First-time buyer activity buoyant!

What are the indices saying about first-time buyers?

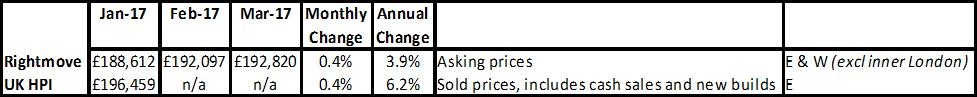

Here's what the various property price indices are saying about first-time buyers but remember national average prices are often misleading.

NAEA Propertymark “Sales to first-time-buyers dipped in February”

Connells Group “First-time buyers surge as lull in landlord purchases kicks in”

Halifax “Home ownership has sailed for one in four young brits”

Average price paid for first-time buyer properties

Proportion of FTBs are on the rise in general

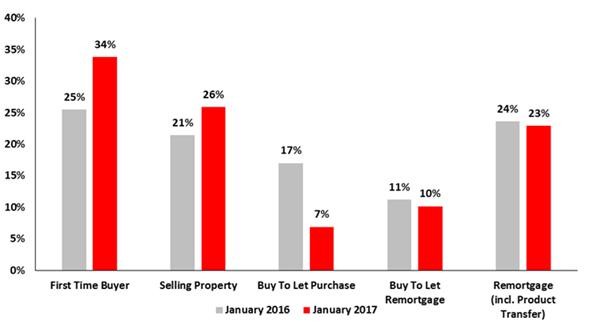

Connells Group “In the first month of 2017, first-time buyer valuations rose by a fifth year-on-year (21%), driven by high employment and an uplift in weekly earnings. This has increased the importance of first-time buyers to the overall housing market, with first-time buyers now responsible for a third of activity (34%), up from a quarter at the start of 2016 (25%).”

NAEA Propertymark “The proportion of sales made to FTBs fell to 22 per cent in February. In January, almost a third (30 per cent) of sales were made to FTBs, a fall from December when the number of sales made to the group reached a high of 32 per cent.”

For more download my comprehensive first-time buyer report.

YoY Change in proportion of Valuation Activity by Customer Type January 2017

Source: Connells

It’s clear that first time buyer activity is buoyant in the market place, despite the ‘average’ increase in property prices shown by the indices, and the Connells data shows it’s seen a much higher increase in FTBs than any other buyers, particularly when you compare to buy to let, although this fall is to be expected bearing in mind the huge Q1 2016 volumes we saw when landlords were trying to beat the stamp duty hike.

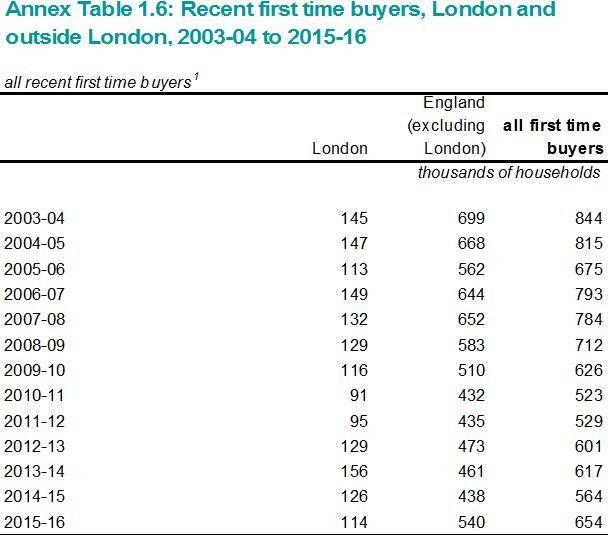

Number of first time buyers and their age

There is a vast difference between the actual data and the reports that are often released by PR companies to campaign and gain footage in the media.

For example, two complete myths which can be exploded are, firstly, the falls in numbers of first time buyers. When you look at the English Housing Survey data below, the biggest year so far in ‘recent first time buyers’ ie the numbers that have bought in the last three years, saw its biggest levels in 2013/14, 2003/4 were similar, but not as high. This is likely to be due to the ‘post recession’ bounce after 50% of first time buyers had rightly left the market during the credit crunch when property prices had fallen so much.

Looking to buy for the first time this year? Download our FTB eBook.

Source: DCLG – English Housing Survey 2015-16 Headline Report

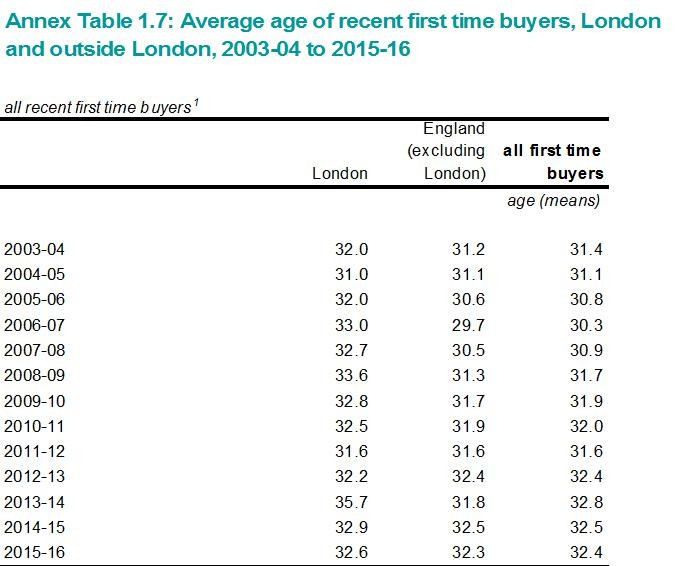

Secondly, when it comes to the ‘average age’ of a first time buyer you have to ask ‘what is all the fuss about’? The data below clearly shows that the average age of a first time buyer today is hardly any more than it was in 2003 – that’s 14 years ago now.

