London report headlines

Rightmove “New seller numbers up and asking prices hit new record in spite of election.”

Halifax “London sees annual fall in house prices for first time since Q4 2012.”

LSL Acadata HPI “Strong growth in London prime property.”

Supply and demand for the London market

The data below comes from Agency Express and gives an indication over a three-month period of what’s happening to supply (new listings) and demand (properties sold over time).

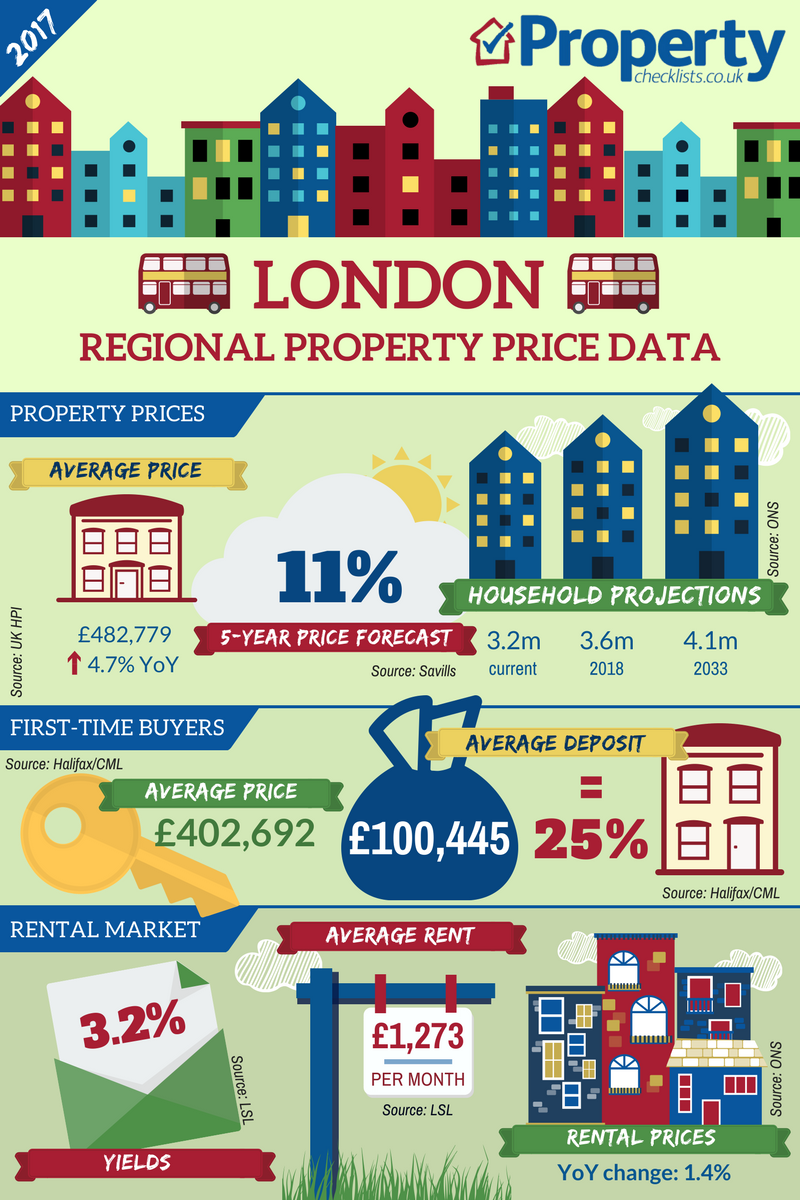

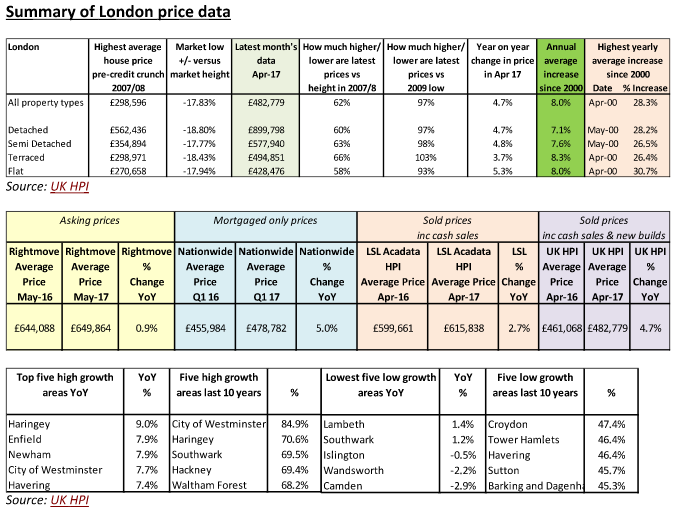

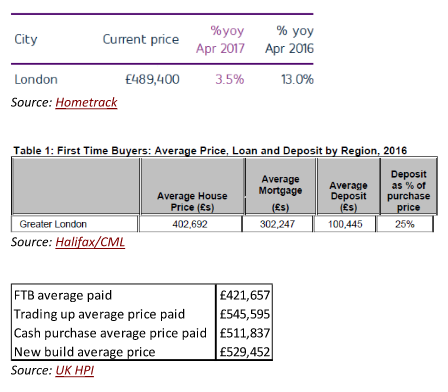

Looking at the first table on the UK HPI, it’s clear that price growth in London, for all properties, has slipped to 4-5%. That’s still a growth, but nearly half of the normal growth we have experienced of 7-8% on an annual basis since 2000. It is also interesting that the dizzy annual growth of 25-30% experienced in 2000 hasn’t been seen since, suggesting that overall, despite recent capital growth since the recession, for now London may well have seen the best property price growth for some 17 years.

