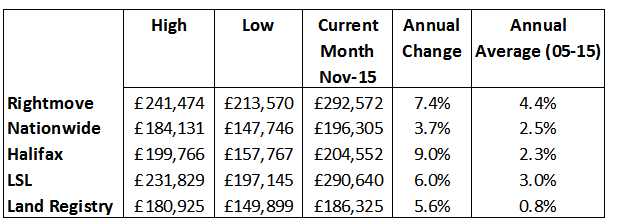

Nationally we saw property prices take a bit of a jump towards the end of the year, although indices which include cash sales as opposed to purely mortgaged sales (Nationwide) show a higher growth, year on year. The Halifax suggested rise of 9% looks very out of sync with the rest of the indices, most suggesting a 5-6% rise.

But when comparing the market to individual annual growth over the last 10 years, things are looking good for homeowners and those looking to trade up. Although first-time buyers are having to pay more year on year, when you look at price performance locally, most regions are still good value versus the pre-credit crunch price levels.

Property price report national headlines

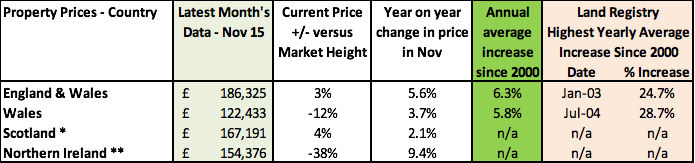

Property price reports by UK country: England, Wales, Scotland and Northern Ireland

Scotland’s index is created differently so can’t be compared to other country performance, but currently prices are seeing some good growth, although still recovering to their pre-credit crunch averages. Hometrack’s index which suggests Glasgow and Edinburgh are up robustly year on year, while Aberdeen, due to the oil crisis, is seeing slight, but rare, falls.

Download the full report for January 2016

Northern Ireland stats show a big increase year on year of over 9%, but this disguises the huge falls seen since the credit crunch of 50% or more. And even at growth of 9% year on year, this would mean it would take nearly four more years (2019) for prices to recover. However, this growth does suggest that for those who want to get on the ladder or increase their investments, now might be a good time to consider buying. Any buyer would be wise to check what happened to property prices for the road/property they are buying during the credit crunch, to better understand the potential risks of a further credit crunch.

What will be interesting in 2016 is to see if the recovery seen now in England and large cities like Glasgow and Cardiff will spread out to the rest of the UK, or if we are experiencing, possibly for the first time, much more steady and affordable annual property price growth.

Country data shows that Welsh prices are up year on year by 3.7%, but growth lags behind the annual average of 5.8%. At this rate, as property prices are still 12% lower than they were before the credit crunch hit, it will take another three years (2018) for Welsh prices to recover to pre-credit crunch levels. This would mean property prices would have been in recession for 10 years in the area.

Scotland’s index is created differently so can’t be compared to other country performance, but currently prices are seeing some good growth, although still recovering to their pre-credit crunch averages. Hometrack’s index which suggests Glasgow and Edinburgh are up robustly year on year, while Aberdeen, due to the oil crisis, is seeing slight, but rare, falls.

Northern Ireland stats show a big increase year on year of over 9%, but this disguises the huge falls seen since the credit crunch of 50% or more. And even at growth of 9% year on year, this would mean it would take nearly four more years (2019) for prices to recover. However, this growth does suggest that for those who want to get on the ladder or increase their investments, now might be a good time to consider buying. Any buyer would be wise to check what happened to property prices for the road/property they are buying during the credit crunch, to better understand the potential risks of a further credit crunch.

What will be interesting in 2016 is to see if the recovery seen now in England and large cities like Glasgow and Cardiff will spread out to the rest of the UK, or if we are experiencing, possibly for the first time, much more steady and affordable annual property price growth

For FREE, independent and up-to-date advice on buying, selling and renting a home, sign up for FREE at Property Checklists. Join now to access our FREE checklists, including:-