Rightmove “Busy start to 2018 with increased home hunter activity”

NAEA Propertymark “First time buyers capitalise on December housing slump”

RICS “Momentum still soft to start the year”

Nationwide “Unexpected pickup in annual price growth in January”

Halifax “Annual house price growth slows to 2.2%”

LSL Acadata HPI “House prices end the year up 0.2%”

Hometrack “UK city house price inflation slows to 5.4%”

For more on property prices, download my comprehensive update.

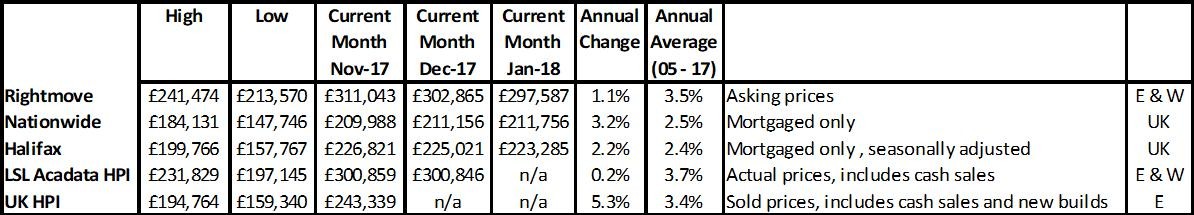

It seems the days of double digit price growth are over for the property market, for the moment at least. The historic price rises of 7-10% per annum haven’t been seen at a national level since 2005 – 12 years ago – and currently annual increases are running at a fraction of previous levels, varying from 0.2% (LSL Acadata) through to 2-3% for mortgaged properties and 5.3% for the UK HPI. ‘Average prices’ from the indices continue to vary by 40%, with Nationwide having the lowest at just under £212,000 and asking prices from Rightmove are now back down to just under £300,000, lower than their November 2017 average of £311,000. This is all evidence that average property prices are not a great measure today of real property prices.

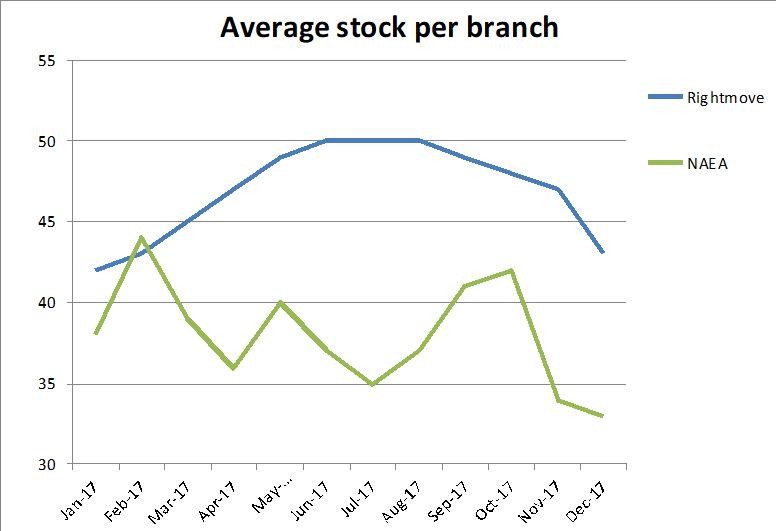

From a property transaction perspective, the outlook is weak. Although Rightmove are suggesting an uptick in those looking at property online, most of the indices are showing falls in deals – NAEA suggest “the number of sales agreed per estate agent branch fell to five – the lowest since December 2014” and the RICS state “newly agreed sales also slipped, extending a run of negative readings for this indicator stretching back to last February”.

So 2018 looks like a tough year transaction wise and in terms of capital growth, meaning the industry is going to have to work incredibly hard this year to achieve sales targets. Competition for business is likely to be high which in turn will put pressure on fees and, as I stated on the BBC 5 Live Investigates programme earlier in the month, excellent sales progression after the offer stage will be needed to hold chains together.

For more, see our data on the various national price reports.

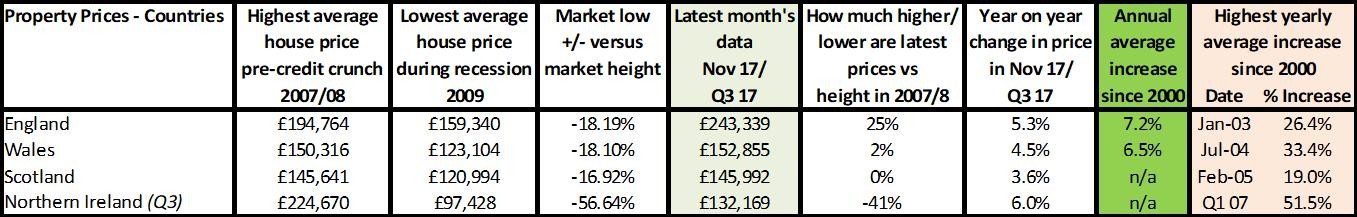

Source: UK HPI

This year it will be interesting to see how well Wales and Scotland perform now that prices have finally recovered to the heights achieved prior to the 2007 crash a decade ago. With most households hopefully now out of negative equity, it may mean those previously ‘trapped’ in their homes are in a position to look to move. New home sales offering the Help to Buy Scheme – where buyers need only a 5% deposit and get a 20% free loan for five years – could really start to take off. Many people mistakenly still think Help to Buy is only available for first-time buyers so it could be something the industry should be promoting heavily to try to get more movement in these countries. Meanwhile the new homes market remains important for the industry in England, too, especially as all the indices suggest the level of secondhand stock coming onto the market continues to be at a historic low. New homes are one of the few ways of being able to achieve guaranteed new sales so should be a priority for any business wanting to have a successful 2018.

