Update: As of November 2017, first-time buyers will pay no stamp duty on properties costing up to £300,000 and for properties costing up to £500,000 no stump duty will be payable on the first £300,000.

So here it is, at last, the end of the worst ‘slab tax’ in history. Now time for a refresher and some facts and figures so you know the impact it will have.

Firstly it’s mostly buyers that benefit as you are taxed on property on entry, not on ‘exit’ – which means any money you make between buying and selling is free of any tax.

Question One: What were the stamp duty limits and what are they now?

Old stamp duty rates:

| Up to £125,000: | 0% |

|

£125,001 to £250,000: |

1% (on the whole value) |

|

£250,001 to £500,000: |

3% |

|

£500,001 to £1,000,000: |

4% |

|

£1 million to £2million: |

5% |

|

£2 million and above: |

7% |

The new stamp duty land tax (SDLT) system:

It’s a bit like income tax, so the first £125,000 is free of charge, whatever you pay for the property. Anything you pay over and above £125,000 is then charged at the new rate of 2%:

£150,000 property stamp duty is now £150,000 - £125,000 = £25,000 * 2% = £500

Under the old system this would have been 1% * £150,000 = £1,500 so a huge saving!

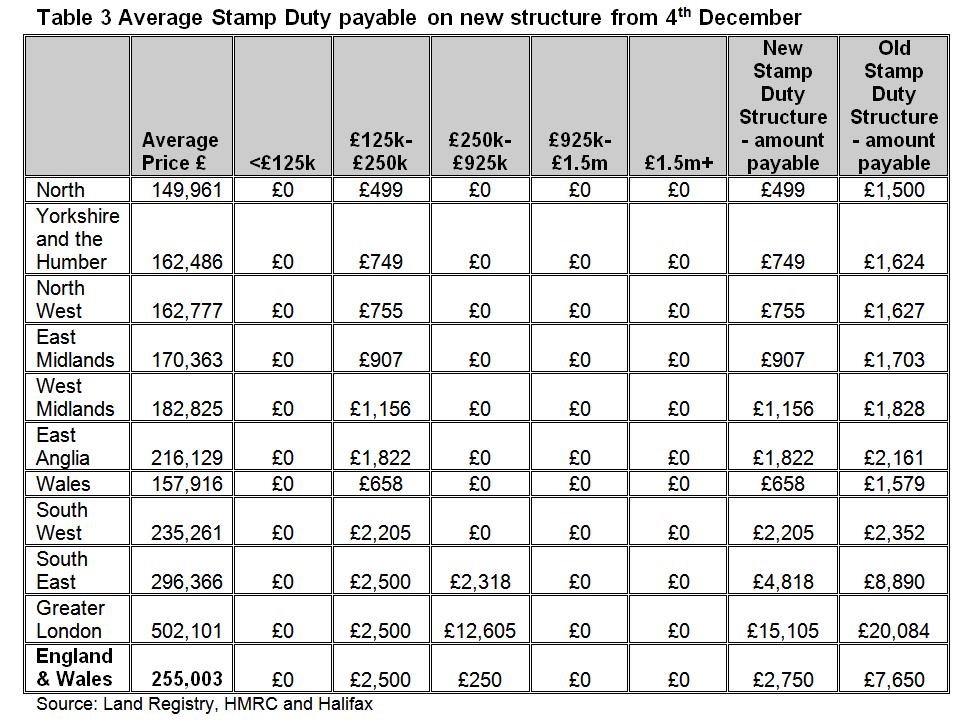

Here are the numbers wirh a regional breakdown from Halifax:

Question two: How much will you save? Here’s my spreadsheet

Please find below my excel document – it should be right, but do check with your agent, mortgage lender and legal company who will confirm the actual amount you have to pay under the old and new system. This means if you are exchanging now, then you can elect which system is better for you.

Download our stamp duty land tax old versus new rates so you can see what you could save.

Question three: What if you are about to exchange?

Your agent, mortgage advisor and legal company will help you. The rules came in, for all exchanges from midnight December 3rd.

If the new rules are in your favour you can use the new system, if they aren’t you can choose the old system.

Please note your contacts will be having a nightmare as they didn’t know this was coming and haven’t had any time to gear up for it, especially provide extra manpower.

Make sure you email and ‘read receipt’ your query so you have evidence you requested the information to see what the changes mean to your purchase and which system will allow you to pay the least.

It’s OK to try and ring them, but be aware they will be inundated.

Question four: Will the changes affect the market?

The main effect will be to take out the huge contentious issues around the £250k to £275k mark, the £500k to £550k price bracket and the over £1 and £2 million.

It’s been rough on both sellers and buyers who have found it difficult to pay a ‘fair price’ for a property without being stitched up with a huge tax bill for just paying a £1 more or lose out on tens of thousands of pounds, so the buyer can save a few thousand.

What other changes will happen?

Due to property’s attracting such high ‘slab’ taxes at rates such as £250,001 plus, it means you don’t see that many priced at £255k or £260k, so there is likely to be more of a range now, rather than lots of properties ‘sitting’ at a ‘ceiling’ price of £250k.

The downside of this for sellers is you may have to pay £10-15k more for the property, but as you only ‘pay’ for a portion and as you then pay this back over 25+ years, it won’t be a huge impact on your finances.

This is especially the case for those buying between £250k and £300k. For example, the Council of Mortgage Lenders data shows the average first time buyer in London pays £290,000 for a property.

To date, they would need a deposit, then to pay around £15k on top, just over half on the stamp duty and the rest on moving costs. The change in stamp duty would mean, you only need £10k, so halves the cost of your stamp duty.

One benefit may be that more sellers will look to move. It’s been suggested that some sellers aren’t trading down to the high levels of stamp duty land tax and although I’m not overly convinced that makes any difference, if I’m wrong, there could well be more properties coming onto the market, good news for buyers!

Download our stamp duty land tax old versus new rates so you can see what you could save.

Question five: How many people will benefit?

Well the Chancellor has announced that 98% will benefit and he’s probably not far off as long as you look at the people who actually pay SDLT – of which in the past, despite the fuss made, 80% paid 1% or nothing.

Here’s are the number of movers in England and Wales stats from Savills:

|

Price Band £ |

Number of Sales |

|

Up to 125,000 |

358,000 |

|

125,001 - 250,000 |

487,000 |

|

250,001 - 500,000 |

208,000 |

|

500,001 - 1,000,000 |

54,000 |

|

1,000,001 - 2,000,000 |

12,000 |

|

Over £2m |

5,000 |

|

Grand Total |

1,125,000 |

So, no change for the 358,000 ie 23% of those that don’t pay anything anyway.

For the 43% who normally pay anything from £1,250 to £2,500 then they will see a good reduction in SDLT from a third to a half, so a huge difference. Although the nearer you get to the £250,000 the lower the saving.

And it’s the same for the 208,000 (18%) who would have paid 3% stamp duty from £250,001 to £500,000 this is a great deal, offering savings of thousands rather than just hundreds of pounds.

For those paying anything between £500,000 and £1,000,000 for a property, there will be some tiny savings, but for those over this rate, the cost of SDLT could go up by tens of thousands of pounds – but hey, buying multi-millionaire properties this can’t be too bad.