The rise in the average age during the credit crunch was to be expected, not press released as some sort of disaster. If you have a recession and prices are falling, why on earth would people want to buy their first home? Now the recession is over, for those in London for example, the average age as I predicted, has come back down again. None of this was ever rocket science but it does go to prove that when we look at property data and particularly first time buyer information we tend to only read negatives into it.

This wouldn’t be an issue if it wasn’t for the fact that people buy when they are confident to do so and save when they think it’s worthwhile. If they are constantly told that they ‘will never be able to afford a property’ – whether true or not – why would anyone bother to look and save for a deposit in the first place?

Looking to buy for the first time this year? Download our FTB eBook.

Source: DCLG – English Housing Survey 2015-16 Headline Report

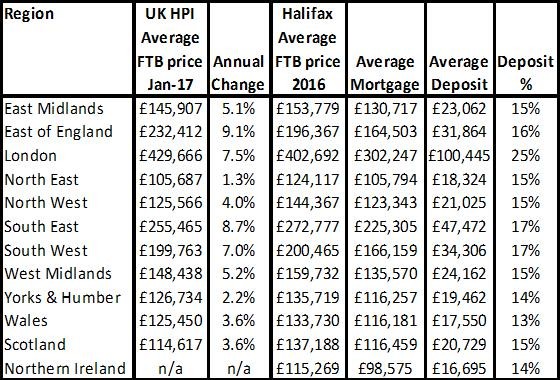

First-time buyers regional prices

Regionally, the data from Halifax shows some fascinating information. The biggest deposits appear to being put down in the most expensive areas, with the likes of Wales, one of the cheapest having deposit levels at almost half that of London (13% vs 25%), and of course this level of deposit is almost 3x that that’s actually needed, especially if FTBs are accessing through the Help to Buy equity loan scheme. This data alone rather than just taken and used to explain why everyone should never bother to save to get on the ladder, should actually spark a national investigation into why on earth FTBs are putting down 3x the deposit levels they actually require – is it an affordability issue or is it just because they can get help from mum and dad now who have gained from previous market growth and are taking advantage of the support to lower their mortgage rates?

First time buyer affordability attitude versus reality

With consistently negative headlines which constantly instil doom and gloom in anyone wishing to buy a new home, it’s not a surprise that a recent first time buyer report from Halifax revealed:

“Almost half (48%) of young Brits think it’s harder than ever to get on the property ladder, with one in 10 prepared to leave the UK in order to buy their own home.”

And a recent report by Post Office Money suggested that “four young singletons (25 per cent) feel it will be impossible to buy their own home without a partner” and “of home owning young couples (aged 18-34), 27 per cent feel they would have only have been able to buy a home together.”

These views are prevalent despite the fact that for some areas of the country, property prices are lower than they were 10 years ago and mortgage rates have pretty much fallen through the floor, and that the reality of FTBs in Halifax’s own analysis always shows what’s actually happening is something completely different:-

“Despite the number of first-time buyers reaching a 10-year high of 339,0001 in 2016, half of 18-34-year-olds don’t think home ownership is a realistic option for their generation – with two thirds (65%) saying they don’t earn enough to afford it.”

The research goes on to say ”the attitudes of young people who don’t own a property, [reveals] that a quarter of 18-34-year-olds think the only way they’ll manage is by inheriting the cash".

Yet as Halifax point out, those that have a positive attitude to buying home can still get on the ladder due to finance being so cheap. “There are still ways for people determined to get on to the first rung of the ladder, as many lenders offer mortgages for first-time buyers with deposits of 5%. This could reduce the amount needed to nail the necessary deposit, and longer mortgage terms help make monthly payments more manageable. In 2016, 28% of all first-time buyers with a mortgage chose a 30 to 35-year term, up from 11% in the past decade.”

Looking at the actual numbers and the research, it’s clear in my mind there is a complete discrepancy between what is actually happening in the market and the attitude of first time buyers that haven’t made it onto the ladder yet.

The media need to be aware of this discrepancy when they report on first time buyer affordability because if they don’t, unnecessary doom and gloom headlines will drive 20 somethings into not buying rather than researching their own area carefully and finding out how they can access the market, for example through Help to Buy and Shared Equity.

What would be great to see this year when we have a relatively ‘quiet’ market is a wealth of reports on how people can get on the ladder if they want – bearing in mind nearly 350,000 did in 2016, it’s clearly possible to do so.