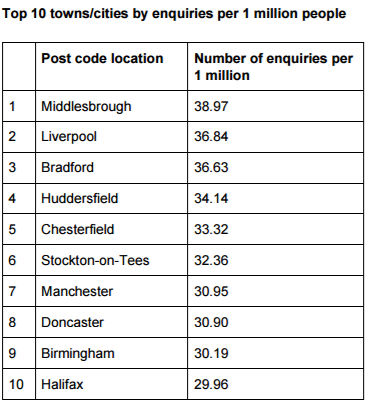

Homeowners in Liverpool, Middlesbrough and Bradford are most likely to consider using a quick house sale company – and their reasons may surprise you.

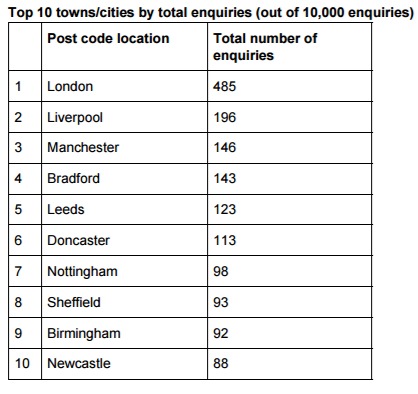

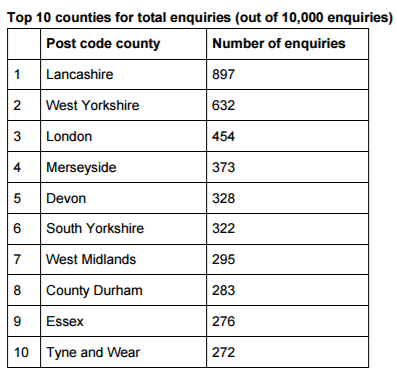

In the 12 months from 1st April 2016, UK cash property buying company House Buy Fast received 10,000 enquiries from homeowners looking for a quick cash sale and found that most came from the postcode locations of London, Liverpool and Manchester.

But, when population was taken into account, Liverpool, Middlesbrough and Bradford came out on top.

Why do people sell to cash buyers?

People are looking to sell their property quickly to a professional cash buyer are typically thought to be those in financial difficulties.

But House Buy Fast’s research show people have a number of reasons for seeking a quick sale, including:

Need to move location quickly

Don’t want to advertise their home for sale on the open market

Relationship breakdown

Landlords needing to sell

Downsizers selling due to illness

Properties in poor condition.

To find out what’s happening in your area, visit the heat maps.

If you are considering selling, or need to sell, your property quickly, here’s some advice from our expert professional buyers:

If you are struggling to pay the mortgage, before you do anything else, speak to your lender or get independent advice from somewhere such as National Debtline or Citizens Advice.

Check out your local property market by talking to agents who have sold similar properties to yours recently, asking them how many weeks it takes from marketing the property to completion.

You can also research the area by searching on property portals for properties which are similar to yours – make sure you tick the box which says ‘Include Under Offer’ or ‘Sold STC’ – and on sites such as nethouseprices.com, which list sold property prices.

Before you let anyone in your home to give you a valuation, make sure you are able to show off your property to its best advantage by ensuring it is clean and tidy, inside and out, even if it still needs work doing.

If you are thinking of selling because you are struggling with the mortgage payments, speak to your mortgage company or a debt agency for independent advice first, such as National Debt Line or Citizens Advice.

For more on selling your property fast, visit our expert quick sale checklist from Open Property Group

Who are people selling to?

There are three types of cash buyers out there: professional, individual property investors and people who claim to be ‘cash buyers’ but are actually just selling your details onto a third party.

So first of all, you need to check if someone claiming to be a cash buyer is using their own funds, borrowing via mortgage or selling your details to someone else. Don’t be afraid to ask for proof of funds from the buyer.

Any company should be a member of either the National Association of Property Buyers (NAPB) or The Property Ombudsman Scheme – or both, and should have a code of practice in place. For instance, members of the NAPB must have signed up to The Property Ombudsman Code of Practice for Residential Property Buying Companies. Being a member of this scheme means they cannot, for example, reduce the price at the last moment without good reason.

What questions do you need to ask?

Find out if the cash buyer charges any fees for their service – if they do, consider other companies as many don’t charge.

They will, however, offer you less than the estimated sale price of the property – this is how they make their money. Find out how much of a discount they demand; 10%, 20%, or more?

Ask them about their valuation process, which may include a ‘desktop’ valuation – which considers online research and chats with local agents on the phone – or a personal valuation, which includes a visit to meet you and the property and may be carried out by a Royal Institution Chartered Surveyor. If they have an RICS survey carried out, ask to see it – and remember to check who pays for it.

Some companies will do a ‘desktop’ valuation first, followed by a RICS evaluation; it is generally this RICS evaluation that forms the basis of the offer.

For more on selling to a cash buyer read our expert checklist from House Buy Fast - Selling to a cash buyer.