I was really disappointed to read news last week that the average deposit put down by first-time buyers is over £50,000 – and could rise by 57% by 2027.

In my view this kind of headline is incredibly destructive; these figures are not only alarmist but hugely misleading and potentially damaging to the property market.

What concerns me is that this sort of news can actually deter young people from trying to get on the property ladder, because it makes them believe – wrongly in many cases – it is out of reach.

The shocking figures come from L&C Mortgages, who warn that the average first-time buyer deposit could rise to over £65k in five years, and rocket to £81k in 10 years. In London, they predict an even worse situation; average deposits of almost £250,000 by 2027.

I feel like a stuck record but I cannot stress enough that averages – whether referring to deposits or prices – are next to useless when it comes to your particular circumstances.

The property market is now so diverse that it varies from town to town, street to street, and even, in some cases, from house to house on the same road. And wherever you go in the country, there will always be areas – or houses – which buck the trend.

I call this the ‘Malteser Market’ as it’s made up of thousands of tiny bubbles.

Let’s look at the facts:

How was the L&C data calculated?

Figures shown on this map are based on research carried out by Opinium Research, which used data from the Office for National Statistics (ONS) House Price Index to work out the average purchase prices and mortgage advances given to first-time buyers in the UK’s 17 key cities over the past 20 years.

Deposits were calculated by deducting the average purchase price in each city from the average mortgage advance in that area.

Opinium forecast future house price growth based on how prices have risen over the past 20 years

The data was at least based on what prices first-time buyers actually paid, but it’s taken 17 cities, including London, so is already skewed in my view as they are typically 3x higher than anywhere else.

Even ‘average’ first-time buyer property prices skew the figures. For example, L&C quote £139,987 as the average deposit paid by first-time buyers in London. This amount would buy a house or flat in many areas of the country outright.

For example, in Nottingham you can buy a property for £70,000, with a deposit as low as £3,500 (assuming 5%).

In fact, in six of the 12 UK regions, buyers spend less than £150,000 on their first home (source: Halifax) so it stands to reason that deposits of £50,000 are absolutely not needed. A first-time buyer can purchase a property with a deposit of 5%, although better mortgage rates may be accessed with a bigger deposit.

There are even opportunities in London where you can get on the ladder for as little as £120,000 via shared ownership – that could be a deposit of just £7,500, here is one we have previously highlighted.

It’s important to note that deposits recorded are not what people have to put down, but what people can afford. Crucially, these are higher than in the past as many parents are now in a position to help out, in some cases because they have inherited paid-off properties themselves from other family members.

And putting down a larger deposit makes perfect sense if you can, as it reduces your monthly outgoings. But putting off buying while you save up could be counter-productive, as prices may rise in the meantime, and you could lose the home of your dreams.

The data timings – the last 20 years – are poorly chosen, too from my perspective and the forecast is skewed. If they had taken the last 10 years, 58% of wards across the country are lower, taking into consideration inflation (based on BBC analysis). And, if they had taken actual forecasts from the likes of Savills etc, they would not have come up with these figures because the next five years are expected to see a much lower rate of house price inflation than we have seen in the past.

As such, I don’t believe the figures L&C have used are reflective are what is likely to happen in the market place.

I do agree that their message of "regular saving" is key

In this release, David Hollingworth, of L&C, says: “Pulling together a deposit continues to represent one of the single biggest challenges and these forecasts will make frightening reading for aspiring first-time buyers. As a result the Bank of Mum and Dad will no doubt continue to play an important role for those attempting to get on the ladder. Parental and family assistance will often help to build a deposit but can also see them providing a guarantee or additional collateral, to secure the mortgage needed.”

“Although improvements to supply of the right type of housing will be required, it is clear that from a practical point of view first-time buyers will need to try to make regular savings as early as possible.”

The problem is, many 20-somethings won’t read this bit, but will see the headline and stats and believe they have no chance of buying a home without parental help. All in all, the idea of saving will be lost – as will potential customers.

Lets be positive and help first-time buyers - what help is available?

So what can first-time buyers do if they feel stuck in a rental trap? Fortunately there are lots of options out there to encourage people to save, and reward them for doing so.

These include:

No stamp duty under £300,000 for first-time buyers

Help to Buy ISA or Lifetime ISA, where the government will top up savings by 25%

Help to Buy 20% (40% in London) free equity loan

| First-time buyer quick guide - Property Checklists | First-time buyer eBook |

|

|

And of course, sacrifices may need to be made – but it’s surprising how quickly savings can mount up. Download our deposit savings calculator to see where you can make savings.

If you have a plan, it IS possible to buy your first home, so don’t get put off by ridiculously scary headlines!

And let’s not forget, for those who are renting, it’s easy to think that it’s ‘dead money’ and you should be a homeowner, but owning does have its downsides; and you can often rent a property much more cheaply than you can buy – although you do miss out on any capital growth.

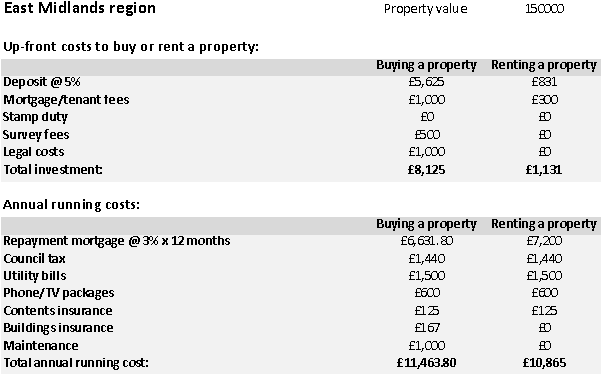

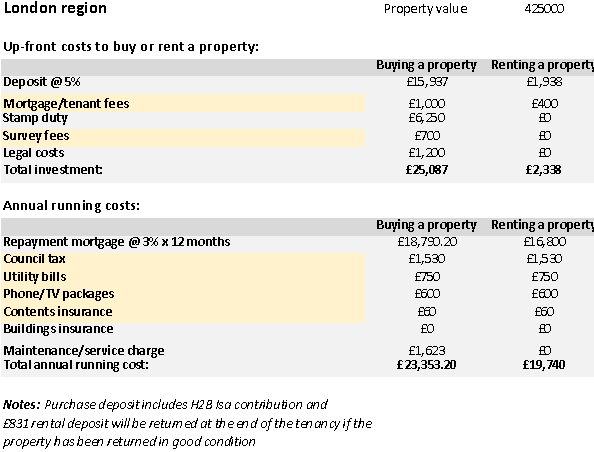

Here’s a like-for-like comparison in the East Midlands and in London; as you can see it’s typically cheaper to rent: