Although it’s too early to tell ‘what happens next’ after the Brexit vote, we have an idea of what’s transpired so far - and this will allow us to measure the impact of the vote (if any) and then help inform us for future shocks to the system and their effect on property prices and rents.

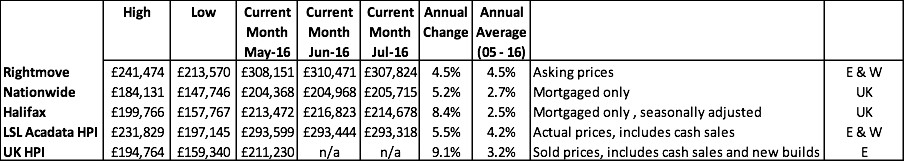

Nationally, you can see from the table below that average property prices for July vary from £205,715 to over £307,824 – a vast difference, but that’s because the lowest figure is for properties bought with a mortgage and the high one is from Rightmove, which has properties on there which are not yet sold – and some would never sell at the price listed.

For instance, the highest priced property currently listed for sale on Rightmove is a five-bedroomed apartment in Knightsbridge, marketed by Savills at £62,999,999!

UK, England and Wales data

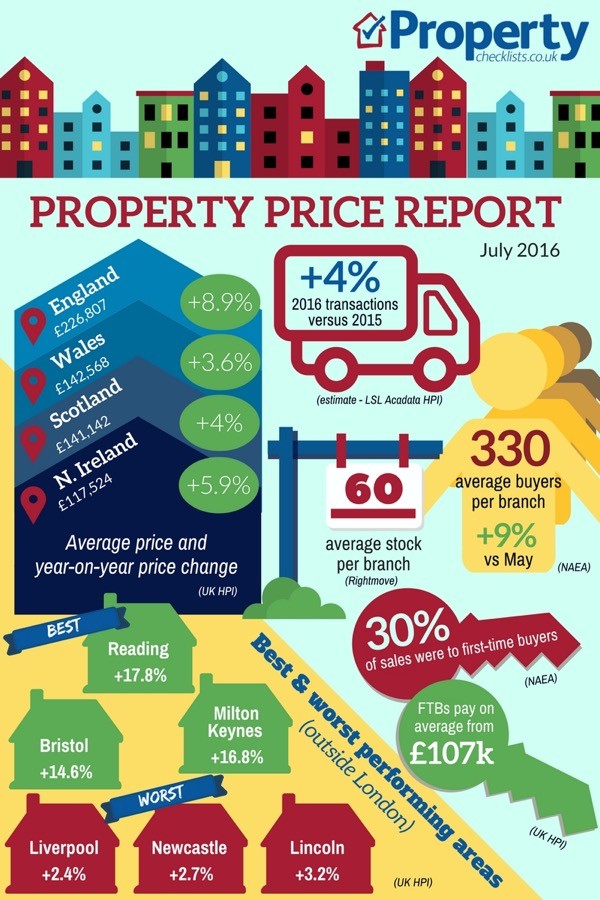

The good news is that first-time buyers, who help to keep the market moving, continued to play their part as a "third of total house sales in June were made to FTBs” according to NAEA.

Looking to buy your first home? Read our FTB Quick Guide

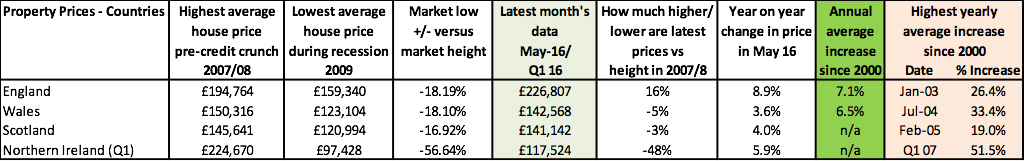

From a ‘country’ perspective, England is definitely the main driver of the overall property price growth and, although Northern Ireland saw good annual growth of 5.9%, this is against a horrendous backdrop of still being 48% down since the crash – meaning a lot of people there must still be in negative equity, which will continue to restrict the market for many years to come.

We may also see in Northern Ireland – as with city centre flats in the Midlands and North which were oversold prior to the credit crunch – that we’ve experienced our first true property price bubble. I know I keep mentioning it, but no-one else seems to be talking about it and it’s a huge story!

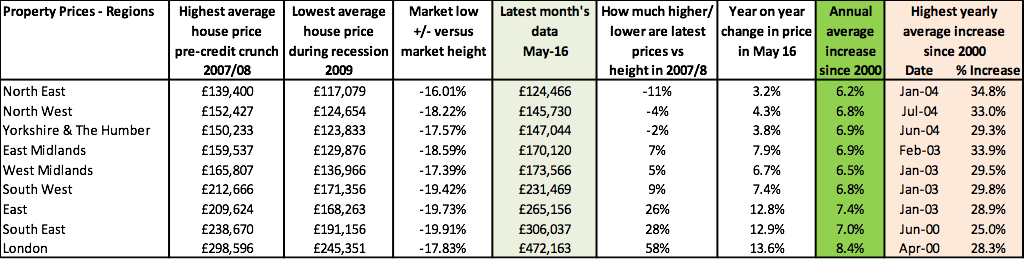

From a regional perspective, this shows that the north/south divide is well and truly alive in the property market, but the Midlands is starting to catch up. Year-on-year growth in the East and West Midlands is now just ahead of its 16-year average annual increase.

