Are prices in the East of England growing or slowing?

Nationwide “All regions saw house price growth in 2016, with East Anglia topping the table for the first time since 2010, with average prices up 10.1% year-on-year.”

LSL Acadata HPI “East of England is top performing region in terms of prices, up 5.9%.”

Source: UK HPI

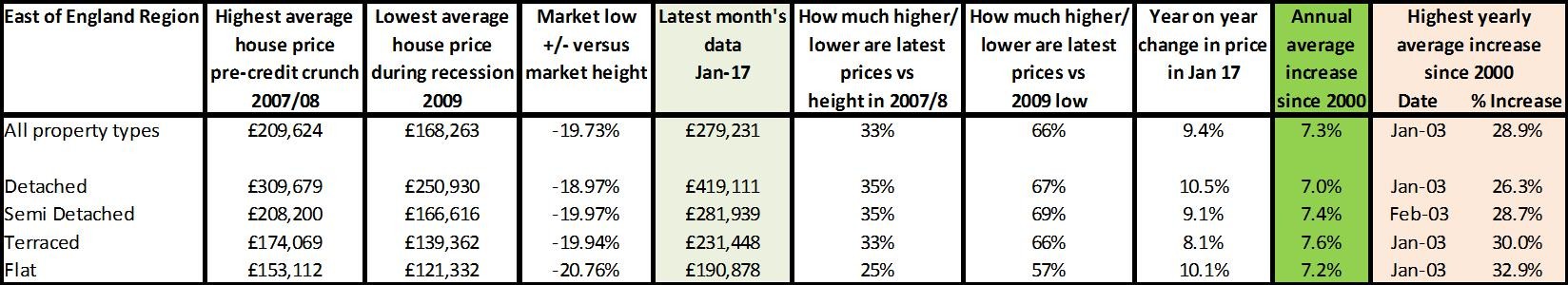

The average house price in the East of England ranges from £279,231 (HPI price paid) to over £326,000 (Rightmove, asking prices) and, at the moment, prices are rising at a faster rate than they have annually since 2000 - with detached homes and flats rising by double figures. Looking at the data, those who bought property at the height of the market should be fine to move on as prices have recovered in the main and, for those who were lucky enough to ‘time their market entry’, they should be pretty pleased as since 2009 the growth in house prices is double that of those who bought prior to the crash. Flats appear to be excellent value for money versus houses, being sub £200,000 and, with parts of East of England commutable to London within an hour or so, it’s a viable place to own a home while working in the capital.

LSL Acadata HPI “Despite a slow down, with prices up just 0.1% over the month, the East of England continues to top the table for annual growth, up 5.9%. The London commuter hotspots of Luton (growing 10.4% in the last year) and Essex (6%) both set new peak prices in the month.”

(Feb 17)

Hometrack “Cambridge and Oxford have recorded strong price gains of >75% which have resulted in record high price to earnings ratios in these cities.” (Jan 17)

Source: UK HPI

The areas in East of England have performed very differently since the credit crunch. For anyone trying to live in Cambridge, it’s not just prices and rents that are tough to afford due to the huge economic and academic success of this area and the lack of building, it’s the sheer fact that there are far more people who want to live there versus the number - and quality - of homes available. All this is set to change over the coming years with areas such as Trumpington being built near the hospital and also new towns such as Cambourne being created. For those keen to find out what is coming up in the area, it’s worth investigating the plans for the Cambridge-Milton Keynes-Oxford Corridor as there is hope for vast numbers of new homes planned to be built in the area and improvements in transport over the coming years. For first-time buyers, although Cambridge may be out of your reach, other areas can be quite good value, especially when you look at the likes of Norwich and Peterborough. Properties can still be - and are - being bought sub £200,000 and in areas such as Peterborough, entry level properties can be accessed near the station for under the £125,000 stamp duty limit, including three-bed terraced homes. There are also opportunities for shared ownership properties. Bearing in mind that currently Peterborough is just 45 minutes from Kings Cross and you will soon be able to reach there from under 40 minutes, it’s commutable to London, without the normal price tag.

Looking for your first home? Read our FTB quick guide.

