publication date: Mar 23, 2015

|

author/source: Kate Faulkner, Property Expert and Author of Which? Property Books

Kate's March rental summary...

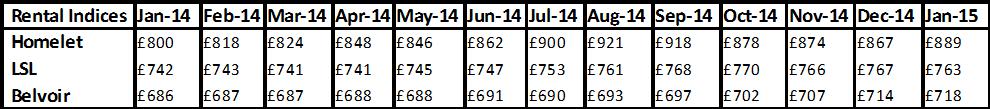

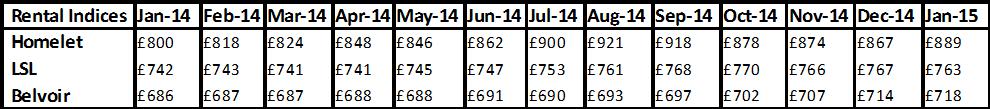

Each month we do summary of the various rental indices to help you understand what’s really happening to rents both nationally and at a regional level. What we are looking for are any trends that might inidicate what is going on in the market.

Download my full rental summary for March 2015

Report Headlines

Belvoir Lettings “The average rent for offices across the UK which have traded consistently over the last six years is £721 per month – an increase of 5% year on year. (Feb 15 – England, Wales & Scotland)”

BMM Solutions “Renters in Yorkshire and the Humber make lowest payments in UK, while Northern landlords enjoy highest yields and lowest deposits. (2014 - England, Wales & Scotland)”

Homelet “In the three months to January, average rental values for new tenancies in the UK were 8.9% higher than the same period last year. (Jan 15 – England, Wales & Scotland)”

SpareRoom “The average UK room rent was £579, up from £570 in January. (Feb 15 – England, Wales & Scotland)”What's happening average rents nationally?

Kate's comments on the latest trends

“The latest round of rental reviews are interesting. They show rents for new lets are rising well, but for those who rent to existing tenants or rent the same properties to the same tenants, the inflation figure is a lot lower. This is backed up by the Office of National Statistics Private Rental Index which, following a review shows rents, on average, rise by around 2% each year – behind the average inflation long term rate of 3%.”

Download my full rental summary for March 2015

What's happening at regional level?

BMM Solutions “Renters in Yorkshire and the Humber pay the lowest rents in the country, at an average monthly rent of £510 pm compared to the national average of £718 per month (pm). Average private rental payments in Yorkshire and the Humber are around a third of the average payment in London at £1,422 which is the highest in the UK (and almost double the national average). Londoners also experienced the biggest increase in monthly rental payments in cash terms, with an average rise of £57pm in 2014. Nationally, average monthly rental payments increased by 1.5% (£11) from £707 pm in the first half of 2014 to £718 pm in the second half of the year.”Homelet “Most regions saw an increase in average rental values, compared to last year, particularly Greater London (12.3%), Scotland (10.8%) and South West (7.3%). Greater London, South East and South West have seen continuing increase in rental values over the last 12 months. Regions to see reductions when compared to last year are Wales by 1.4% and North West by 1%. (Jan 15)”

Room Rents

SpareRoom “Rents in the Isle of White, Northampton, Barry, Sale and Dumfries have stayed constant since last quarter but the Isle of White (2%) and Northampton (1%) have seen steady annual rises. Other areas, including Enfield (4%), Birmingham (5%), Livingston (5%) and Gravesend (6%), have seen more significant rent rises year on year. Areas where room rents have fallen since February 2014 include Durham (1%), Keighley (2%), Glasgow (3%) and Loughborough (3%). (Feb 15)”

Kate Faulkner comments on Regional Rent Variations:

“When it comes to policy setting for the election, residential property decisions are tough. If rent controls are brought in as Labour thinks is a good idea, some Londoners may benefit, but it could well be at the expense of everyone else in the rest of the country. Rent controls will drive up existing rents, which are currently rarely increased from one year to the next. As a result rents rise at less than inflation and instead have the ‘perfect cap’ of being in line with wages. If rents can’t rise at a rate that landlords can deliver accommodation for from a cost perspective, this could end up with landlords selling and a reduction in properties available to rent – a disaster considering the growth forecast for the tenure. Throughout the recession, rents have proved they work really well for tenants in the private rented sector, in comparison the controlled rents in the social sector have increased at 3x the rate in the PRS. Unfortunately Labour’s policies for the PRS could, sadly, be terrible for the majority of tenants.

Download my full rental summary for March 2015

For FREE, independent and up to date advice on buying, selling and renting a home, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-

All our information is brought to you by Kate Faulkner OBE, author of Which? Property books and one of the UK's top property experts.

This website is Copyright © Designs on Property Ltd and Propertychecklists.co.uk protected under UK and international law.