The latest picture from the Land Registry for Nottingham city especially looks pretty good!

So far, Nottingham has really lagged behind the rest of the country and indeed the rest of the East Midlands in terms of catching up on falls seen since the credit crunch.

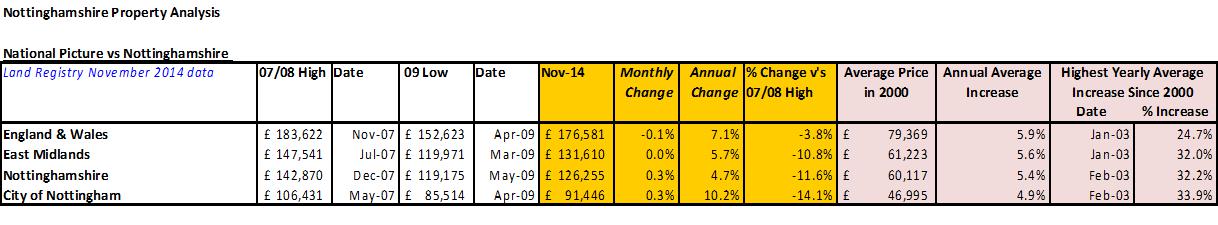

But as the chart below shows, prices ‘shot up’ in November in our City Centre by over 10% in November 2014, double the growth we saw in the East Midlands and in Nottinghamshire as a whole. This growth even beat the national average increase of 7.1% which is virtually unheard of as it includes London which during the same timeframe actually grew by over 17% year on year in comparison.

But, it’s important to remember, this isn’t necessarily ‘an increase’. For anyone who bought a property in the region prior to 2007 heights, it may well mean your property is still valued at a lower price than when you bought it. Average prices at this time were £106,500, so even with a 10% growth in house prices in 2014, anyone buying at the height of the market could find their property is still 14% lower in value than it was at the time.

Better news though if you bought since the lows of 2009. It does mean you are likely to have seen some growth in your property value since then and for those who really bought at what appears to be the ‘bottom’ of the market in the City in 2013, your property value may have grown as much as 12%!

Is 10% a shocker of a rise?

Have we seen it before? The answer to this depends on when you look back at the market and if this type of rise is what is being forecast on-going.

After the last crash in the 1990s, a 10% hike in prices is nothing in comparison. Back in 2003, the rises we saw were as high as 34% in one year, so although a 5-10% uplift is welcome, it’s actually less than a third of rises we have seen in the past.

What about those in negative equity?

Secondly, we have to ask whether prices will continue to rise so everyone in the area can be sure they won’t be in negative equity in the future?

Unfortunately the answer to this is “unlikely”. There are two ways of looking at what prices may rise by. Firstly we could look at the long term annual increase each year and that’s about 5%, but the forecasters are actually predicting just 2-3% increase year on year, especially with the May election likely to create more caution for buyers and sellers than optimism.

At this rate of growth, it could take another 4-5 years for a property to recover its price, which would mean it would be worth the same in 2020 as it was in 2007, that’s 13 years of potentially zero price growth.

Who wins who loses in the current market?

But, apart from those who are in negative equity, anyone looking to buy for the first time, trade up or trade down, the fact that prices have recovered strongly in 2014 and are forecasted to increase on-going, even at half the rate of previous price growth, it’s still good news for most!

For FREE, independent and up to date advice on Buying, Selling, Buy to Let or Renting a Property, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-