Are South West prices slowing?

Report Headlines

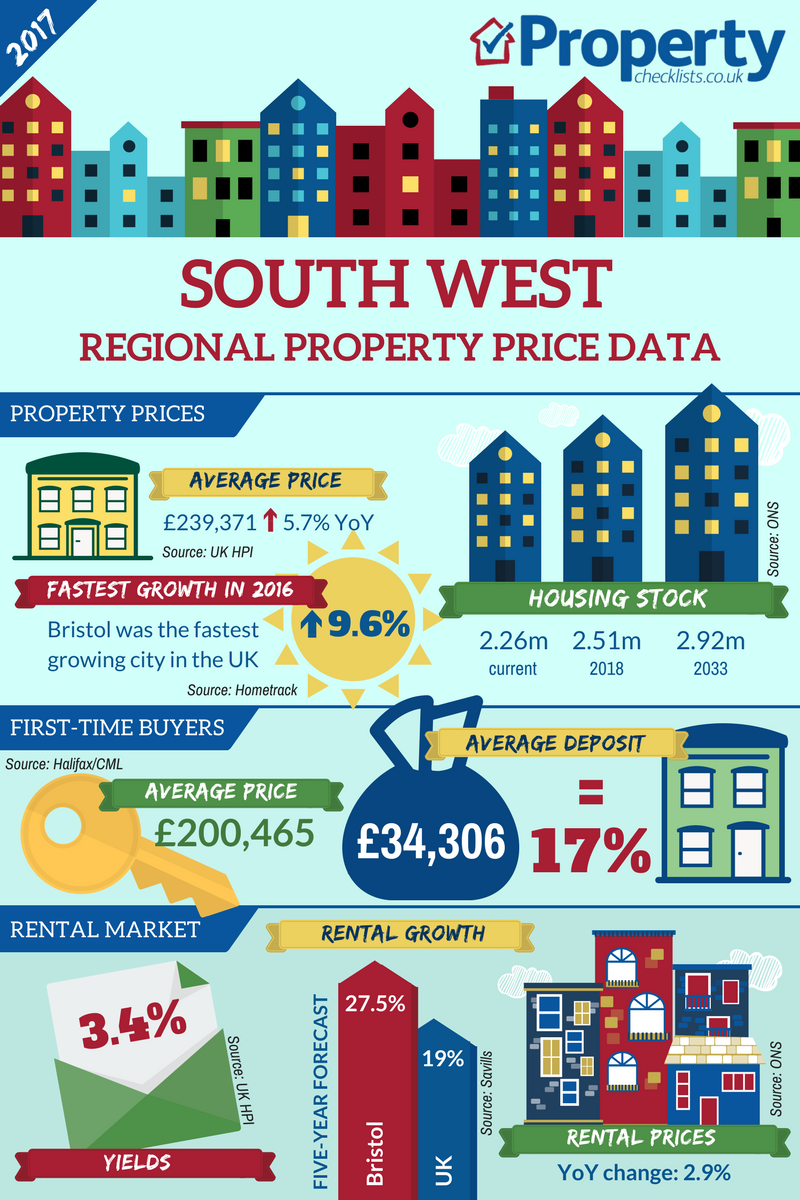

Nationwide “Overall, prices in Southern England (South West, Outer South East, Outer Metropolitan, London and East Anglia) were up 5.5% year-on-year.”

LSL Acadata HPI “In November, the South West fell to fourth place for its annual increase in average house prices, behind the West Midlands.”

Source: UK HPI

For more price stats visit our comprehensive data page.

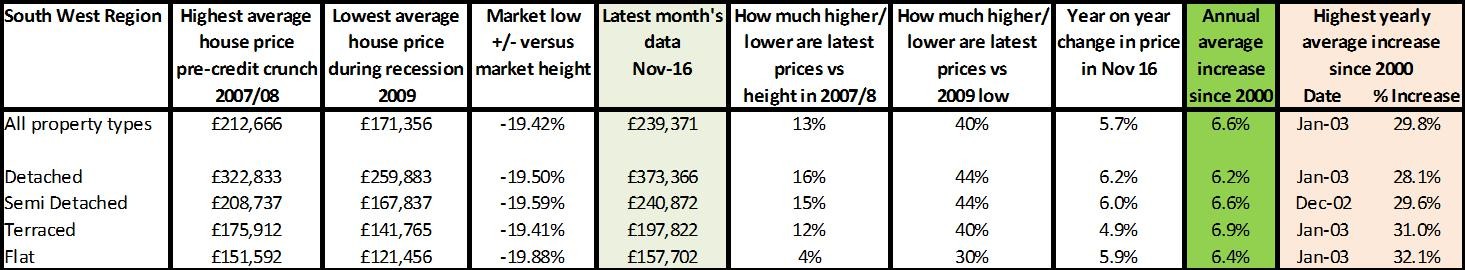

Overall, property prices in the South West have performed robustly in 2016 versus 2015 but are currently showing some signs of slowing down. When and what you have bought (eg, flat versus house) will determine how well property prices have recovered from their 20% falls during the credit crunch. As the property prices show for individual property types, any measures ‘on average’ completely skew the cost of housing in this year, with flats being an average of £157,000 versus a detached home fetching over twice as much. So it’s important to dig down deep into the property type you want to buy to see if it’s affordable rather than looking at ‘headline’ averages.