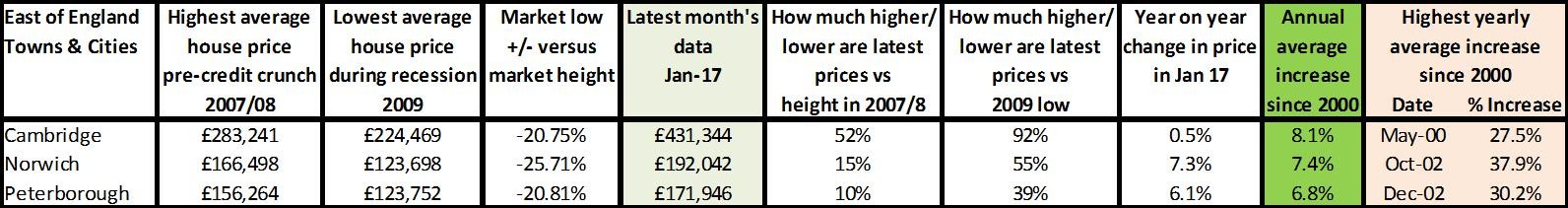

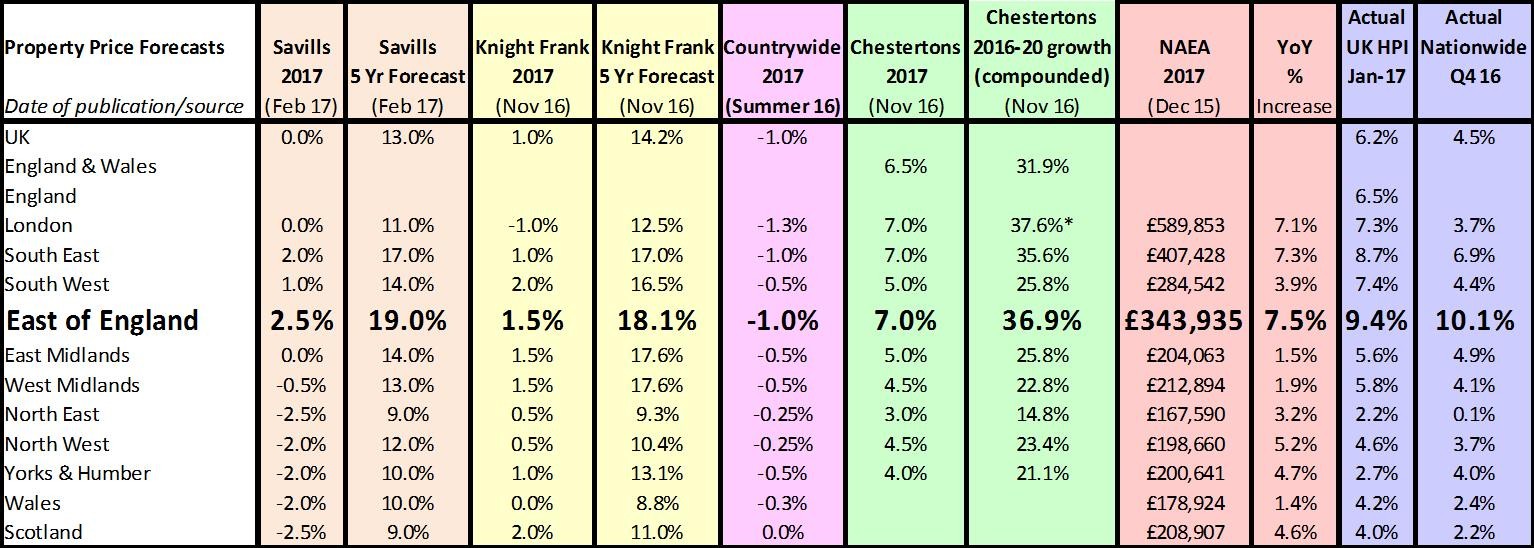

East of England price forecasts

Moving forward, the region is expected to grow, potentially even faster than London, with Savills forecasting a 19% increase in prices versus 11% in London over the next five years, although this has never really happened before, so we’ll have to wait and see if London truly is slowing. Also, it is likely that growth will be mixed. Many areas such as Norwich, Ipswich and Peterborough do have the space to build homes and, with the government’s current big push to build, these areas are also likely to be attractive to Build to Rent schemes - with good rental income possibilities as they build/let new properties in bulk as opposed to landlords just buying and letting one or two buy to lets. As such, not only may this area prove to be accessible to those considering moving out of London, but the wealth they can bring may also help to drive prices upwards, perhaps even helping some make the move longer term back to London as their equity grows.

Renting in the East of England

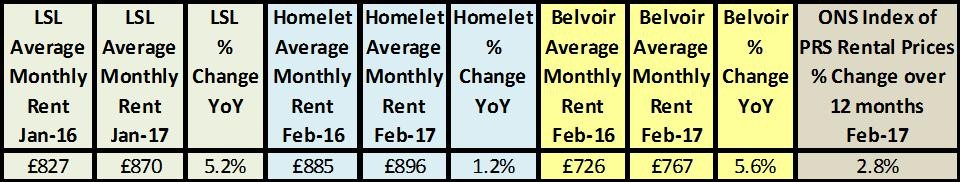

LSL “The East of England was home to the fastest rising rents in the last year. Prices in this area increased by 6.9% in the year to January 2017 and now stand at £870 per month. This region also saw the fastest growth month-on-month with rents ticking up 0.7% between December and January”. (Jan 17)

For more rent stats visit our comprehensive data page.

Looking to rent? Read our how to rent quick guide.

Rents are strong in this neck of the woods, at £750-£900 per month, while other areas ‘north’ of here are charging around £500-£600. That means that anyone in this sector has to find £10,000, net of tax, to pay for a roof over their head; virtually impossible on a minimum wage. This potentially makes it easier for youngsters who can to stay at home with mum and dad and save for a deposit via a Lifetime ISA or to rent rooms rather than whole homes to keep costs down. For those with families, though, access to social homes is important for the future, as is potentially finding long-term landlords who want to support those who haven’t always had life easy. In the likes of Cambridge, this is definitely an area where vulnerable tenants need to be better looked after to make sure they aren’t living in sub-standard homes.

For more, download our in-depth analysis of property in the East of England.