The general consensus is that it’s cheaper to buy than it is to rent and in many areas, this can be proven to be true, especially if you know how to play with the statistics or use averages!

However, the rhetoric around buying being cheaper than renting is surely one that, in the main, should be focused on the ‘first time buyer’ market. Should people continue to be tenants or should they get on the ladder? Does it matter which and what’s the ‘local market’ break even when it’s better to buy or rent?

Here’s some examples of the real decision making that tenants have to make when thinking about whether to stay where they are or to buy – and you might be surprised at some of the results!

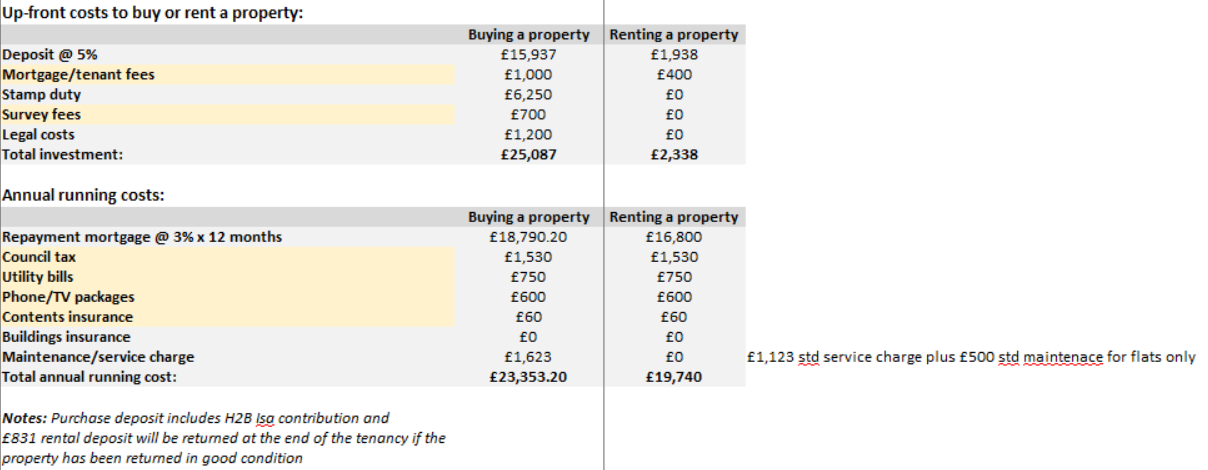

London

Based on average purchase for FTBs of £425,000 and an average rent of £1,400 a month for an equivalent property.

In the case of London the amount of cash required to purchase and then run the property annually is a lot lower – assuming zero or negative price growth.

Over the next 5 years Savills estimate prices will grow by 11% and the repayment monies will start paying down the mortgage, increasing equity from day one, so overtime it’s likely that buying, with rates being so low is still likely to be better in the long run as long as prices are still rising and mortgage rates low, but the ‘actual’ annual running costs are lower.

An 11% increase from £425,000 would mean additional equity of just over £46,750 while the additional running costs of an owned property during this time would be just over £26,000 but the FTB would also have to have saved 12x as much to put a roof over their head to cover deposit and buying costs.

Here are the same numbers for my neck of the woods:

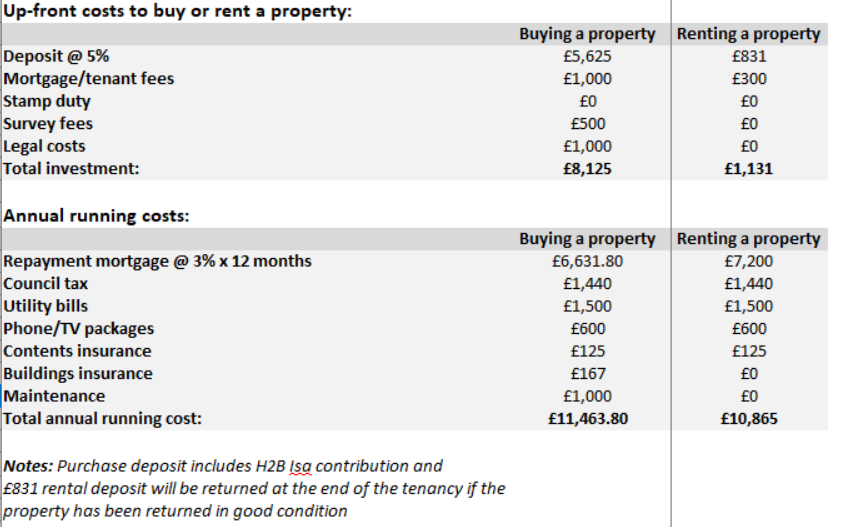

East Midlands

Based on average purchase for FTBs of £150,000 and an average rent of £600 a month for an equivalent property. Interestingly you don’t even have to spend this much, many two bed properties could be bought for less than £100,000.

Over the next 5 years Savills estimate prices will grow by 14% in the region and the repayment monies will start paying down the mortgage, increasing equity from day one, so overtime it’s likely that buying, with mortgage rates being so low is still likely to better in the long run, but the ‘actual’ annual running costs are lower to rent.

A 14% increase from £150,000 would mean additional equity of just over £20,000 while the additional running costs of an owned property would be just under £6,000 but the FTB would also have to have saved 7x as much to put a roof over their head to cover deposit and buying costs.

Is renting really the dead money tenants are made to think it is?

What these figures suggest is that renting is not necessarily the ‘dead money’ it has been considered in the past and indeed in both of these cases, the amount of money spent on rent is not hugely different to the interest charged by the lender.

A lot of time and effort is spent making tenants miserable and even guilty that they are renting rather than buying, these figures show that, renting can, from a financial perspective, be a very sensible option and it allows many tenants to rent a property they otherwise couldn’t afford to buy.

What’s happening in your area? Have you got any examples of it being cheaper to rent than buy? Tenants that are much better off renting than buying? Do contact me.

| Buy to let tax - Nicholsons Chartered Accountants | First-time buyer quick guide - Anthony Pepe | Renting a property - Safeagent |

|

|

|