Financial pressures on young people are at the centre of the fall in home ownership, according to the first major review into home ownership in more than 10 years.

Led by Peter Redfern, chief executive of Taylor Wimpey, The Redfern review was commissioned by John Healey MP, when he was Shadow Secretary of State for Housing, and looked at home ownership and the housing market.

The review suggests a long-term, non-partisan approach to tackling housing problems, including the creation of an independent Housing Commission, a review of Help to Buy and a focus on maintaining a healthy private rented sector.

These are some of the key findings of the report:

Causes of the decline in home ownership

The most notable factor after the crash was the higher cost of and restrictions to mortgage lending to first-time buyers. It is estimated that this led to a 3.8% drop in the home ownership rate between 2002 and 2014.

The major factor behind the fall in home ownership before the crash was the swift increase in house prices. Private home ownership is estimated to have fallen by 2.6% between 2002 and 2014 due to higher real house prices.

The other key factor leading to lower home rates ownership is the continued fall in income for younger people aged 28-40, compared to those aged 40-65. Before the financial crisis, the two groups had a similar average income, but afterwards a 10% gap developed. This reduced the buying power of potential first-time buyers, resulting in a 1.4% drop in the home ownership rate.

A word of warning

Policy changes, discussed below, would mitigate some of the impact outlined above.

If current trends, such as the widening income gap between young and old, are allowed to continue the impact won’t just be on home ownership, but also private renting and social housing.

A significant increase in supply won’t necessarily increase the home ownership rate.

How can home ownership rates be increased?

Challenge relative wage rates

Challenge mortgage lending standards

Provide subsidies to certain groups

Wider conclusions

House prices do not necessarily correlate with the availability of housing.

An increase in new supply does not magically improve the rate of home ownership.

We need decades of consistent improvement in property supply.

It is possible to improve supply where it’s needed but this require a long-term, principled approach and policy decisions should reflect that.

Potential policy options

Help to Buy should be targeted more exclusively at first-time buyers.

The government’s planned Starter Homes scheme should proceed but only on exception sites, where an exception has been made to normal planning rules.

First-time buyer discounts should be retained for the foreseeable future.

A strong private rented sector is also important so rental conditions should be improved for tenants but we should avoid increasing landlord costs unnecessarily.

More support should be provided to schemes that promote saving for young people such as the Lifetime ISA.

The ‘one for one’ replacement policy for Right to Buy needs extending in order to ensure that every council home sold via the scheme is replaced, not just some of them.

Kate's view

In the main, the conclusions are pretty fair. The surprise to me is really that most of this happened under Labour itself and the policies being supported by them are Conservative ones.

However, that is a good breath of fresh air as Help to Buy was very heavily criticised by many pundits, yet has proved to be successful in my view for several reasons:

It ‘turned’ the market by getting people who weren’t even thinking of buying to do so.

The scheme has given developers the confidence to build and keep on building even when we’ve had market wobbles as experienced following the Brexit vote.

It encourages younger people to buy new. This is of major importance as in the past, people have tended to prefer and compete the price upward of the limited supply of the likes of Victorian homes, which aren’t necessarily good value for money, especially from a running cost perspective.

The report says Help to Buy should be more geared towards first-time buyers but the stats suggest these are the people who are taking it up anyway.

Want to know more about Help to Buy? Read our Help to Buy checklist.

Latest stats from the government show that 81% of the sales were to first-time buyers and if it helped some people to trade up to new builds, that is good news as it releases other stock for people to buy.

The two things that I think influence the decline in home ownership which are not being recognised, or investigated enough, are:

First-time buyers were scared stiff – rightly so – of buying when property prices were crashing around their ears and, in some areas, have yet to recover.

Renting is a popular and in many expensive areas a cheaper way to put a roof over people’s heads; the reports that say buying is cheaper assume people have a large deposit to put down. If they did, they would be buying in the first place!

