Report Headlines

Rightmove “New price record, though lower than the average increase of 1.6% at this time of year over the past seven years and best sales since 2007 should mitigate pre-election jitters”

NAEA Propertymark “Supply of houses available to buy at lowest level for March since records began”

RICS “Sales market still lacking impetus”

Nationwide “Annual house price growth slowest in nearly four years”

Halifax “Annual house price growth unchanged at 3.8%”

LSL Acadata HPI “Eight of 10 UK regions record new peak average prices, with the West Midlands taking the top spot for regional annual price growth”

Hometrack “City house price growth is 6.4%, up from 4.9% at the end of 2016”

National Prices

I think this is probably one of the first years I can remember where we have seen a slowdown in housing market activity, yet we have not seen the normal ‘panic’ of house prices crashing in the media, bar the odd report. This hopefully suggests that there is a better understanding of the fact that housing markets tend to ‘ebb and flow’ over time and also because over 50% of people own their property outright, with 35% of those buying now cash buyers, so are less likely to be affected by what is going on in the wider economy. This is good news for the market as, in the past, news headlines could literally prevent people from buying so they could ‘wait and see’ what happened and that could cause a slump in its own right, whereas since the credit crunch, markets seem to move on whatever the stats tell us what is happening.

For more on property prices, download my comprehensive update.

However, this doesn’t mean the market isn’t going to be affected by what’s happening in the economy and politics over the coming months. Nationwide probably put this best: “In our view, household spending is likely to slow in the quarters ahead (along with the wider economy) as rising inflation increases the squeeze on household budgets. This, together with mounting housing affordability pressures, is likely to exert a drag on activity and house price growth in the quarters ahead.” Of course, all the indices mention the issue of poor stock levels, with the NAEA showing the lowest number of properties for sale since their records began in 2002. As a result, price growth is expected to slow, but not ‘collapse’.

For more, see our data on the various national price reports.

Source: UK HPI

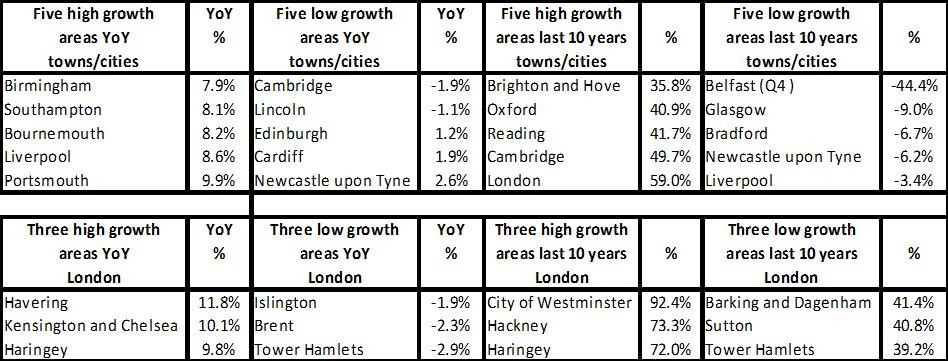

City house price growth seems to be topping the charts currently. Most indices talk about prices rising and reaching ‘record highs’ but this is on the back of growth which is much slower than it’s been for some time. The exception to this is the Hometrack’s City Index which actually reports quite robust activity in the regions. Since the credit crunch – a decade ago now – most of the regions outside of the South and East of England haven’t experienced great growth, particularly faster than the annual average. And although house price growth regionally isn’t seeing the double-digit growth we saw in London and parts of the Home Counties and beyond, rises are more similar to the long-term average growth of 7-8%. And there are still plenty of areas that are struggling to recover to the house price levels achieved a decade ago. The North East, Wales, Scotland and Northern Ireland are all still showing prices lower than they were prior to the credit crunch. And, although the likes of London and areas such as the East of England have seen their prices rise 30-60% since the last market high, it’s not a surprise that these areas are now seeing a ‘natural’ slowdown as affordability bites.

For more, see our comprehensive regional and city data.

Property demand and supply

With stock disappearing from the market fast, although this may continue to increase prices, it is really more stock that agents require. Many people seem to forget that a lack of stock is bad news for buyers, but in fact it is even worse news for agents. Unlike other industries, such as the car or health and beauty market, which if demand rises they can just produce more of what people want, agents on the other hand are in a fairly unique position in that they are restricted to ‘sell what they have’ instead and then often blamed for not having enough homes and profiteering from the situation.

Need to sell sharpish? Read our how to sell quickly guide.

A lack of stock moving forward is probably the biggest threat to agents and for those that want to survive and thrive, making sure that they are taking instruction for the little new build that is coming through is essential to have enough homes for sale. This is especially true as first time buyers are helping to drive the market, partly due to schemes such as Help to Buy. Not being involved in new build sales could limit agency growth in the future.

For more on property prices, download my comprehensive update.