Looking to buy for the first time? Read our FTB legals checklist.

This is due to affordability being limited by the amount people can borrow at 4.5x their income, coupled with the stricter rules from the Mortgage Market Review (repayment only and assessed on ‘long term’ not current rates). This could have done the trick at holding back prices in the Capital, which is good news for buyers, but not necessarily for sellers. In addition, Hometrack highlight another factor: “This steep deceleration in growth reflects weaker levels of demand from home owners and investors in the face of affordability constraints, tax changes and weaker market sentiment.”

As ever, performance is regional – even in London – with some areas hardly growing at all year on year and some, such as Wandsworth, even falling, while Haringey is still shooting up nearly 10% versus last year. Longer term, over the last five years, typically poorer areas such as Croydon and Barking and Dagenham have seen some great growth, but two thirds that of richer areas such as City of Westminster.

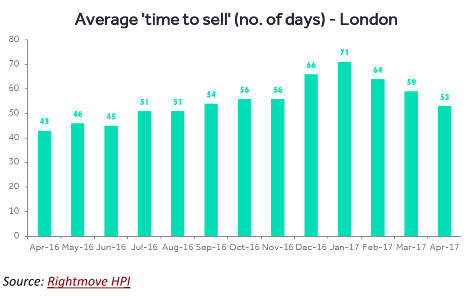

Looking at things from a sales volume perspective, it looks like those properties that do make it to the market are selling as fast as they did last year, in the main. However, it’s clear that demand has dropped substantially versus the previous years which saw a big recovery from the recession in the market. Since 2013, the number of properties selling in February has been around 8,000, but this February saw a dramatic drop to just under 6,000, a fall in sales of around a quarter. As Hometrack point out, this could be the fall in second home/investment sales on top of the affordability issues and pent-up demand following the recession.

Need sell quickly? Read our selling to a cash buyer checklist.

We will have to wait, probably until the end of the year or early next year, to see if the lower demand is permanent or just the market having a breather following rapid activity.

What is the future for London Prices 2017 and beyond?

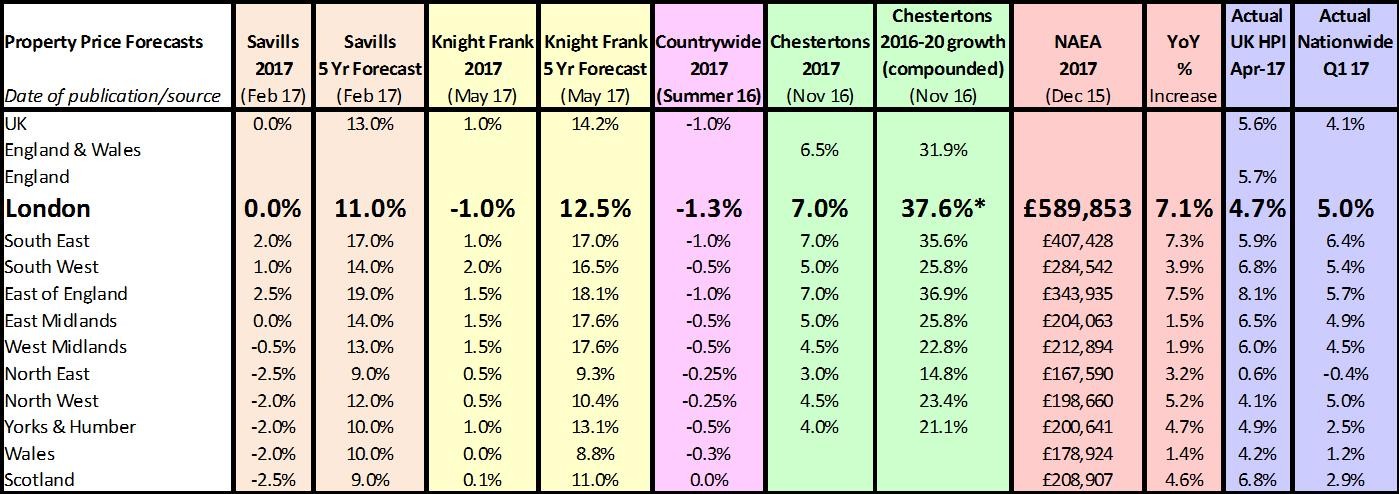

*Compounded

Typically, London has outperformed all other regions since we’ve had access to online stats dating back to 1995. However, now you can see that the majority of forecasters are suggesting that London could see some of the slowest growth across the country. Growth of 11-12.5% predicted by Savills and Knight Frank suggest that property, for the first time, will not grow in excess of inflation, meaning wages have a chance to catch up with house price growth, potentially improving affordability for those who wish to buy. This, coupled with more shared ownership and new initiatives such as starter homes and the generous Help to Buy schemes may well help more on the ladder in the region in the coming years. For those who bought at the start of the slump, it may mean hanging onto the property longer than five years to achieve sufficient price growth to afford the next move, especially as the levels of stamp duty owed on property is still very high for London buyers.