And a recent report from the Council of Mortgage Lenders suggest that far more people are satisfying their desire to buy than is being reported. Their latest research suggests that:

“There continues to be a strong bedrock desire for home-ownership across all age groups- 72% of adults want to be home-owners in two years’ time and 80% hope to be so in 10 years’ time.”

While 72% of people want to buy a property, the proportion of people actually doing so is 62%, but this is only slightly lower and it’s not unusual for aspirations not to be quite met.

The CML also conclude that “amongst those who are not already home-owners, the longer-term appetite for home-ownership appears to have abated since 2010”.

Download their report which analyses and compares the different government schemes that can help people own their own home and their report on home ownership.

We need an overarching housing policy that allows people access to social homes, renting privately from large and small landlords and the option to buy. But until MPs and lobbying groups accept that the private rented sector is a good alternative to owning a home – especially for students, migrant workers, divorcees and transient workers across the UK – and that many people who rent (15% estimated by Rightmove) are actually home owners as well, then we will continue to have housing issues in the UK for the next 30 years, caused by poor policies in the last 30.

Prefer to rent? Read our how to rent checklist.

How are first-time buyers doing in the market currently?

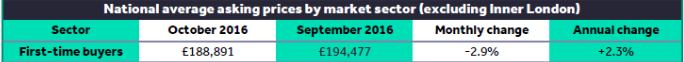

Source: Rightmove HPI

Ignore the cost of an average first-time buyer property from Rightmove being £194,477; this is always going to be higher than reality due to it being based on asking, not accepted, prices. What is interesting – and potentially very good news for first-time buyers – is that property price inflation for them first seems to be waning with a fall month on month, but also that rises year on year are, for the first time in a while, actually lower than wage rises. On average, according to the ONS, wages are up 2.9% year on year, while annual costs here are just 2.3%. Better still, with mortgage costs falling, this means that the rise can pretty much be mitigated by reductions in mortgage payments versus take-home pay. All in all, the picture looks pretty rosy at the moment for those wanting to get on the ladder.

Worried about the legals of buying? Read our first time buyer legals checklist.

Regional prices for first-time buyers

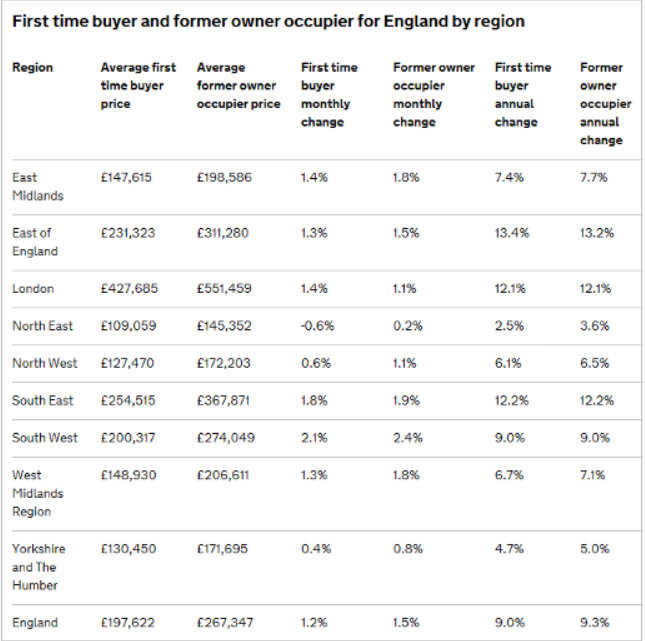

Source: UK HPI

As you can see with the data from the UKHPI which measures actual prices paid, rather than asking prices, the cost of buying a home for first-time buyers is, in the main, a lot less around the country with just prices in the South West, East and London being higher than £200,000. Some areas allow you onto the ladder at half of this cost. And don’t forget these are ‘average prices’ paid. So, for example, in the East Midlands although the average paid by first-time buyers is £147,615, I know that in Nottingham you can buy two-bed terraces for £60-80,000 and newly built flats in the city centre for around £100,000. What these figures do show is that in most areas, first-time buyers are paying way less than £150,000 for a property which, with a 5% deposit, that means finding £7,500 or, if there are two of you, just under £4k to buy a property – way below the levels that are often sensationalised in the press.