For more on property prices, download my comprehensive update.

Source: UK HPI

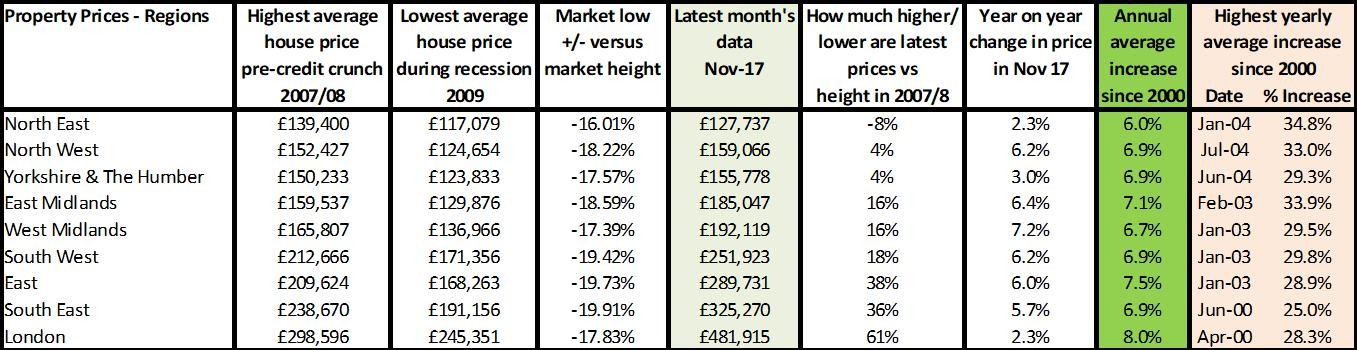

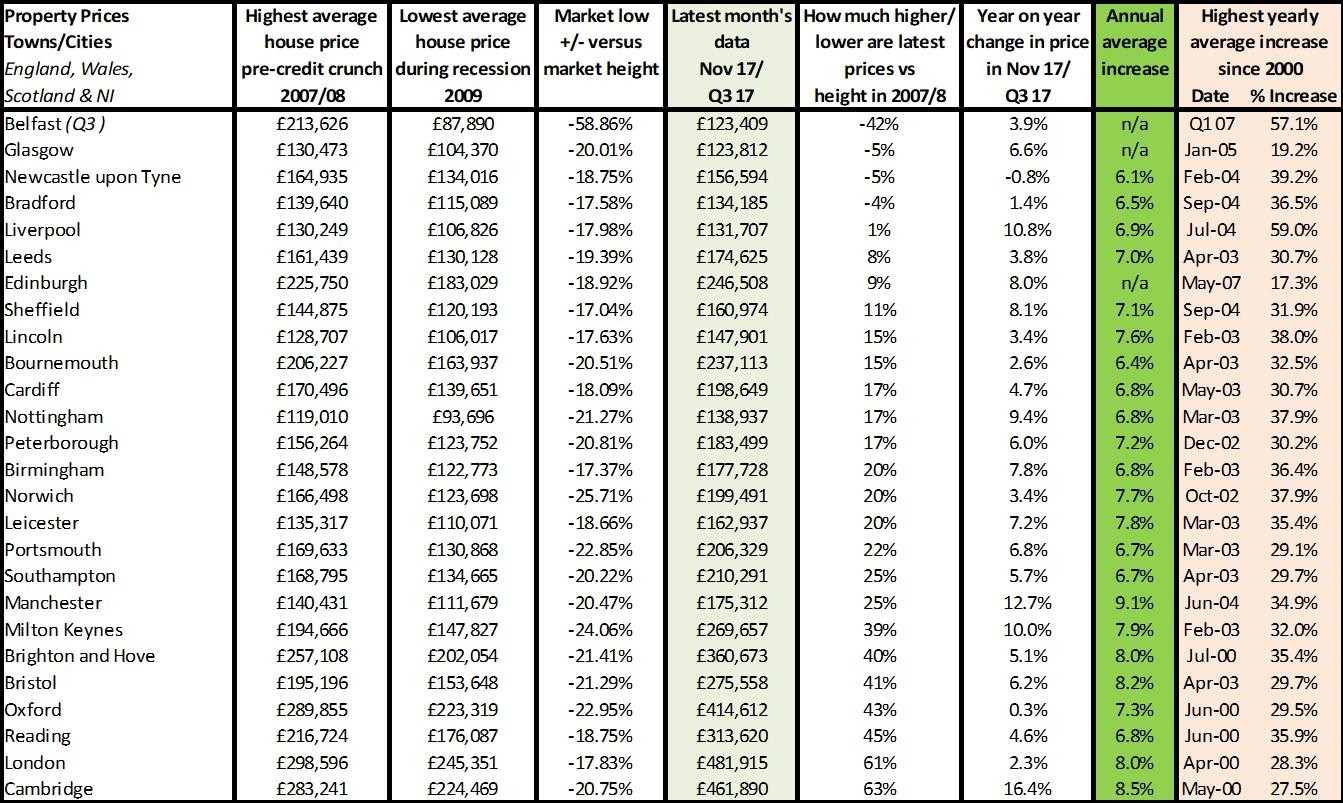

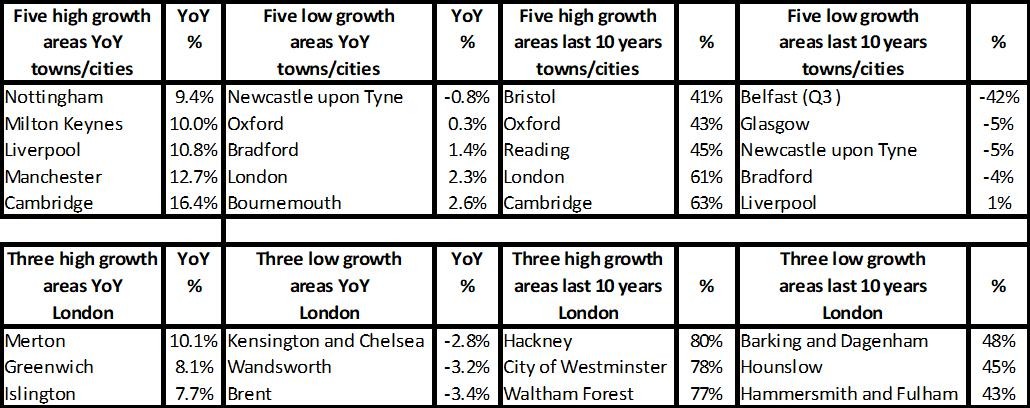

The Land Registry figures show that house price growth at a regional/town level continues to be incredibly diverse. We are still seeing a ‘ripple effect’ where London has grown by 63% since the previous height and this growth has spread out to the South East, with the likes of Brighton and Hove growing 40% in comparison. By the time we get to the Midlands, this strong growth seems to stop – although there is a ‘ripple’ of growth, it’s at a third to half the level of London, only just tipping into double-digit price growth on an annual basis. Then when we get to the so-called ‘Northern Powerhouse’, price growth does exist, but only just enough to return property prices to their 2007 heights, with areas such as Bradford, Glasgow and Belfast struggling to recover even a decade later. Now that London is seeing a ‘reverse ripple’ effect and most indices are seeing falls in prices due to a lack of demand, the big question is whether this slowdown will start to spread to the South East, then up to the Midlands.

Hometrack appear to have the answer to this and the good news is that it’s a resounding ‘no’, bar London. Now owned by the Zoopla group, their “analysis of ZPG listings data reveals how underlying market conditions continue to improve across cities outside south eastern England.”

What’s critical to knowing if prices are going to rise/fall is understanding the level of discounts sellers are willing (and able) to accept and, according to Hometrack, “the discounts sellers are accepting to achieve a sale are shrinking”. For example, their data shows that “the average discount over 2014-2016 was 3.2% which has reduced to 2.9% in 2017 across England. A different