LSL Acadata HPI “Annual growth for the North West in January was 3.8%.”

Source: UK HPI

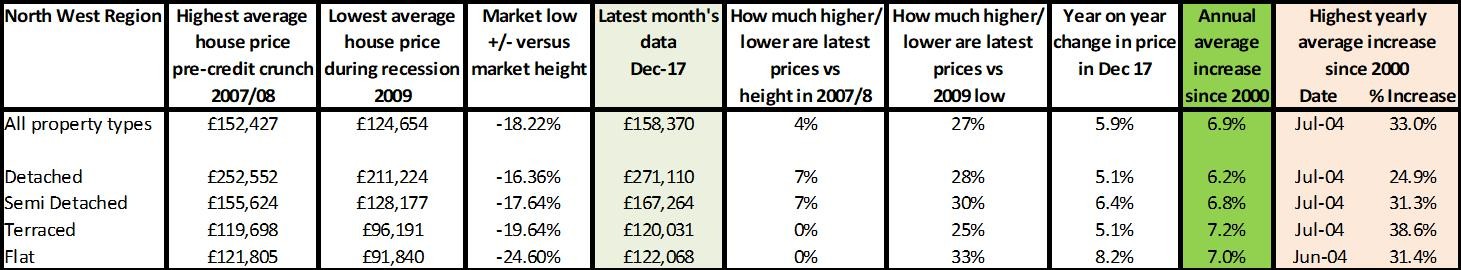

The figures for the North West tell a fascinating story which is not one we hear about much in the media. First the UK HPI stats show the vast difference between the falls in the prices for flats for example (25%) versus detached homes which only fell by 16%. As a result, for those who own a detached or semi property, prices are up 7% versus the heights achieved 10 years ago, while those in oversupplied two bed properties – and especially the overpriced and sold city centre flats – have seen no change at all. Having said that, for those who ‘timed’ the market right and bought at the low of 2009, good growth of 30% could have been achieved.

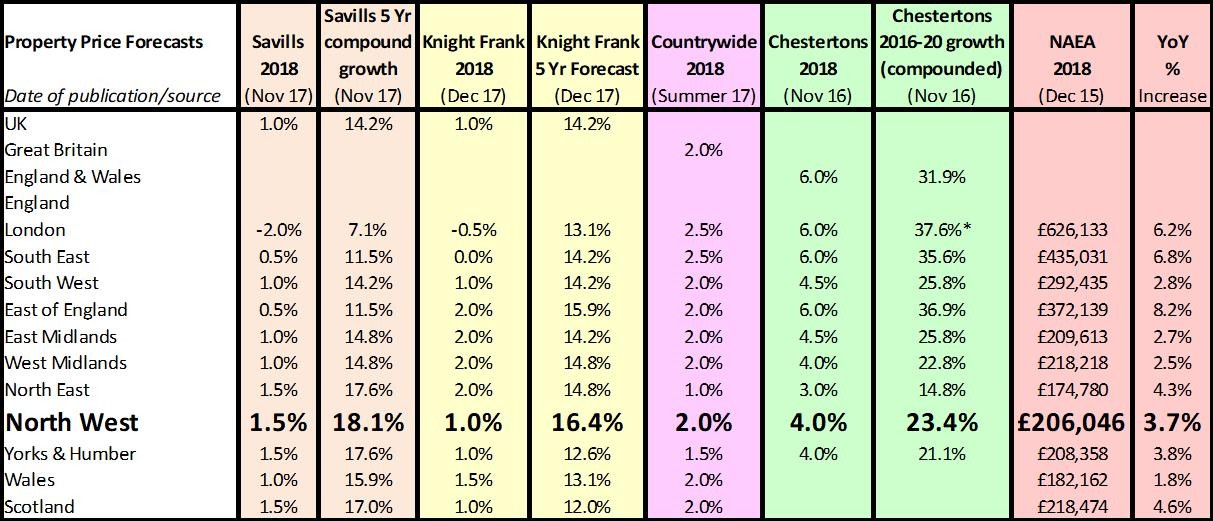

So historically, property prices have not performed that well since the crunch in the North West but the recent year on year price rises which match the long term annual growth since 2000, suggest that the area may well be about to recover. The question will be how far prices can rise and for how long. In other areas we’ve seen double-digit growth for several years and forecasters such as Hometrack suggest 20-30% rises are possible in this Northern Powerhouse over the next five years.

However, looking at historical data, it is unlikely that this growth will be applied to all property types in all areas, so buyers wanting to make money in the North West need to choose their investment carefully, especially bearing in mind property price growth is not keeping up with inflation by any means.