For more on first time buyers, download our FREE first time buyer eBook.

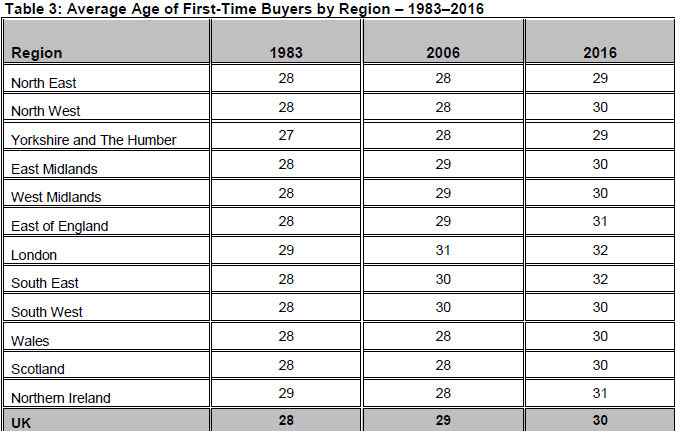

Average age of first-time buyers

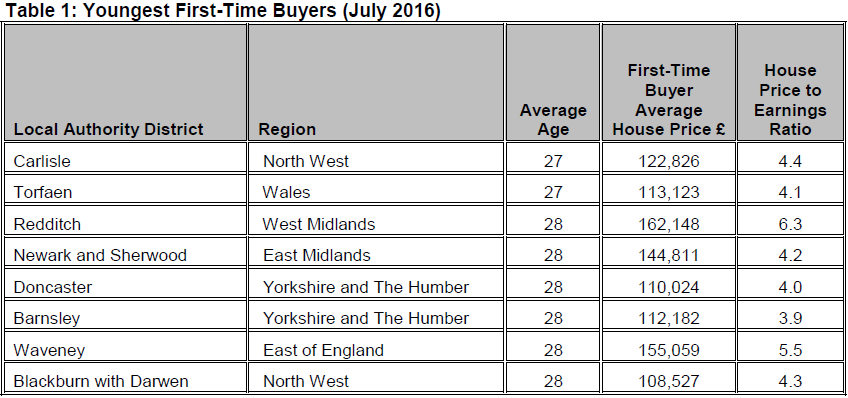

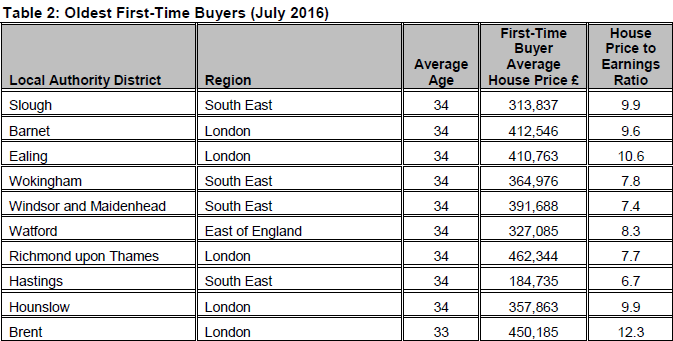

The tables below showing the average age of first-time buyers and average house price to earning ratios are fascinating. Again, they show that using national averages to talk about affordability is a poor way to analyse and report on markets to the public. Basically what these stats show is that it is easy to scare the living daylights out of potential first-time buyers, but the reality for many areas outside London and the South is that people are buying at the ‘old average’ age of 27-28 apart from regions where stock is so tight versus demand.

I also believe that the average age of first-time buyers will reduce down overtime. The reason being is that many FTBs chose not to buy following the recession in 2007 so naturally the average age went up and, until we have seen property prices recover back to their normal levels everywhere across the country, of course the average age will have gone up as why would FTBs bother to buy in areas where property prices were dropping from 2007 to 2013?

Buying your first home? Read our FTB quick guide.

Source: Halifax