If you remember I recently wrote about the new UK property price index from the government’s Land Registry, which helps us compare Scottish, English, Welsh and N.Ireland data.

The new index shows that average house prices have increased by up to 25% in some areas, compared with the old stats. And having redone our analysis of long-term annual averages, it certainly seems that price inflation – which used to be around 5% – is now more like 6-7% outside of London and, for Greater London, 7% as opposed to 6%. However, London has seen a 10% FALL in its average house price.

Looking to step up the property ladder? Read our Trading Up Checklist

What’s driven the change? The stats team tell me they have re-evaluated the ‘mix’ of properties in each area, so for example terraces, flats, detached and semis. What this has done is made the mix in each area more representative of the location. This has led to an increase of 15-25% in average prices in all areas while in London prices have grown faster each year, but are reported at a lower average.

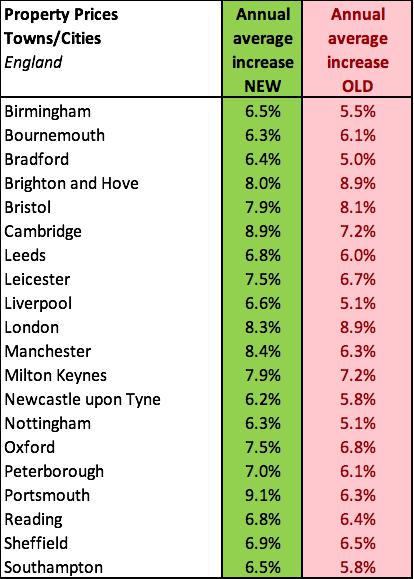

Here’s a summary of the annual average property price growth we were recording in the past and what we are recording now:

What’s happened so far this year?

Remember that the Land Registry and new data looks at what ‘has happened’ to property prices because it records and releases data between three and five months AFTER offers have been made. So it’s an accurate measure, but as property prices can ‘turn’ from positive to negative and vice versa within three months, it’s not necessarily reflective of what’s happening locally to prices now, so local agents are still the best source for the most up-to-date property price trends.

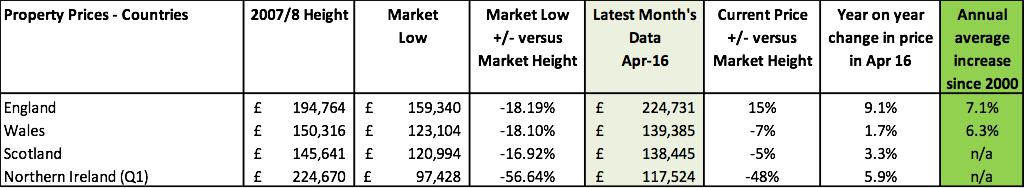

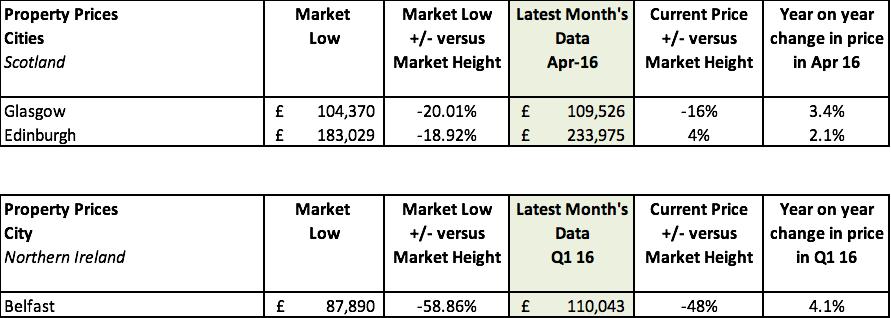

Latest data from the Land Registry, Scottish and N.Ireland data

The data below shows that although England has recovered to its pre-credit crunch highs, the other countries haven’t managed to quite get there yet so if, as predicted (even prior to Brexit) price growth slows in the second half of the year, these areas are potentially going to have to wait 10 years before everyone who bought at the height is out of negative equity.

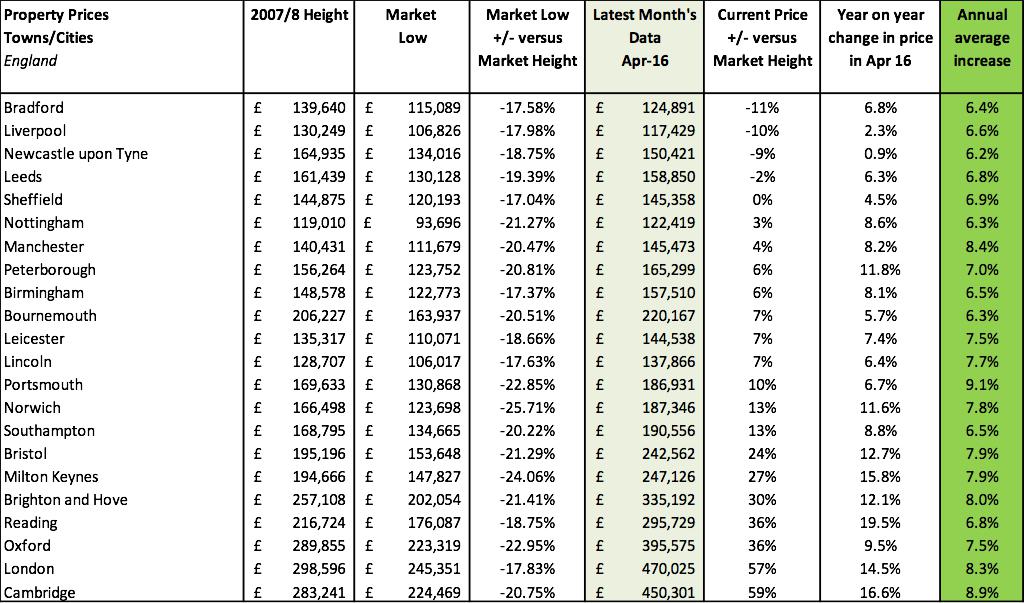

But as the data below shows, many towns and cities in England have yet to recover their property price averages, too, with Bradford, Liverpool, Newcastle and Leeds still well behind and the likes of Sheffield, Nottingham and Manchester only just starting to recover to their heights of nine years ago.

Buying for the first time? Read our FTB Quick Guide

Taking into account that inflation since 2007 has increased by 25%, for the past nine years property hasn’t kept up with the cost of living rises at all. In fact, only these six towns have exceeded inflation rises:

Of course this is ‘on average’. But it matters as over 50% of people in England own their homes outright and this means that, in reality, it’s a depreciating asset. This is especially important for anyone investing in property with cash as it means your property is likely to not be delivering a great return compared to other financial investments.

And for the other countries:

For buyers of course, it is good news that prices haven’t grown in line with inflation as to some extent as it does mean that many areas are still far better value than they were at the height of the credit crunch and, with the uncertainty of the coming months, there may be some even better bargains available!