I picked up a great article by the Council of Mortgage Lenders (CML) last week, looking at stamp duty and tax reform. It certainly provided food for thought, as it suggests that the 2014 stamp duty increases – imposed by the government to raise more income – are actually having the opposite effect.

If you have an opinion on property tax reform don't hesitate to get in touch.

Has the increase in second homes stamp duty had any effect?

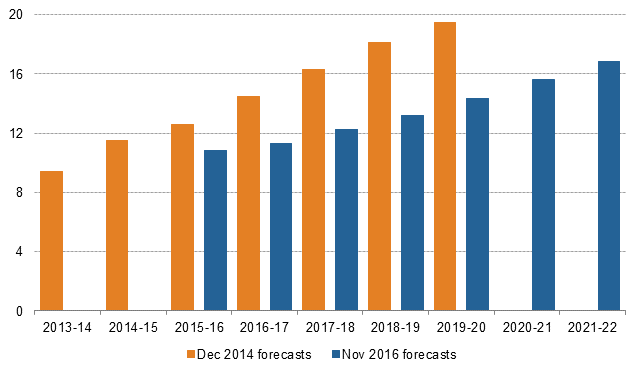

The most recent forecasts, published in November, expect revenue for 2019-20 to be £14.3 billion, much lower than the forecasts of December 2014.

This is the case even with the 3% stamp duty surcharge on second homes boosting receipts by 75% more than expected since its introduction in April.

So is stamp duty failing?

Whether you are moving house or buying for the first time, stamp duty is one of the major upfront costs.

Prior to the changes in 2014, no-one paid any stamp duty land tax on properties under £125,000, then there was a slab tax system, so if you paid for example £126,000, you would owe 1% for the total value: £1,260, then 2% if you bought a property over £250,000 eg £251,000, you would pay £5,020 and so on.

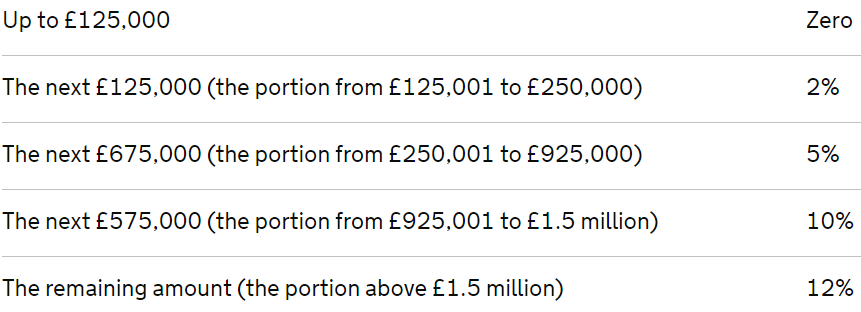

Now, there is no charge on properties up to £125,000, unless it’s a ‘second home’ from the value of £40,000 and then you’ll pay 3%.

Are you looking for your first home? Read our quick guide.

From there the stamp duty costs are:

To work out exactly what you would need to pay, visit the HMRC Stamp Duty Calculator.

According to CML, it’s not unreasonable to assume that these costs, on occasion, make the difference between someone getting on the ladder and staying at home with parents or continuing to rent, or indeed stop people trading up.

Looking to trade up? Read our trading up checklist.

In fact, the CML has consistently suggested that stamp duty is damaging to the housing market as it dampens activity.

Stamp duty is a transaction tax and therefore requires people to actually move home in order to produce any revenue. If, for example, potential second-steppers decide to extend their current home as an alternative to moving, then stamp duty tax revenues will fall.

According to the CML this is exactly what is happening and forecasts for stamp duty receipts have been revised in recent budgets and in the Autumn Statement, ostensibly as result of falling property transactions.

Is stamp duty actually damaging the market?

Transactions

The lower forecasts are not only down to less overall activity in the market, but also due to the original stamp duty reforms introduced this time two years ago.

Those changes increased the amount of tax payable on higher value properties. According to the CML, this stunted activity at the top of the market, precipitating a drop in the average value of transactions.

The 2014 reforms also altered the structure of stamp duty from the previous slab tax system to a marginal one and have been dismissed in some quarters, leading to a negligible improvement.

But they recognise it would be remiss to put falling activity levels solely down to stamp duty changes as, clearly, factors such as the economy and inflation levels need to be taken into account. However, as the chart above shows, in December 2014 stamp duty was predicted to rake in £19.5 billion a year by 2019-20 and it doesn’t look like this will happen.

It’s harder to mover home

It’s not only Downing Street’s tax revenue that is affected by lower activity levels in the property market; it makes it harder to move home, too. And that’s very bad news for the whole population and economy.

Fewer transactions reinforces the inefficient use of housing stock and means:

Youngsters struggle to buy their first property;

Second and third-steppers struggle to trade up;

Older people find it tough to tap into their property wealth;

Older people find it hard to find homes to fit with their needs in old age.

The impact of fewer transactions has repercussions for the wider economy, too. A lack of mobility for workers means an inefficient labour market as people can't move to where the jobs are available, thus stunting economic growth.

But, first-time buyers have benefited according to Halifax...

The Halifax review released at the start of the year indicated that first-time buyers had been boosted by stamp duty changes. In most regions across the UK the changes have resulted in savings for first-time buyers.

The biggest savings were in London with “someone buying at the average first-time buyer price of £367,990 now paying £8,399 in stamp duty fees compared to £11,039 before the change – a difference of £2,640.”

Buyers in Northern England and Scotland are making significant savings of, on average, more than £1,000 with many buyers in Wales, Northern Ireland and the North still paying nothing as they can buy below the threshold.

Reforms required?

The conclusion of the CML is that stamp duty changes haven’t had a huge impact. They have simply rounded the edges of the previous system, giving buyers just a small saving and causing unexpected ructions at top of the market. However, I think it’s been a welcome boost to many and has helped them to save faster to get on the ladder.

However, there wasn’t, and hasn’t been, much major discussion of housing taxation reform in recent times.

Is that discussion necessary? Are we approaching fundamental reforms?

Do you think it’s time to scrap stamp duty altogether?