It’s the time of year when the pundits get out their crystal balls and work out what’s likely to happen in 2015 to property prices and rents.

For many, you may think that these are pretty irrelevant, but whether you are a home owner or an investor, understanding what might happen to prices and rents in 2015 can help you work out whether next year is the time to sell, buy, invest or stay renting.

Is anyone any good when it comes to forecasting?

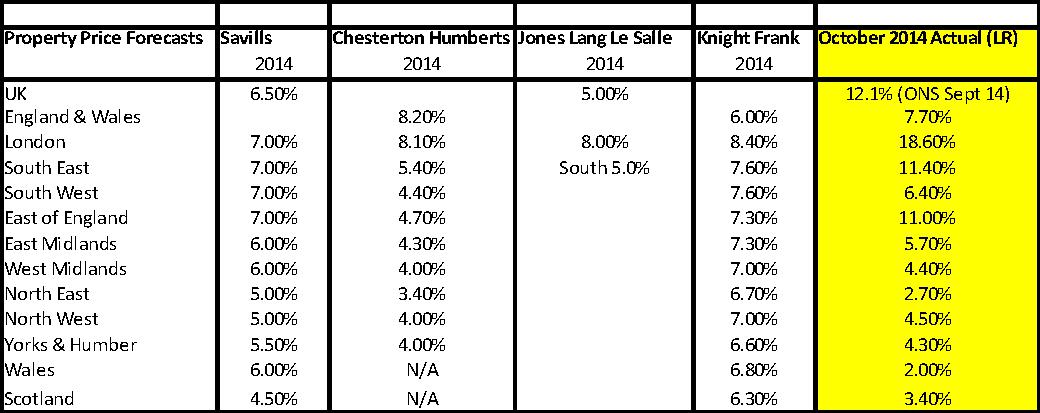

Well last year we produced the 2014 forecasts and here’s an update on who did well and who didn’t do so well!

So far it looks like the forecasts for London were pretty wrong – it grew by twice the rate the property experts thought it would. This is a surprise really as post the last crash in the 1990s, prices in London soared by 30-40% in 2000 year on year and in the regions the equivalent rises happened in 2003, although they didn’t see quite the level of increase London did - prices rose by 20-30% year on year.

What’s the difference between property price rises now versus 2000 onwards?

Up until September of this year (2014) the property price recovery has pretty much mirrored that of the 2000, especially in the London Boroughs.

However, now things have definitely changed. From 2000, mortgage lenders effectively changed the way they lent money. Instead of lending based on your income, so three or three and half times your income, they lent based on affordability measures.

In addition, buy to let lending took off which allowed investors to borrow based on the mortgage payment being 120-130% of the rent.

This had the an immense effect on property prices and allowed them to rise exponentially.

However, we now have the opposite happening. Mortgage lending is being restricted and indeed Mark Carney, the Bank of England Governor has declared that he wants more powers to try and curb the excesses seen by lenders prior to the crash in 2007.

The next difference between now and back in 2000 is that in England at least, one in two properties which are owned are now owned outright ie with no mortgage. Many of these are owned by the baby boomers who have now paid off their mortgage. For the future they are likely to be trading down to two and three bed homes or move out of more expensive areas to less expensive areas and with a continued stock shortage, this could well drive prices forward – whatever restraints the Bank of England puts on those needing a mortgage to move.

So what’s next for 2015? Read my property price forecast special.

For FREE, independent and up to date advice on Buying, Selling, Buy to Let or Renting a Property, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-