It’s significant that both Rightmove and LSL are reporting prices falling in England and Wales, year on year, for this month, and albeit these are ‘tiny’ falls, they indicate a slowing market. This year to date, Rightmove’s average peaked at £309,348 in June, while for the LSL Acadata HPI, the peak was in January: £304,739. Versus these peaks, prices currently are almost 1% lower than in June for Rightmove’s asking price index while LSL Acadata record a 1.8% fall from their January peak. Add to this Hometrack’s headline that “UK city house price inflation is +2.4%, half the average growth rate over the last five years (4.8%)”, and although they record a rise versus other indices, it’s clear there won’t be any market bounce before Xmas and we’ll have to now wait until 2020 to see ‘what happens next’. With an election upon us, housing is going to be a key topic, but perhaps not as high as it would be without Brexit still ‘being on the list of ‘to dos’.

To find out more, download Kate Faulkner's comprehensive price report here

Country wise, both England and Scotland are seeing little growth – although both have huge internal regional differences. Meanwhile, Wales house prices are now surging ahead, especially when compared to Scotland with a 4.5% rise year on year, and still only 12% up over the last 12 years, but Scotland remains one of the best ‘value for money’ areas with average prices just 6% higher than the pre-credit crunch peak, and prices year on year only up by 1.6%. Northern Ireland remains ‘in recovery’ but the burst property price bubble remains with average prices still 39% lower than they were 12 years ago in nominal terms, when adding the impact of inflation – a 36% rise since 2007 – real prices are vastly down. Astonishingly though, this didn’t stop a ridiculous headline from the Belfast Telegraph suggesting that prices are ‘soaring’ compared to the rest of the UK! This is a stark reminder to agents, brokers and legal companies that they need to ensure local communities know what’s really happening in the market and making sure people ignore these ridiculous headlines.

