Q2 18 - E, W & S)

LSL “South West of England see rents rise fastest” (Jul 18 - E & W, index started in 2009)

ARLA Propertymark “Rising rents hits 10 month high” (Jun 18 - UK)

RICS “Lettings market data provides further evidence of the impact of tax changes on BLT supply” (Jul 18 - E, W & S)

For more download my comprehensive rental update.

Source: Belvoir Lettings

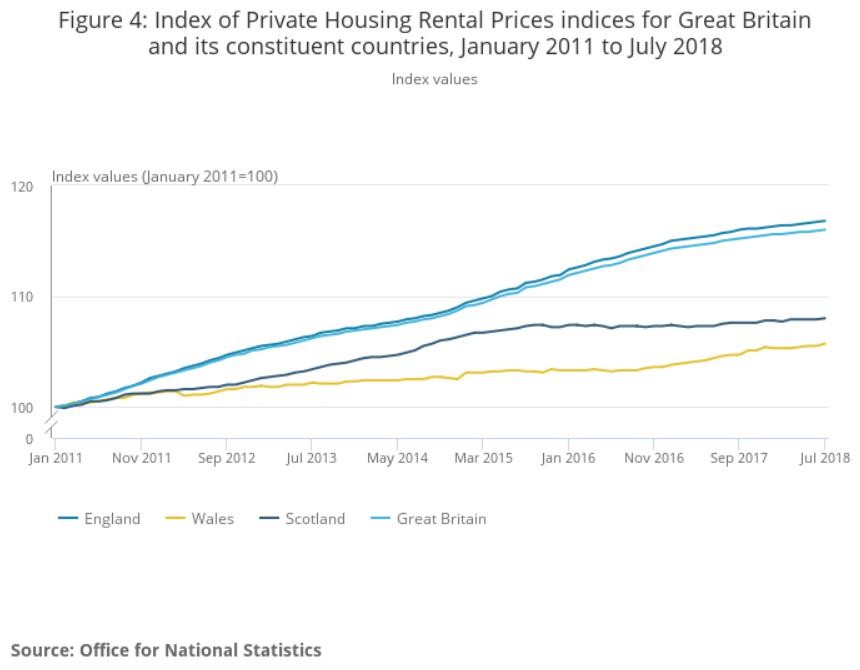

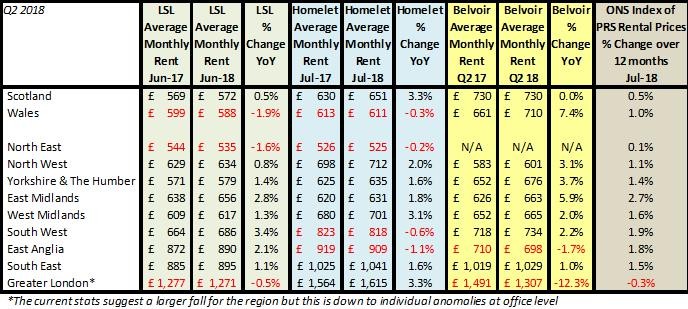

It’s clear from the charts above from Belvoir and the government’s own Office for National Statistics that claims of rents being ‘extortionate’ or ‘sky rocketing’ are inaccurate. The Belvoir research shows that rents have risen well below inflation over the last decade, they recorded a 12% rise from 2008 to 2017. The ONS data shows that for Great Britain, rents have risen from 2011 to 2018 by 16%, but only 5% in Wales and 8% in Scotland. This is in comparison to an inflation rise from 2011 to date of around 16% and utility prices have increased for tenants far more. So, if rents aren’t rising, nor are they ‘expensive’.

Why are newspaper and media headlines reporting differently? Part of the reason I believe, is that landlords rarely increase their rents to existing tenants and with average tenancies of four years, the general cost of living typically rising by 2.5 to 3%, they should be seeing an increase of around £100 during that time – more if the market and wages allow. So this ‘feels’ like a big jump, but actually tenants have benefited from lower than normal rents for three years, until they go back into the market place.

The reality shown by all the rental indices is that rents for most don’t ‘sky rocket’ and they certainly aren’t ‘extortionate’ and the reports that say they are should be seriously scrutinised for their accuracy. For example, a recent report by Shelter accused landlords of increasing rents more than the pay rises they receive. Firstly this may happen ‘on average’ but we know it doesn’t happen in reality as renting affordability, unlike house prices, moves in line with wages. And even if they have risen more than the average wage, Shelter should be focusing the blame on companies and the government pay caps - landlords can’t influence people’s pay and their costs are driven by inflation and the cost of housing, the latter of which has gone up far more than rents in most areas.

We know companies and the government are not increasing pay with inflation and especially other household costs such as utilities. The data shows landlords are, in the main, increasing rents at below inflation, if wages are growing at an even lower rate, that really isn’t something that landlords and agents can be blamed for.

For more download my comprehensive rental update.

Regional variations in the rental market bear little resemblance to rental movements. In some areas such as London we are seeing year on year falls in prices (not all boroughs) while in the likes of Edinburgh prices are increasing year on year by nearly 10%. In comparison all of the indices suggest that rents are being held back by inflationary pressures cancelling out any real wage growth since Brexit was announced and pretty much every region is now growing at less than inflation and some areas are even in negative territory.

This may be a bit of a surprise given that many pundits expected rents to rise with the changes in taxation and loss of landlords, but it doesn’t mean that this won’t happen in the future. Currently we are only just starting to pick up that landlords are making the decision to sell and for now, we haven’t seen the huge droves of landlords leaving the market that was predicted.

My view has always been that whatever happens to landlords costs, they can only increase the rent if wage rises allow and in the last 18 months we have seen a slowdown in rental inflation purely because Brexit drove down the value of the pound, inflation increased and now wage rises are being swallowed up by an increase in food and other costs, meaning there isn’t much left for people to pay more for their rent.

Supply and demand

Although rents do vary across the country and there are rental inflation differences, when it comes to stock, the reports are fairly clear. Far more people want to rent houses than there are to go around. Work we did for Belvoir over the last decade showed than in areas like Tunbridge, rents on average were rising at an inflationary rate, but when broken down into property types, 3 bed houses were increasing at a much faster rate. This is because renting has become more popular in higher wage brackets and in some areas, more cost effective in the short term than buying a home. Listening to agents and landlords, demand remains very specific to the area, with some properties in short supply (typically houses) and others (flats and room rents) more competitive rents can be achieved where there is, in some cases, more stock available than demand.

Yields

Making a living out of Buy to Let for those who are new to it is going to be much more difficult in the future. Yields in the past were often 6, 7% or more and have dropped significantly. This is mainly due to house prices rising mainly at a much faster rate than rents. That’s why high priced growth areas such as London, the South and East Anglia show low rates of 4% yield, while other areas such as the North East can achieve 5%. For landlords who have been in the market a long time, the yields will be very different, but for new landlords, paying a higher price for property, securing, on average, a lower income return and having to pay much higher taxation levels, can mean for some, investing in property isn’t as ‘safe as houses’ and people would be wise to check what their cash can achieve through property versus financial investments.

| Buy to let tax - Nicholsons Chartered Accountants | How to rent - Property Checklists | Renting a Room - Spareroom |

|

|

|