LSL Acadata HPI “The North West is up (3.8%) with Blackburn with Darwen up by 9.4% on the back of sales of detached houses, has seen the strongest growth anywhere other than Rutland, while the key population centres of Merseyside (up 8.2%) and Greater Manchester (2%) both recorded new peak average prices in the month.” (Jan 18)

Hometrack “House price growth for Birmingham, Manchester, Leicester and Liverpool grew by more than 6% per annum. Cities outside southern England have further room for house price growth. We do not expect growth to match the increase registered in London as the market dynamics are different but we expect house prices in regional cities such as Manchester to increase by 20% to 30%. This is based on our analysis of how the last housing cycle unfolded and adjusting for today’s policy environment. It assumes mortgage rates remain low by historic standards and the economy to continues to grow. At current growth rates this will take 3 to 4 years to feed through into house prices.” (Jan 18)

Source: UK HPI

This is definitely a region that is still affordable for the majority of people. With FTBs paying an average of less than £150,000, two people earning £20k each should be able to borrow £140,000 and save for a £10k deposit, especially with the government’s 25% top-up available. However, this doesn’t mean properties can’t be bought for less, with shared ownership available for as little as £31,000 depending on the location, shared ownership percentage and type of property, as well as plenty of new builds available under the Help to Buy Scheme. Here are some excellent shared ownership examples:

2 bed terraced house in Walton, Liverpool - £31,250 (25% share)

3 bed terraced house in Aintree - £37,750 (75% share)

2 bed semi-detached house in Cottam, Preston - £63,500 (50% share)

1 bed flat in Manchester - £65,000 (50% share)

2 bed semi-detached house in Openshaw, Manchester - £67,475 (50% share)

2 bed terraced house in Blackpool - £70,000 (50% share)

3 bed terraced house in Warrington - £80,000 (50% share)

2 bed semi-detached house in Etterby, Carlisle - £82,800 (60% share)

2 bed semi-detached house in Openshaw, Manchester - £101,212 (75% share)

2 bed flat in Reddish, Stockport - £105,000 (75% share)

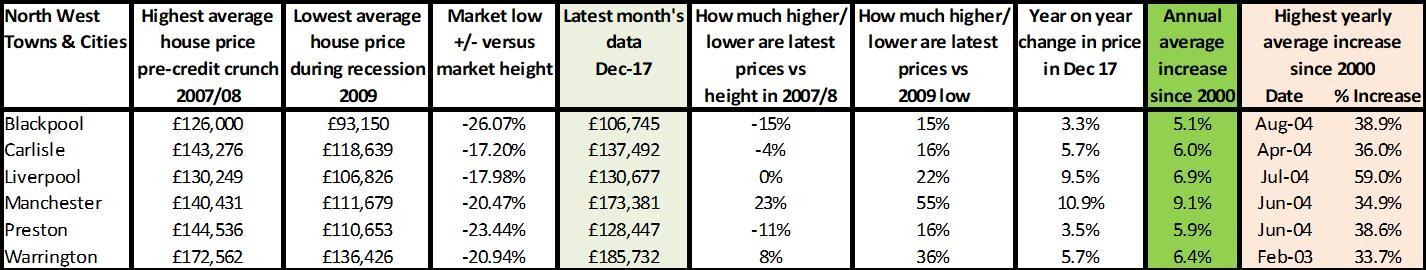

What the stats show though is how different areas are performing in the North West. Blackpool and Preston are up by just 3% year on year, but since 2007/8 prices are still 11-15% LESS than they were 10 years ago, making affordability, in theory, easier for first-time buyers and those keen to trade up the ladder. In contrast, prices in the major city of Manchester do appear to be peaking with prices being up by nearly 11% year on year and just one of the few cities to almost keep up with inflation over the last 10 years, although much of this growth has happened in the last few years.

The North West house price forecasts over the next five years are the strongest for the UK. Not only is the economy performing well, but affordability is such that people can afford to pay more for a property versus areas in the South. However, as stated earlier, understanding which areas and property types are going to do well isn’t an easy task and investors hoping to replicate the money they have made from down south are unlikely to see the same returns if they don’t do their due diligence.

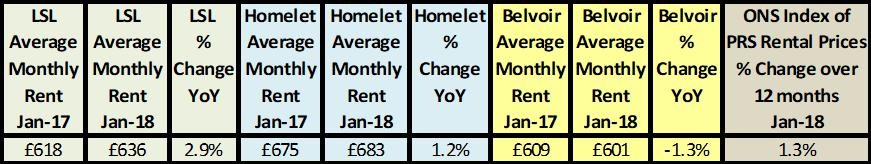

Although some indices are seeing inflationary rent rises, this isn’t happening in all areas, especially those which are seeing a glut of properties for rent and it’s clear that the government ONS data is showing that North West rents are not growing at the English average, which means rents are not, typically, keeping up with inflation. This is significant as if an investor is hoping rent will cover pensions, one of the first investment rules is to make sure income keeps up with inflation. In addition, with increased costs being passed on by the government to landlords, it may mean that profits could be squeezed further. For those that know the area well, it’s likely that there are some good opportunities; however, for those investing in the north who are used to property markets in the south, it may well be easy for them to become unstuck, especially if investing via so called ‘property gurus’ or ‘investment clubs’ rather than those that make money from managing successful lets and not from selling properties at a so-called ‘discount’.

For more, download our comprehensive North West regional property report.

| Renting a property - Property Checklists | First-time buyer quick guide - Property Checklists | Quick guide to buying and selling - SLC |

|

|

|