Report Headlines

Belvoir Lettings “For England, Scotland and Wales where offices have been trading consistently over the last eight years, the average monthly rent is £752, a year on year increase of 1.6%.” (Sep 17 - E, W & S)

LSL “The North West is home to fastest rising rents in the UK” (Oct 17 - E & W, index started in 2009)

ARLA Propertymark “Surge of rent increases subsides” (Sep 17 - UK)

Countrywide “London tenants fuel rental growth across Southern England.” (Oct 17 - E, W & S)

RICS “Rental expectations are somewhat subdued in the near term, with contributors anticipating only a marginal rise on a UK-wide basis.” (Sep 17 - E, W & S)

For more download my comprehensive rental update.

Having run and reviewed rental indices since 2008, we know a lot about rental trends. Typically they rise when wages increase in excess of inflation and flatline or even fall when wages are stagnant. We do see rents rise for short periods of time when demand is particularly high versus stock levels but, unlike house prices – which can rise for several years – we don’t see rents do this for more than a few months. But despite the increase in landlords’ costs and taxes threatening to increase rents for tenants, this doesn’t appear to be happening so far. Latest research on the rental market from the respected Hometrack team states that “rents have tracked earnings over the long run.

Rental affordability is worst in London while it is the best for a decade in regions outside southern England.

For more download my comprehensive rental update.

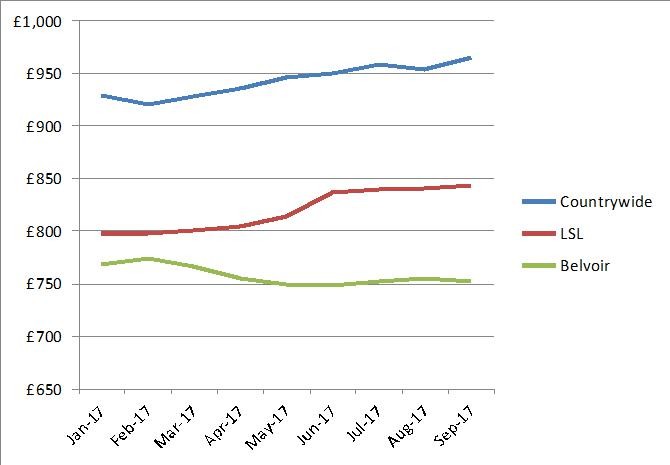

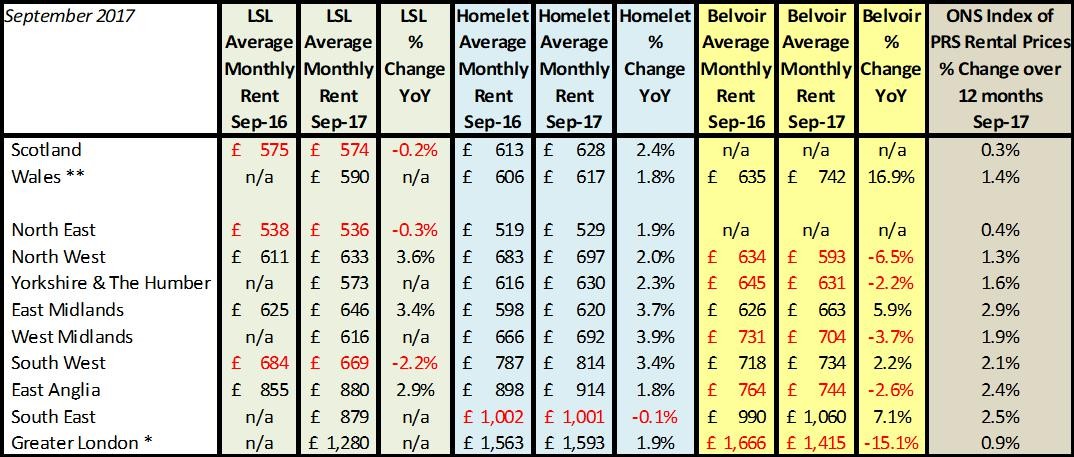

Although we can’t compare the rental indices below on a ‘like for like’ basis, we can look to see if the different indices are seeing similar trends to get a more localised idea of what’s happening. What’s interesting this quarter is the amount of ‘red’ figures, suggesting that rental inflation has abated. This is likely to be caused by wages and inflation matching, restricting what people can pay for properties to rent. This is happening even in areas where demand is higher than supply, such as London where rents are not seeing the rises they have in the past. Additional information from Hometrack shows the diversity by region of rental performance, with their analysis suggesting “residential rental growth over the last decade has ranged from +45% (London) to -7% (N.West) across regions. The variance is largely explained by local economic factors.

Housing crisis hitting young Scots and PRS tenants more than most

It’s interesting that despite Scotland making more changes than any other country in the UK to help support tenants, including banning letting fees, Shelter are now stating:

“Young people and private renters are disproportionately affected by a ‘terrible shortage’ of affordable homes in Scotland, according to a new report. Figures from Shelter Scotland’s ‘Impact Report’ have highlighted that a shortage of affordable homes, welfare reform and stagnant wages have seen tenants struggling to afford housing costs.”

It is perhaps worth noting that although the rest of the country is now looking to follow Scotland with banning of letting fees and agent regulation, unfortunately so far it’s not making a great deal of difference to tenants, even according to Shelter’s own analysis.

To me this makes it clearer than ever what is really required to help vulnerable tenants in the PRS is to build the social homes they need and get the 1 million people off the council waiting lists, rather than focus on trying to ‘force’ the private sector to deliver what only social investment can afford to do.

Read the article and full report.

Supply and demand

What is stark about the figures for this quarter, both from Belvoir and from RICS, is that the idea people rent just because they can’t afford to buy. In fact, people are now wanting houses as opposed to the cheapest properties they can get their hands on (eg flats), suggesting renting is more about a lifestyle choice.

And we perhaps have the first indication that landlords are not coming into the market, as government policy was designed to achieve. However, the government’s grand plans that this would magically help tenants to buy has not come to fruition as demand for rental properties – apart from in the South East and East Anglia – has continued to increase.

What the government is likely to find out over the next year or so is that there are good reasons why people rent rather than buy – which are partly financial and partly a lifestyle choice. The question is: how long it will take them to backtrack on measures introduced to curb demand and change policy to attract landlords once more?

Yields

Again, despite constant accusations that landlords and indeed letting agents are being ‘greedy’, what the yields show is that in the main, it’s the cost of buying and delivering housing that is high, while rents are pretty reasonable. As a ‘back of fag packet’ analysis, any tenant paying rent which is at a 5% or lower yield, is likely to be renting a property at a cheaper rate than they could buy. Today’s landlord needs to be extremely savvy when buying to let, making sure the deal stacks up both now and into the future.

| Buy to let tax - Nicholsons Chartered Accountants | How to rent - Property Checklists | Renting a Room - Spareroom |

|

|

|