However, apart from some areas in London, we aren’t seeing anything like the ‘rebound’ in prices which followed the last recession in the 1990s. Then, prices were increasing in excess of 25% in just one year (see the last column, below) suggesting that property price growth is being slowed by things like:

Affordability, helped by the restriction in lending levels at 4.5x income;

Mortgage market review restricting lending based on rates hitting 7%;

Renting instead of buying is more culturally acceptable and a sensible, cost-effective way to put a roof over people’s heads – especially in ‘expensive’ areas.

Source: UK HPI

But if you are looking at buying, then areas such as Yorkshire and Humber and the North are still tremendously ‘good value for money’ in the long term, with property prices still up to 11% lower than they were in 2007/8. That’s nearly a decade ago and in the past you’d have expected property prices to have doubled in that time.

For more download our latest comprehensive price report

What’s happening in your town or city?

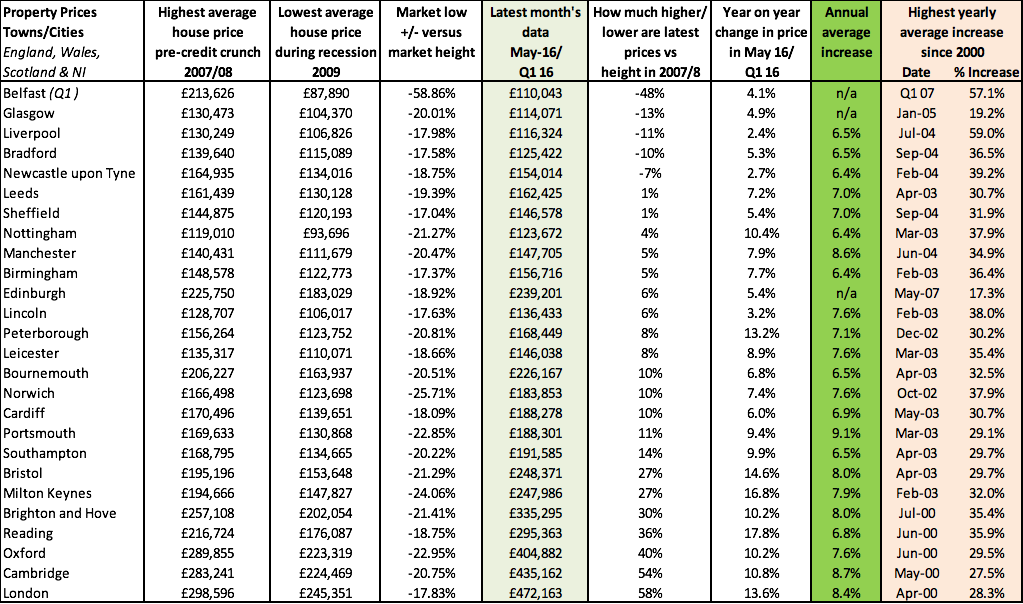

The table below shows the huge variation in property price performance across the UK. The new government UK House Price Index shows that, in the main, prices tend to rise around 6-8% year on year.

Currently, few areas are performing at this level, even though we are years into the effects of the credit crunch and it just goes to show that there are still plenty of places around the UK that are affordable and that the main housing crisis (however that’s defined) is really concentrated on the South.

Meanwhile, we see that most towns and cities though have now at least recovered from the lows of the credit crunch… with the exceptions of Newcastle, Bradford, Liverpool, Glasgow and Belfast.

Although areas such as Reading, Milton Keynes and Bristol are seeing growth of 15-17%, this is half the rate that we have seen in the best performing years in the past.

Yes it’s still tough to buy while prices are rising at these levels, but it’s clear that property prices at the moment aren’t performing at anything like the level they have between.

This means if we experience some good economic growth and wage rises over the next 5-10 years, we could even see an improvement in housing affordability for the first time in years.

Meanwhile, average stock for sale and average number of buyers both dropped off in June, but we’ll need to see the trend over the next few months to understand the impact this has on prices – which, if both fall at the same rate, could end up being no impact at all.

Finally, new builds continued to add stock, albeit not at previous building rates, but new homes registrations were slightly up year on year for Quarter 2, 2016. According to the NHBC, this was the strongest quarter since Quarter 4, 2007 – the start of the credit crunch.

But unfortunately it’s bad news for the social homes market as much-needed new stock fell by 10% year on year.

What’s happened to rents?

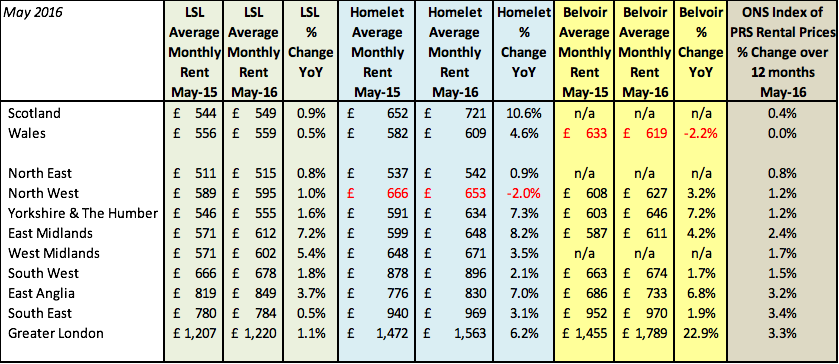

Rents are doing pretty well year on year in most places as the table shows below, however, they aren’t ‘extortionate’ and, according to Countrywide, in the main rents are actually a lower proportion of people’s income than they were at the start of the credit crunch in 2007.

Looking to rent? Read our renting quick guide

This is very much a reflection of rents being pretty flat throughout the recession, falling in 2008/9 and for some areas, such as Nottingham, only just recovering to previous heights seen then.

For more download our comprehensive rental report

So, although rises are currently above wage increases, over time they remain on par and below inflationary increases.