Download Kate Faulkner's comprehensive price report here

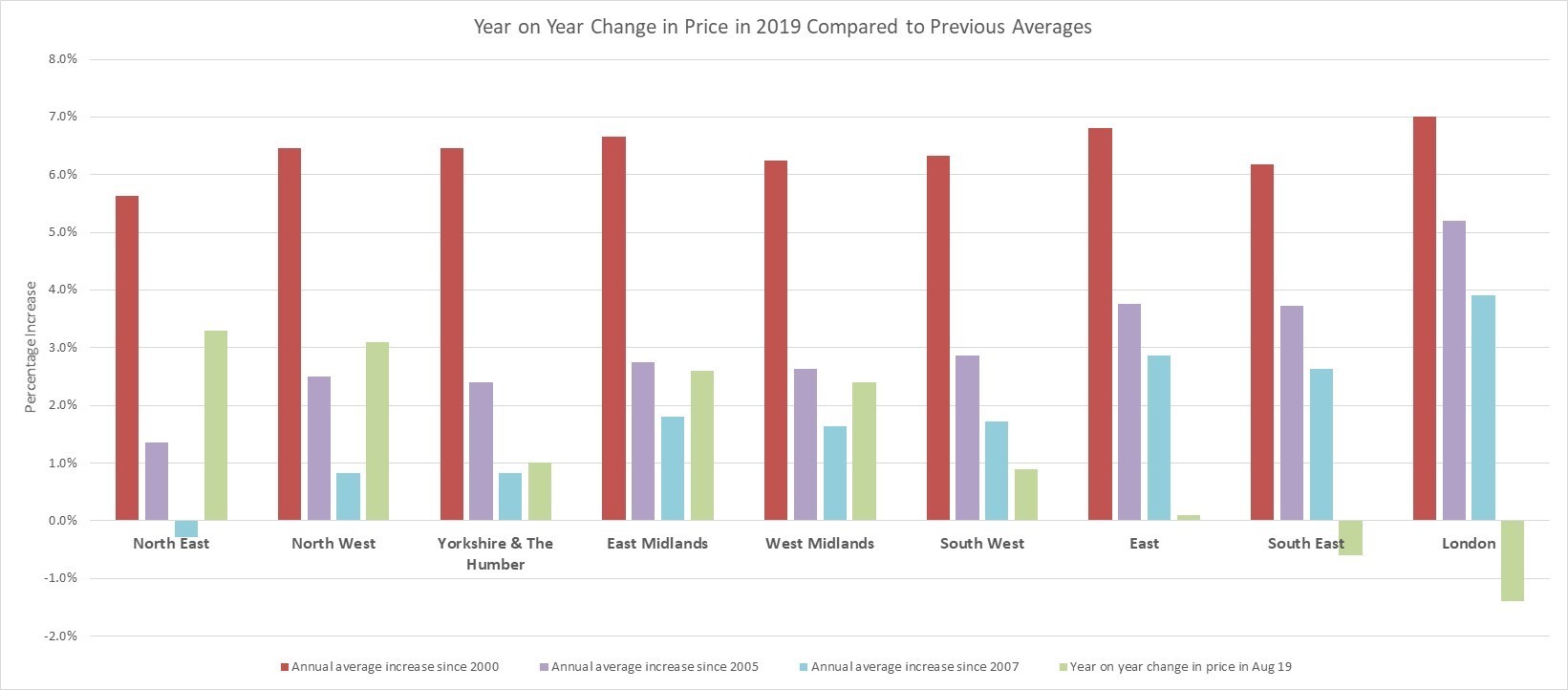

Although England has an average growth year on year of just 1.1%, this hides the differences in each region. It’s clear London and the South East are stalling ‘on average’ with prices slightly lower than last year while the North West continues to see price rises of just over 3%. Interestingly, the North East has picked up recently, with a 3.3% increase, but this won’t be felt by all sellers as prices for many who bought before the credit crunch are still lower –3% on average. With inflation running at 36%, London property prices are the only region which have seen property prices rise in real terms, while the South East has seen property prices maintained and although higher than the 2007 peak, all other areas, in real terms are much lower than we’ve seen previously. With small rises year on year, it’s unlikely that this is going to change over the next year or so, especially if we hit a recession which is either driven by poor economic performance in the UK or indeed at a Global level.

Source: UK HPI

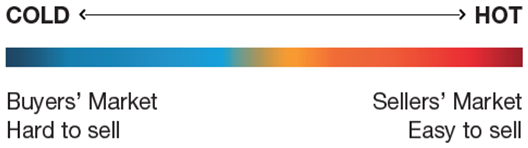

With the country data suggesting Wales is doing well and the regional data reporting rises particularly in the North of England, the towns and city data show a much more buoyant picture. Activity though seems to be best in the Midlands, with Leicester, Lincoln and Peterborough recording growth of around 5% year on year. Meanwhile, other areas are suffering from an affordability perspective with Oxford suffering the most this month, with falls of -4.3%, followed by Milton Keynes where prices have fallen by -1.7%. However, considering the falls in transactions, prices are, in the main, far more resilient than they have been in the past.

Reallymoving have produced a forecast of what will happen to property prices over the next few months, based on their quoting service. According to this information, the North East price rises will remain in place for the rest of the year, while they are expecting the North West , Yorkshire and Humber and the East Midlands to see more of a bounce, and the South East to see price falls worsen.

To find out more, download Kate Faulkner's full price report

Transactions are definitely running behind even the new ‘low norm’ we’ve seen since the credit crunch, but despite the low sales and the fact that property price growth is waning, in the past, prices have fallen by far more when sales have contracted. The RICS probably sum up the current issues when it comes to transactions and sales: “Following three consecutive months of a largely stable trend in supply, the latest results point to a renewed decline in the volume of fresh listings coming on to the market. Comments from contributors are suggesting that the Brexit impasse seems to be dissuading vendors.” According to LSL Acadata, volumes are down -4.5% so far year on year, with the South West and East Midlands seeing the highest falls (-5%) while East Anglia, the North and Yorkshire and Humber appear to be most resilient with just -2% falls.

Source: The Advisory

|

Advantages of a new build property - Barratt |

Open Property Group |

Identifying and solving condensation, Envirovent |

|

|

|