LSL Acadata HPI “In November, out of all the regions, the South West fell to fourth place, behind the West Midlands for the highest annual increase in average house prices.” (Dec 16)

Hometrack “Bristol was the fastest growing city in 2016. Average prices increased 9.6% down from 11.6% in 2015 but affordability pressures are set to result in slower growth in 2017.” (Dec 16)

Source: UK HPI

It’s a mixed performance from properties in the South West when you look at it on a city/town basis. Bristol with its strong economic growth means homes are ‘auctioned’ to the highest bidder when they come on the market, pushing prices upwards. However, areas like Bournemouth haven’t seen quite such robust growth. On the surface first time-buyers appear to have to find a lot of money to buy at an average of £200,000, but remember this is the ‘average’ — with some people paying less and some more. For two people, this may mean finding £100,000 each or looking at shared ownership to purchase.

Looking for your first home? Read our FTB quick guide.

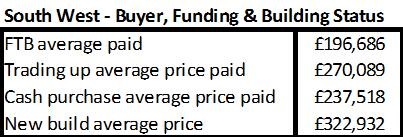

Looking forward, it does look like the South West is likely to see a lot lower capital growth, hopefully allowing more people to afford property as for the first time in a long while, wages have the opportunity to grow faster than house prices.

With average prices in the region growing at 6-7% in the past, growth rates of a few percent mean prices potentially only rising at a third of their historic levels.

This suggests that people should start looking for homes now even if in the past they have felt they would never be able to afford to buy.

Supply and demand

From a property sales perspective, most stats suggest that volumes are down year on year, but this is due to the huge activity in the first quarter driven by the government’s rise in stamp duty for second homes, which of course would affect the South West not just for buy to let but for holiday homes, too. Any sales data really needs to look at year-on-year rather than month-on-month or quarterly data. Having said that, it is obvious that areas where prices haven’t performed so well – such as Bournemouth – may well be due to the fall in sales, as demand versus supply is the real driver behind property prices.

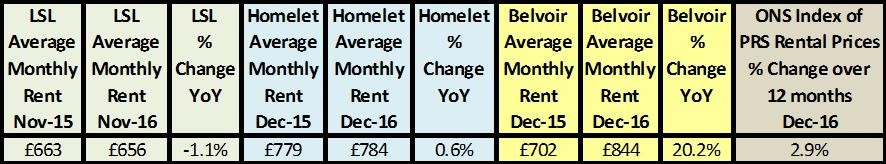

Note: Although the Belvoir year on year percentage comparison appears to be high, in reality this increase is predominantly down to the mix of properties advertised during December 2016 in the Christchurch (Dorset) and Plymouth (Devon) Belvoir offices. Average rents in Gloucestershire and Wiltshire remained fairly stable.

For more rent stats visit our comprehensive data page.

Looking to rent? Read our how to rent quick guide.

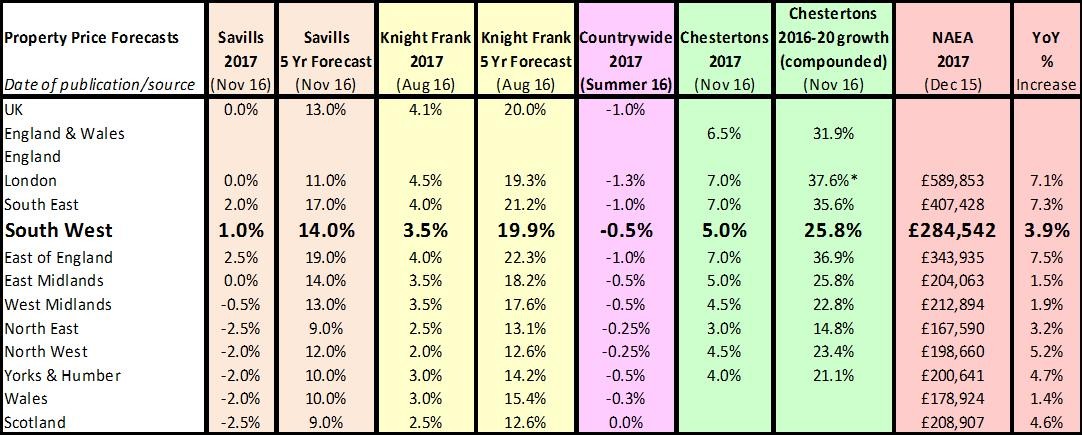

LSL “Just one region saw rents decrease on a yearly basis – the South West. Properties here attracted an average of £663 a year ago and this has fallen to £656 in this survey.”

Rents in the region may feel high for some but, with rental growth appearing to be at around 2% per annum, this is lower than the normal 3% inflationary increase and a third of the increase when you compare rents to property price growth which, to date, is running at 6-7% per annum. However, moving forward the prediction is that rents will rise faster than house prices. That’s good news for those looking to get on the ladder, but not for those who need to rent to allow for flexible living. Sadly, with the government’s policies curbing investment in the private rented sector, this is likely to restrict supply and cause tenants to pay much higher rents. As such, for those looking to rent or move to rental accommodation, this would be better to do sooner rather than later to ‘lock in’ as low a rate as possible over the next year or more.

For more, download our in-depth analysis of property in the South West.