As 2014 comes to the close we've been looking at how the various property prices indices are predicting the UK market to perform in the coming years.

Download the full report for December 2014

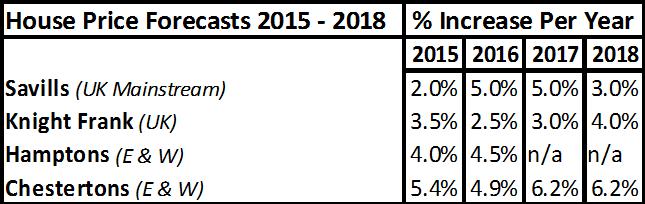

Here's what the indices are saying:

Download the full report for December 2014

Savills “Across the UK we expect prices to rise by 19.3% in the five years to the end of 2019 on a nominal basis, meaning that after inflation, real house price growth will be marginal. Constraints on price growth are most likely to be felt in London. There is already evidence of a change in sentiment among buyers.”

Knight Frank “We remain of the view that pricing in the UK is high in historic terms and affordability constraints will limit future price growth. However, with the UK economic recovery continuing to gain traction and with positive real wage growth increasingly likely over the next five years we believe there is scope for sustained price and rental growth beyond 2015.”

Hamptons “Overall we expect house price and transactions growth to be fairly modest for the next two years. On the upside SDLT reforms and a stronger economic recovery would boost confidence, but on the downside, lower expectations about future price growth, low wage growth and continued caution on the part of lenders could lead to a weaker outturn. In addition, uncertainties around the general election and housing market policies, including mansion tax, may continue to unsettle the markets.”

Chestertons “We believe that national house price growth will slow to 5.4% in 2015 while total growth over 2015-18 will reach 22.8%. Our forecast shows a similar picture at a regional level with the South East and Eastern regions recording the highest growth. For London, after a strong 2014, we forecast price growth will slow to 6.6% in 2015.”

Jones Lang LaSalle “On balance we believe that UK house prices will rise steadily over the next five years, in the order of 3-5% pa. We forecast transactions across the UK will increase from current levels and stabilise around 1.31m pa. We expect housing completions in England to grow from around 120,000 to 150,000 pa in the next five years.”

Halifax “A further moderation in house price growth is likely next year. House prices nationally are expected to increase in a range of 3-5% in 2015.”

NAEA “The NAEA predicts that in 2015 London and the South East will show slower growth in terms of price. With stamp duty reforms now in place, we’re hoping for greater supply in the market nationwide as there's more encouragement for people to buy and sell. Areas outside London and the South East, where the market has been slow in terms of volume and price, will hopefully catch up.”

Download the full report for December 2014

Kate Faulkner comments on Housing Market Price Forecasts:

"The forecasts over the coming years are pretty consistent from one property expert to another. Prices moving upwards by 3-5%, lower than the pre-credit crunch annual average increase, would mean a steady market, but one which encouraged both buyers and sellers to participate. What’s desperately needed moving forward is more properties to sell. We need more people who occupy existing homes to move to more appropriately sized accommodation and we desperately need more high quality, low running cost, new build stock."

For FREE, independent and up to date advice on Buying, Selling, Buy to Let or Renting a Property, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-