system for selling homes in Scotland means sales prices are higher than listings prices (see chart below)”. London, however, is seeing the opposite with “increased levels of discounting. In 2014, when the rate of house price growth was almost 20% per annum, the average discount to asking price was just 0.5%. Weaker, price sensitive demand has seen the discount widen to an average of 4% with the largest discounts of up to 10% being registered in inner London where price falls are most concentrated”. Having said that, with prices here growing from 40-80%, depending on the borough, even selling at a 10% discount will still make a good profit for people who have owned their property for five or more years, and they may even be able to get a bargain if trading upwards.

Source: UK HPI

For more, see our comprehensive regional and city data.

Stock continues to tighten while new buyer enquiries are falling, too, suggesting transactions will slip this year. From an agent perspective, particularly for those who only charge when they sell, it’s imperative to focus on securing listings which buyers exist for. Listing properties which no-one is looking for, especially if the seller is unrealistic about the price which can be achieved, is likely to incur unnecessary costs. Indications are that first-time buyers will be the main purchasers this year – with NAEA suggesting the percentage of sales to this group increased to 32%, up from 27% in November. It will be also essential to try to get deals through quickly to reduce the likelihood of expensive fall throughs. The good news is that NAEA research suggests sales are going through faster, but still a proportion are taking around 17 weeks, which is a long time to wait for payment.

| Buy to let tax - Nicholsons Chartered Accountants | Storing your belongings - Big Yellow | Quick guide to buying and selling - SLC |

|

|

|