There have been some recent features in the media about first-time buyers finding it impossible to get the property ladder. You'll have seen six-figure numbers quoted as being necessary for a deposit as well as the supposed astronomical average house prices around the country.

However, is this really the case? And if not, what’s the correct story?

You can listen to me discussing these issues on last Friday's 5 Live drive (about 20 minutes in) and read my thoughts below:

What’s actually going on?

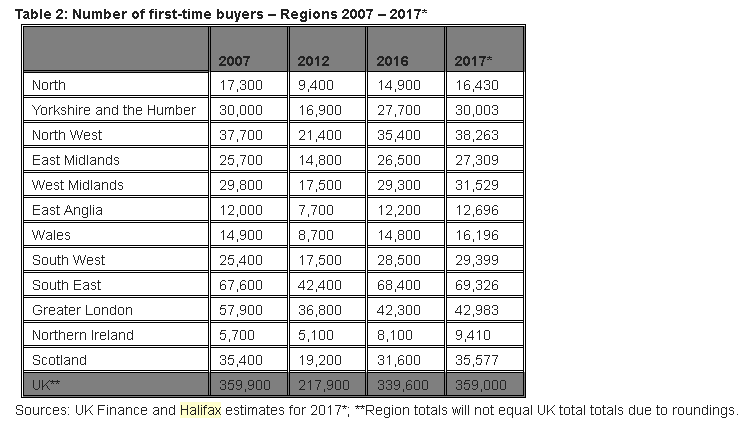

The reality is quite different to the oft-peddled media narrative. In fact there were 359,000 first-time buyers in 2017, an increase for the sixth consecutive year and more first-time buyers than in 2006.

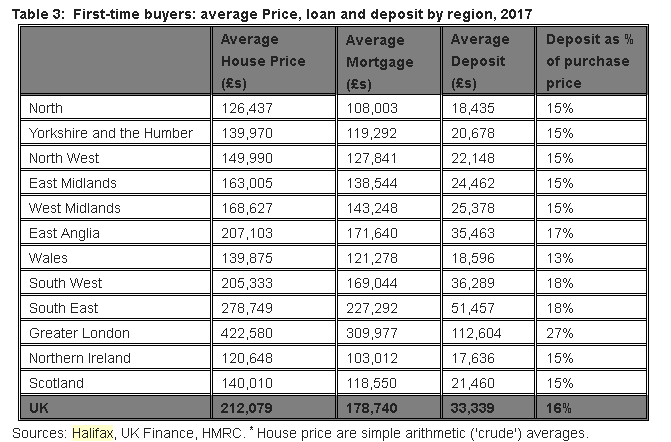

And FTBs are actually putting down higher levels of deposits than they have in the past - with average deposits doubling from £17,740 to £33,339 in past decade, according to Halifax. It’s always assumed that this is what FTBs have to put down but in my view it’s what they can put down - due to help from parents.

Secondly, I find that the average country data quoted always skews what’s happening regionally. What’s clear from the data below is that even in areas like the North East, where property prices have hardly moved for a decade, or are still lower than they were 10 years ago, there has still been a fall in the number of first-time buyers.

This clearly indicates that affordability is not necessarily the ONLY reason people are choosing not to take that first step on the property ladder.

Why are average price statistics so misleading?

Let's take the example of Greater London vs the North. In London the average house price is £422,600 with an average deposit of £112,000, whereas in the North the average price is £126,500 and deposit £18,500.

Despite higher wages in the Capital, affordability is clearly much more of an issue than in the North of England but someone just looking at the national averages wouldn't necessarily appreciate that.

And even then affordability problems are exaggerated. I found a Shared Ownership property at £100,000 for a 40% share of a 2 bed flat in N18, Edmonton. Londoners can also search in Peterborough, currently a 50-minute commute away from Kings Cross, expected to fall to under 40 minutes, where there were 61 results for properties UNDER £70,000.

Looking in the “North”, there were 364 results under £70,000, many 2-3 bed properties, even though the average price quoted for first-time buyers is £126,500. That’s almost double what they actually need to spend.

The problem is averages can been misleading when it comes to what’s happening at street level, let alone the regional or national market. In 2016, I wrote a piece explaining house prices can vary massively even on the same road – on one street in Peterborough, admittedly a main road, a particular property was marketed at £850,000 while another was up for sale at £90,000.

What should people do if they think they can’t afford to buy their first home?

The key takeaway from this for FTBs is not to be put off by average price figures as they often don't mean much to individual buyers.

Instead consider:

Do you have to live in the area that you work/grew up in, could you move somewhere cheaper?

Look at sold property prices rather than just asking prices

Talk to a mortgage broker to find out what you are able to borrow and don’t forget there are schemes like Help to Buy ISA/Lifetime ISAs which the government will top up your deposit by 25%

Talk to local experts and take advantage of government schemes such as Help to Buy and shared ownerhip

Make sure you really know whether you can’t afford to buy, don’t believe or trust the ‘average figures’ or the media – don’t forget they want to sell headlines, not houses!

| First-time buyer quick guide - Property Checklists |

|