What are the indices saying about first-time buyers?

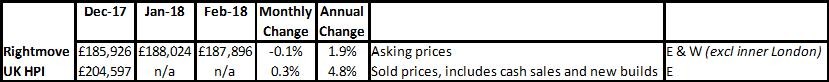

Here's what the various property price indices are saying about first-time buyers but remember national average prices can be misleading.

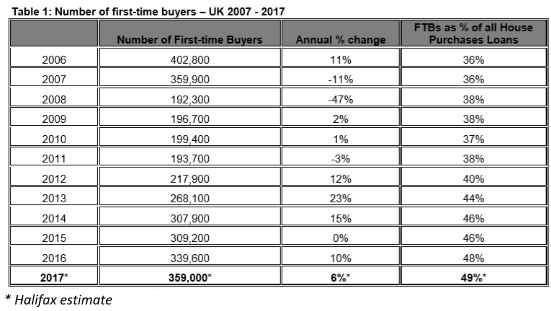

Halifax “Number of first-time buyers highest since 2007 despite deposits doubling”

UK Finance "First-time buyers in 2017 reach decade-high but market cools in December”

NAEA Propertymark “Increased competition stifled first time buyers (FTBs) in January, as sales to the group fell”

Average price paid for first-time buyer properties

Proportion of first-time buyers

Source: Halifax

10 years after losing nearly 50% of first time buyers, we are nearly seeing them return to previous levels, being just 11% behind now. This is partly due to the recovery from the recession, giving people confidence to purchase, but also I think due to the Help to Buy Schemes. In 2017, approximately 32,000 properties were sold under Help to Buy and 80% of these are sold to first time buyers. For those critical of the scheme, the loss of H2B could result in a fall in FTBs and, worse still, a decline in their interest in new builds, which in my view would not be good news for the industry but more importantly for those who are trying hard to save with Help to Buy and Lifetime ISAs and the new build scheme.

We should be wary of some of the data and claims made in the recent FTB reports. For example one of the key reasons for FTBs being a higher proportion of house purchase loans is because more people own their home outright and paying down their mortgages, while others are moving and buying with cash, so this is a natural increase mainly due to the ageing population and the baby boomers paying off their mortgages.

Download Kate's comprehensive first-time buyer report

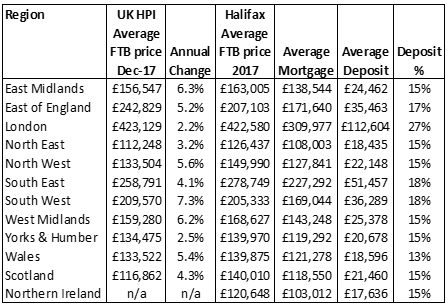

First time buyers regional prices, average deposit and mortgage levels

These figures are useful on the one hand as it shows that many people are buying their first home for less than £150,000 in Scotland, Northern Ireland, Wales and the English regions of Yorkshire, North East and West. In the Midlands, it’s just under £160,000. Affordability issues start ‘biting’ in areas such as London, the South and East of England where the price paid suddenly jumps to around £250,000 or over £400,000 in London.

Unfortunately even a property costing over £100,000 will sound a lot for many people, so the problem with these ‘average’ stats is that they can put potential FTBs off buying altogether, meaning they don’t save because they believe they can’t buy, when in actual fact, in an area such as Nottingham in the East Midlands, a two bed property can cost just £70,000 – or less if buying with the shared ownership scheme.

What’s important is not to place too much emphasis on these figures and in particular not to quote the ‘average deposit paid’ as ‘what first time buyers need’ or ‘have to have’ which again can put buyers off. For someone buying in an area where the ‘average’ FTB pays £156,547 in the East Midlands and finds £24,462 for a deposit, this is just what it says it is – an average. People are buying for a lot less and also putting down 5-10% deposits, which would be around £5k to £10k, a lot less than the £24,462 FTBs are putting down.

Download Kate's comprehensive first-time buyer report

| First-time buyer quick guide - Property Checklists |

|